As a seasoned researcher with years of experience tracking cryptocurrency markets, I’ve seen my fair share of volatility. The recent surge and subsequent correction of Cardano (ADA) has caught my attention, as it seems to be following a familiar pattern.

As an analyst, I’ve observed a significant rise in Cardano (ADA), with a growth of more than 100% over the past month. However, within the last week, there’s been a slight dip of almost 4%, suggesting some short-term selling pressure might be at play.

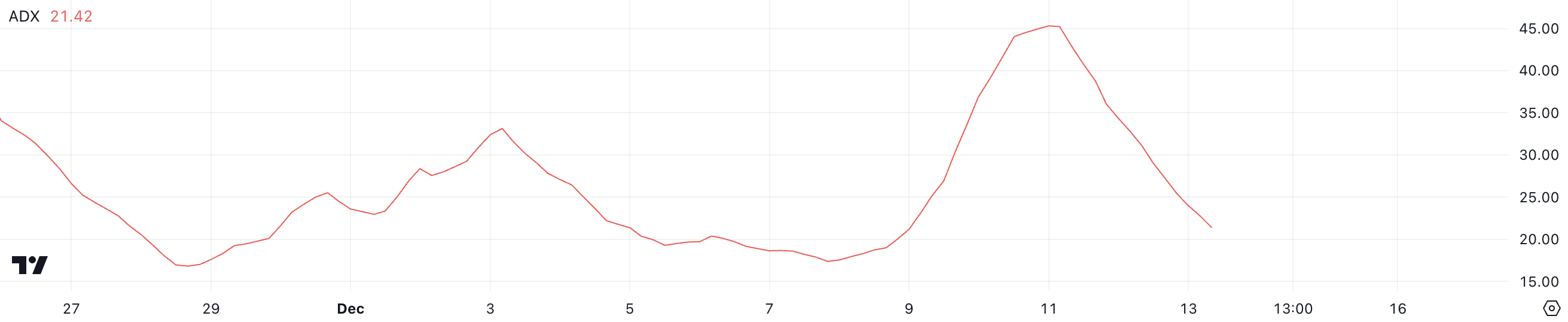

From December 7 to December 10, there has been a softening of the steep decline, as evidenced by ADA’s Average Directional Index (ADX) decreasing to 21.4, which indicates a lessening of the trend’s power. Yet, increased whale accumulation hints that major investors are preparing for a possible resurgence.

Cardano Strong Downtrend Just Faded Away

From December 7th through December 10th, the value of ADA saw a significant decrease, falling approximately 23%. This decline was indicated by an increase in its Average Directional Index (ADX), which reached 45, suggesting a powerful downward trend.

Conversely, the pace has slowed down, and the ADX for ADA currently reads as 21.4, suggesting a substantial reduction in trend power.

In simpler terms, the ADX (Average Directional Movement Index) helps determine the strength of a trend in financial markets. Values greater than 25 indicate a robust trend, while values below 20 suggest no clear direction is apparent. With ADA’s ADX currently at 21.4, it falls within a neutral range, suggesting that the price action may be consolidating or stabilizing rather than moving strongly in one direction.

It seems that the recent decline in ADA’s price has come to a halt, however, there is neither a clear uptrend nor a downtrend at present, making it difficult to predict its short-term direction.

ADA Whales Are Accumulating Again

From December 7th through December 10th, there was a significant decrease in the number of ADA wallets holding between 10 million and 100 million ADA, dropping from 406 to 400. This is the lowest point since November 11th.

This decline suggests that large holders were reducing their positions during the correction.

Monitoring whale actions is essential since these substantial investors can influence market trends by either purchasing or selling large amounts of cryptocurrency. Notably, following a steep drop, the number of such wallets has increased again and currently stands at 405.

This revival might suggest growing optimism from significant investors, potentially signaling impending price consistency or an uptick in Cardano’s (ADA) price in the short term.

ADA Price Prediction: Will It Go Back to $1.20?

Following the decline below the $1.15 resistance level, the price of Cardano fell to approximately $1.10. The Exponential Moving Averages (EMA) suggest a weak trend, as all three lines are quite close together at this time.

Given the current ADX stands at 21, it seems like the intensity of the latest correction has weakened. This could imply that Cardano (ADA) might be transitioning into a period of price stability or consolidation.

If a fresh drop in value occurs for ADA, it may challenge its current support at approximately $1.03. If this level is not maintained, there’s a possibility that the price could fall even lower to around $0.87. However, on the positive side, signs of large-scale investors (whales) buying up more ADA suggest they anticipate a market recovery.

If Cardano experiences a recovery, I anticipate it may encounter resistance at approximately $1.24. Should this resistance be overcome, there’s potential for the price to climb further, potentially reaching around $1.32.

Read More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Franklin Templeton’s 2025 Crypto Predictions: BTC Reserves, Crypto ETFs, and More

- USD CAD PREDICTION

- Where To Watch Kingdom Of The Planet Of The Apes Online? Streaming Details Explored

2024-12-13 21:36