As a crypto investor, I’m excited to see that Cardano (ADA) has experienced a 7% price surge over the last 24 hours, which translates to a 17% increase in its 7-day gains. Additionally, the trading volume has significantly increased by approximately 25%, pushing it close to a whopping $2 billion. This positive momentum is certainly encouraging!

As more whales amass ADA and it nears significant resistance points, the question becomes whether the upward trend will intensify or if a potential downturn might occur instead.

ADA’s Current Uptrend Lacks Strength

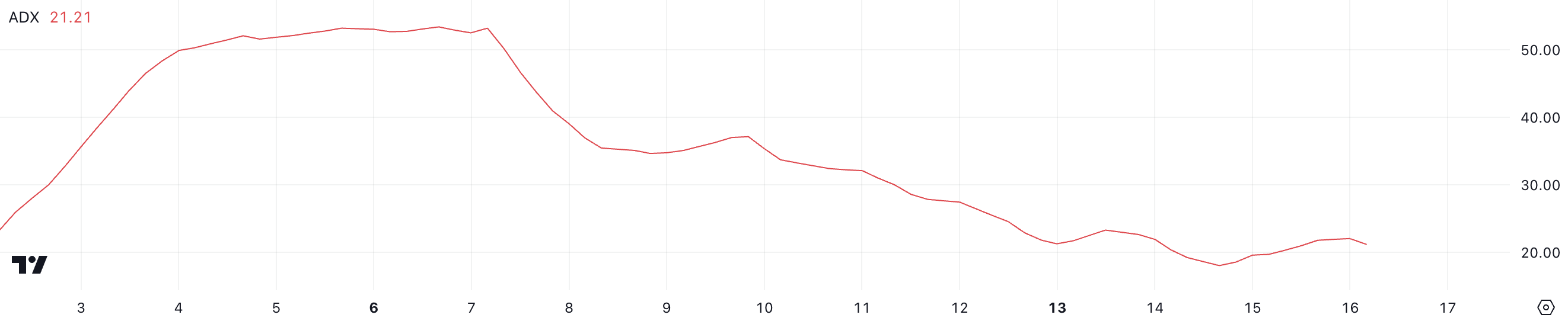

The Cardano Average Directional Index (ADX) has climbed to 21.2 from 18 two days back, suggesting a progressive strengthening of its directional movement. Today, the ADX momentarily exceeded 22, surpassing the level that generally indicates a more robust trend.

As a crypto investor, I’m seeing an upward surge in ADA that seems to be in line with its persistent growth trajectory. This trend, although still in its infantile stage, is demonstrating promising signs of picking up speed.

As a researcher analyzing market trends, I’ve found that the Average Directional Index (ADX) measures the strength of a trend on a scale from 0 to 100, irrespective of the direction. Values less than 20 signify a weak or consolidating market, whereas values exceeding 25 hint at a robust trend. At present, the ADX for ADA is 21.2, suggesting that the trend is nearing significant strength but has not yet fully demonstrated its resilience.

If the Average Directional Index (ADX) keeps climbing, this might indicate that Algorand’s (ADA) upward trend is becoming stronger, raising the possibility of prolonged price growth. Conversely, if the ADX slows or decreases, it could imply that the current surge in price is weakening and might lead to a period of consolidation instead.

Cardano Whales Started Accumulating Again

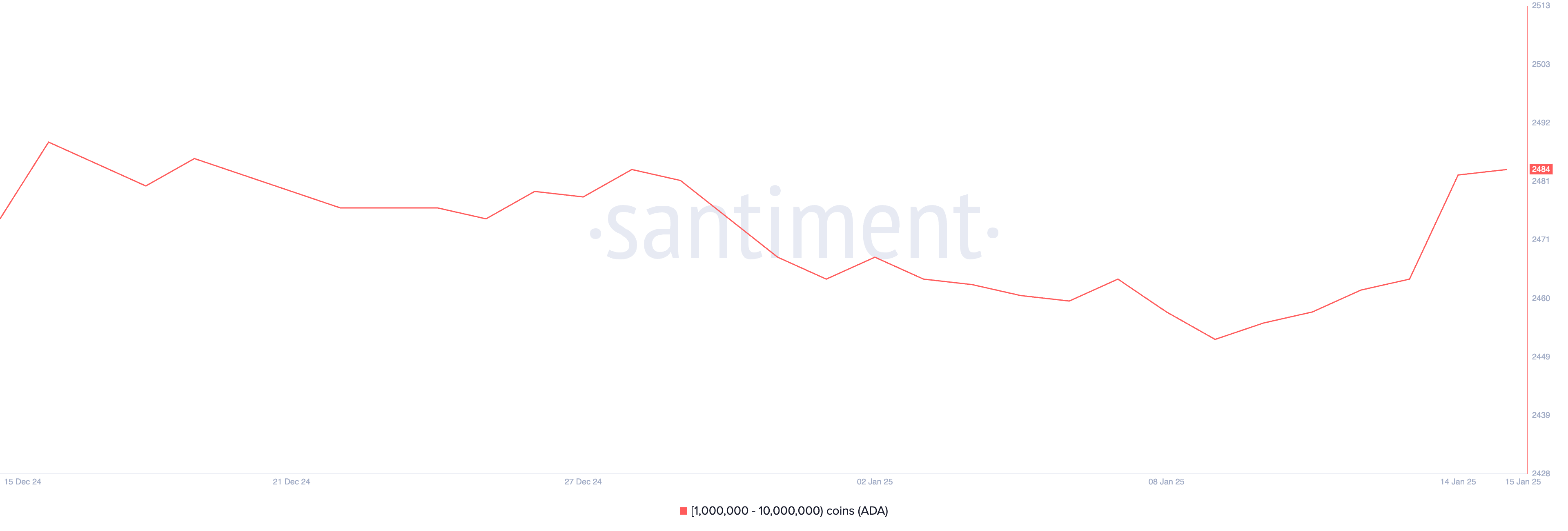

On January 9th, the number of Cardano wallets holding between 1 million and 10 million ADA hit a one-month low at 2,453. Since then, this figure has been on an upward trend and now stands at its highest point since December 28th, totaling 2,484.

The rise in the number of significant investors indicates a resurgence of curiosity and stockpiling by key market players, potentially exerting substantial influence over Cardano’s price trend.

Monitoring whale behavior is essential since the actions of these large investors can significantly impact market fluctuations. The surge in the number of whales might suggest growing optimism about ADA’s price trajectory, as they might be preparing to capitalize on potential future profits.

If the buildup persists, it might lead to an increase in demand for ADA, potentially boosting its price due to less available supply in circulation and a high concentration of ownership often leading to price growth. On the flip side, a reversal in this trend could indicate possible selling or decreased support, suggesting potential price drops.

Ada Price Prediction: Can It Start the New Rally?

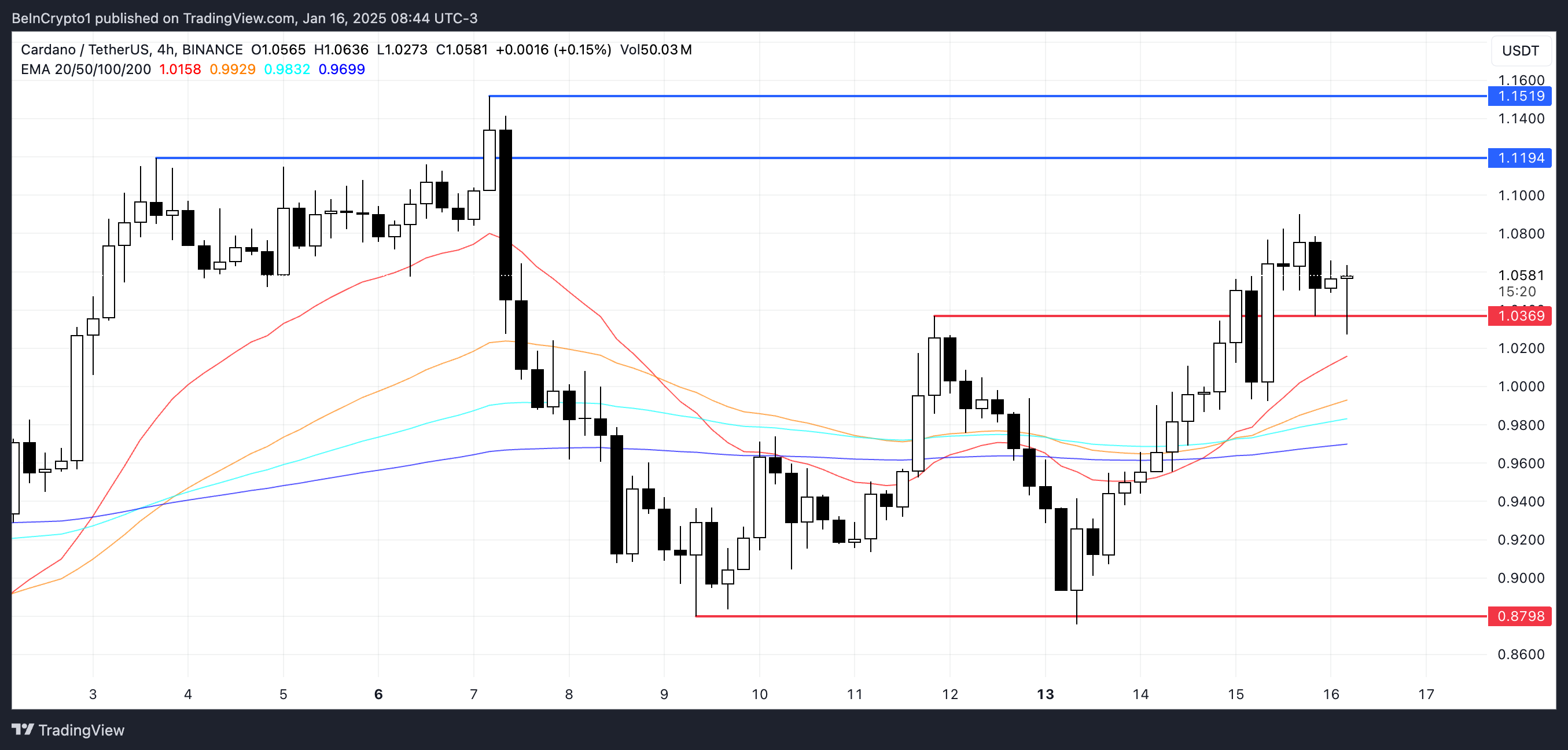

The current arrangement of Cardano’s Exponential Moving Averages (EMAs), as it stands, indicates a bullish trend, with the shorter-term averages sitting above the longer-term ones.

Today’s trend indicates a robust upward push, which has been further validated by the appearance of a ‘golden cross’ two days back. This technical pattern is commonly recognized as an early indicator for prolonged price increases.

If the ongoing upward trend continues, it’s possible that the price of Cardano may encounter its initial resistance point at approximately $1.119. Overcoming this barrier could lead to additional increases, with a potential target at around $1.15.

Conversely, maintaining the current support at $1.03 is crucial for the continued upward movement of ADA. If it falls below this point, it might suggest a reversal, leading to a potential downtrend that could dip as low as $0.879, which represents a possible 17.9% decrease.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

2025-01-17 01:02