As a seasoned crypto investor with over a decade of experience navigating through various market cycles, I can’t help but feel a sense of deja vu when observing Cardano (ADA) at its current state. The ongoing decline in ADA’s price and the deteriorating market sentiment are all too familiar, reminding me of previous bear markets that I’ve weathered before.

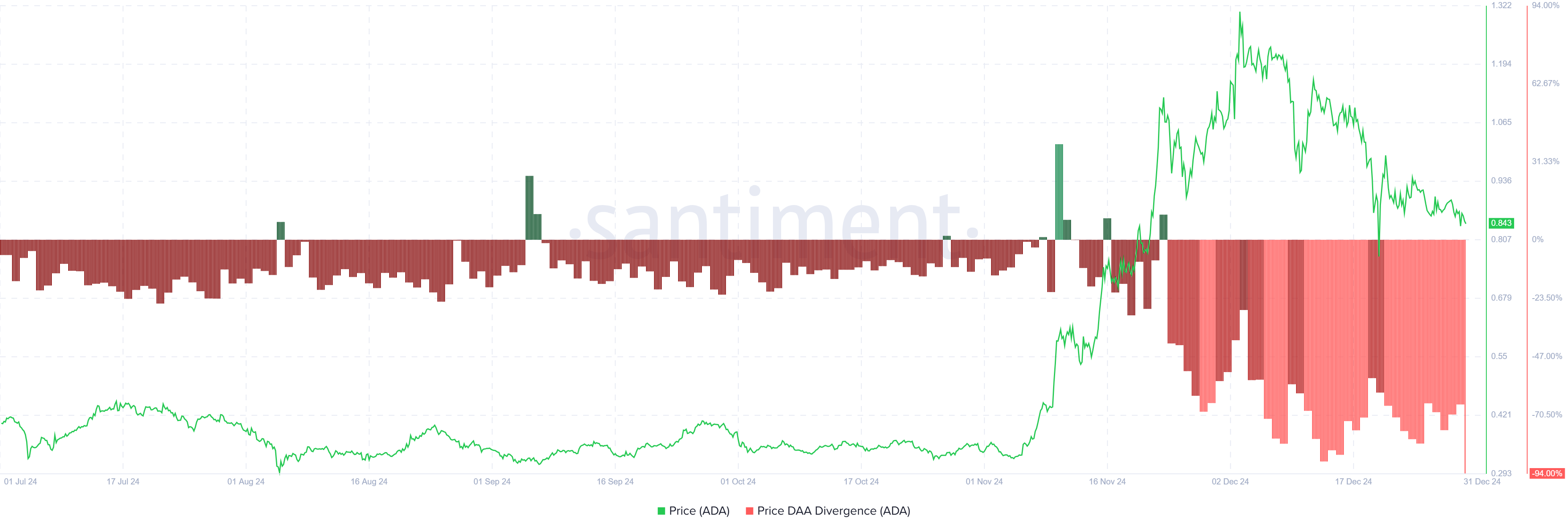

Investors’ skepticism towards ADA is understandable given the recent price action and dwindling network participation. However, as someone who has seen altcoins rise from the ashes before, I remain cautiously optimistic about Cardano’s potential for recovery. The Price DAA Divergence indicator may be flashing a sell signal now, but history has shown us that such signals can sometimes be misleading.

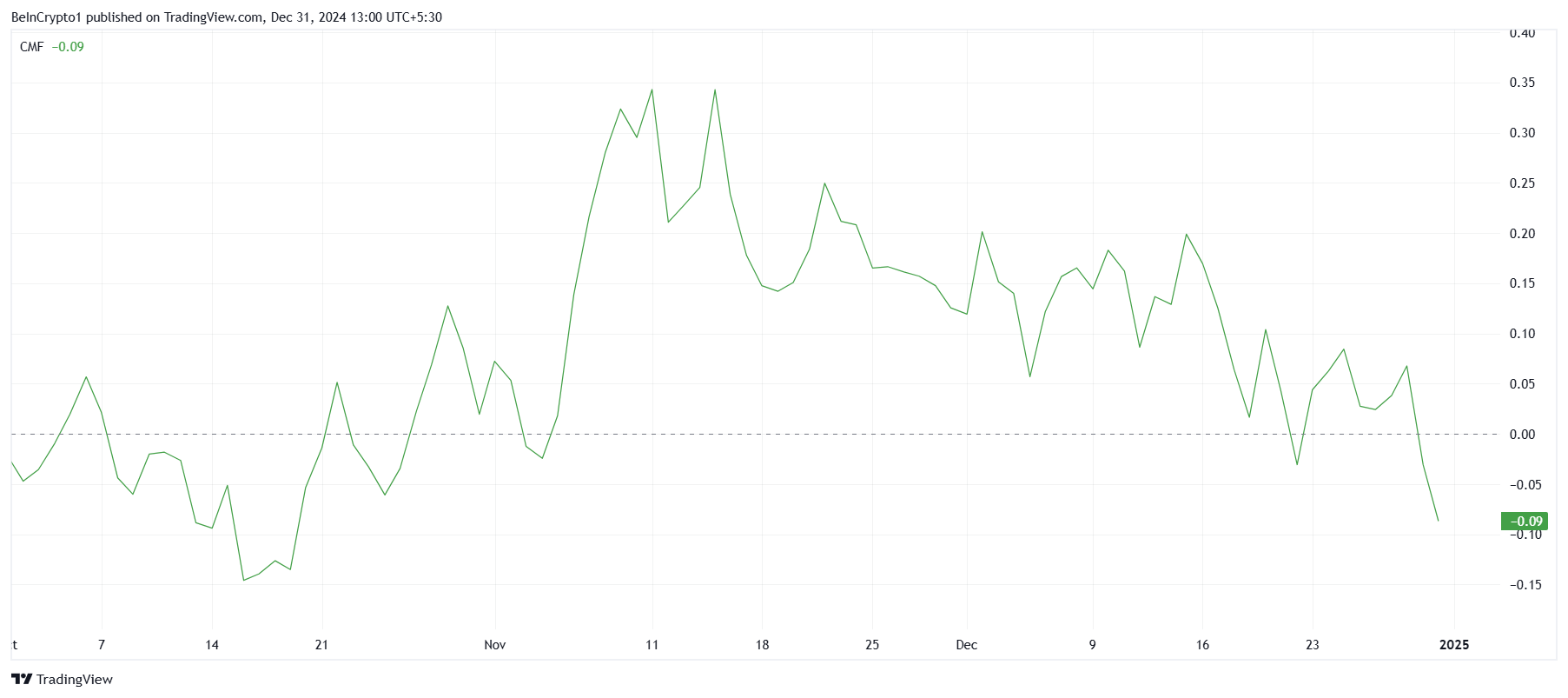

The shrinking active user base and prolonged negative Chaikin Money Flow (CMF) are concerning, but they don’t necessarily spell doom for ADA. In fact, these indicators have often served as buying opportunities in the past when market participants were most pessimistic. The key lies in identifying when fear is at its peak and anticipating the eventual rebound.

If ADA manages to reclaim the $0.85 support level, it could indeed provide a stepping stone for the asset’s recovery. However, this will require a significant shift in market sentiment and a reduction in outflows, which may not be immediate given the current macroeconomic climate.

As for my personal investment strategy, I believe that long-term success in crypto requires a blend of patience, resilience, and a sense of humor. So, while I brace myself for potential further losses, I’ll also keep a close eye on ADA’s progress and remind myself not to take the market too seriously – after all, it’s just a bunch of ones and zeros!

Joke: Why did Cardano cross the road? To get to the other side of the bear market, of course. But don’t worry, it’ll probably be back before you know it!

The price of Cardano (ADA) has been consistently decreasing and recently reached a low not seen for several weeks at $0.84. This persistent drop in price mirrors the struggles faced by the overall market as investors seem less hopeful.

The fact that ADA hasn’t been able to maintain crucial support points has made its situation even more vulnerable as we approach 2025.

Cardano Investors Are Skeptical

As a researcher, I’m observing a sell signal from the Price DAA Divergence indicator for Cardano (ADA). This signifies a worsening market sentiment towards the cryptocurrency. The trigger for this signal comes from a confluence of factors: a downward price trend and decreased network participation. These trends indicate that investors are becoming less confident about ADA’s potential for recovery, with uncertainty looming over its prospectus.

In addition to the pessimistic perspective, it seems that the number of actively using ADA users is diminishing. This decrease in engagement mirrors a wider apprehension among investors. The decreased activity aligns with the downward trend, implying that market participants are progressively distancing themselves from the asset as recovery appears unclear.

In simpler terms, the overall strength of Cardano (ADA) appears to be diminishing, as the Chaikin Money Flow (CMF) indicator has reached its lowest point in almost three months. This pattern suggests that right now, withdrawals are more common than deposits within the ADA market, suggesting a shortage of new funds flowing into the ecosystem. The continued negative CMF value indicates some difficulties Cardano faces in building investor trust.

As a seasoned investor with over a decade of experience in the crypto market, I have learned to read between the lines and anticipate trends based on past performance and current market conditions. Currently, I find myself observing the situation with Cardano (ADA) with growing concern. The lack of clear price direction is causing unease among ADA holders, as selling pressure continues to mount. This trend, if unchecked, could potentially lead to further decline in the asset’s value.

Given my background and understanding of market cycles, I believe that unless there is a significant shift in macroeconomic or network-specific factors, this downward spiral may persist. The continued outflows from the ADA market suggest that this trend is likely to be prolonged, intensifying Cardano’s struggles.

As an investor, I am closely monitoring the situation and considering my next steps carefully. I believe it is important for all investors to remain cautious and make informed decisions based on the latest developments and trends in the market.

ADA Price Prediction: Aiming At Recovery

Currently, Cardano’s price ($0.84) has dipped below the significant support threshold of $0.85. Despite maintaining its position above this point in recent times, the past 24 hours have brought renewed pressure that has led to additional drops. This downward trend leaves Cardano in a vulnerable state.

As a seasoned investor with over two decades of experience, I have witnessed many market fluctuations. From my perspective, if ADA fails to hold onto its $0.85 support level, it could potentially plummet to $0.77. This drop might be intensified by the continuous high outflows that are currently weakening the asset’s price stability. In such a case, bearish sentiment would likely escalate, discouraging further investor participation and potentially leading to additional price declines. It is crucial for investors to closely monitor this situation and consider their risk tolerance before making any decisions regarding ADA.

In other words, if $0.85 serves as a strong support point, ADA might have an opportunity to bounce back. If this level is successfully flipped, ADA could aim for $1.00 as a new support base again. However, this recovery hinges significantly on enhancing positive sentiment and minimizing the flow of capital out from the market.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 30 Best Couple/Wife Swap Movies You Need to See

- Persona 5: The Phantom X Navigator Tier List

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

2024-12-31 12:45