As a seasoned researcher with a penchant for cryptocurrencies and a soft spot for Cardano, I must admit that the recent surge of ADA is nothing short of intriguing. Over the past week, witnessing the price soar by more than 43% has been like watching a well-timed rocket launch – captivating and exhilarating. The last time we saw such a significant rise was back in May 2022, making this comeback all the more exciting.

In just the past week, the cost of Cardano‘s native token ($ADA) has skyrocketed by more than 43%, and it’s even higher – over 140% – for the last 12 months, as part of a broader surge in the cryptocurrency market. This dramatic increase in the price of ADA was notably accompanied by an uptick in large transactions, or “whale” activity.

According to CoinDesk’s report, the value of the cryptocurrency momentarily touched $0.9 across multiple trading platforms, reaching its peak since last May, as it gained popularity and amassed a market value exceeding $30 billion.

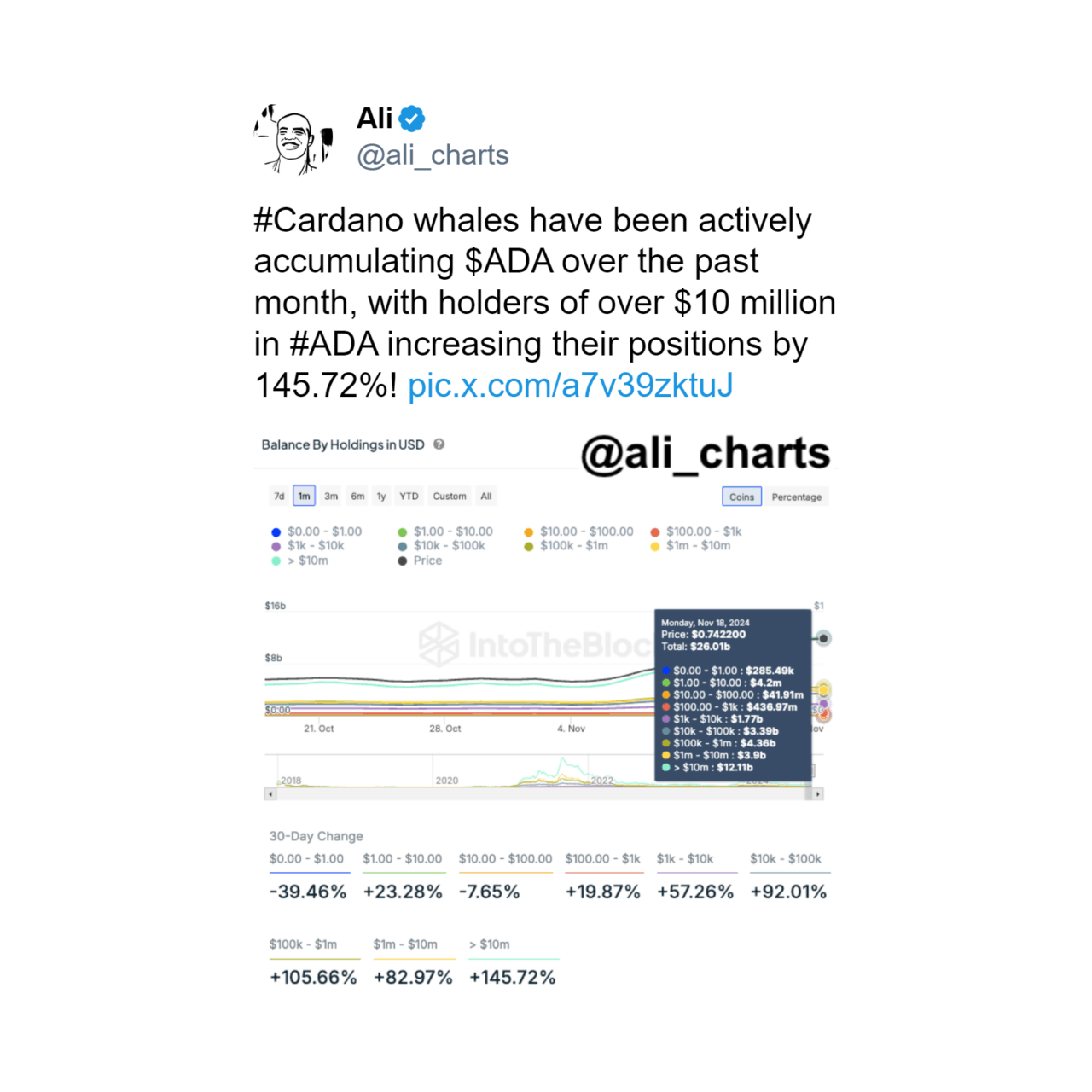

The rally is driven primarily by whales amassing more ADA, as noted by well-known crypto analyst Ali Martinez. Over the last month, these significant investors have boosted their ADA holdings by approximately 145% or more, representing a total value of over $10 million.

According to Santiment’s analysis, Cardano has been separating itself from other altcoins, reaching a nearly 8-month peak. The firm further mentioned that the ratio of ADA’s price against Bitcoin is also at a high level. Interestingly, the last time whale activity was as high was before a substantial 26% increase in ADA’s price.

The surge in cryptocurrency values, particularly ADA and Bitcoin, has been advantageous for the Cardano Foundation. According to recent disclosures, this non-profit organization, which backs the Cardano network, reported holding a total of $478.24 million in assets as of December 31, 2023. Notably, about 82.5% of these assets are invested in ADA, while approximately 10.1% is held in Bitcoin. The remaining portion is kept in cash and cash equivalents.

It’s quite probable that the worth of these assets has substantially increased due to the recent surge in cryptocurrency market prices. For instance, if the Foundation hasn’t liquidated any, their ADA holdings have climbed by more than 100% over the past year.

The report highlights that the primary source of income for the Cardano Foundation is through staking rewards from the ADA tokens they manage on the Cardano network. In the previous year, these 668.8 million ADA tokens yielded an additional 20.9 million ADA, equivalent to a 3.1% return.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-11-22 21:10