Over the last day, the value of Cardano (ADA) has increased by 4%, making an effort to surpass the $1 mark once more. However, it’s worth noting that over the past week, ADA has dropped by 12%. This recent uptick is seen as a sign of stabilization for ADA after a prolonged phase of strong selling activity.

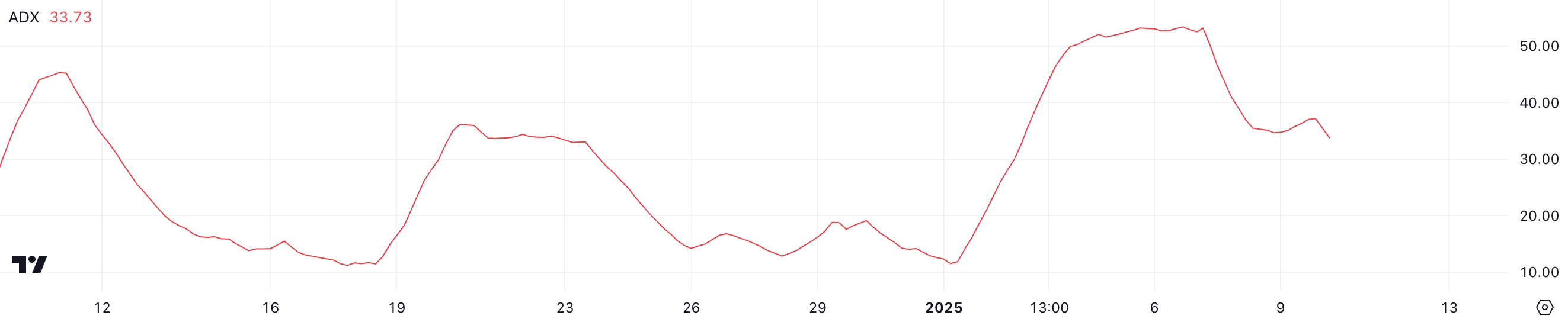

According to ADA’s ADX, the intensity of its past decline is decreasing, possibly indicating a change in direction. Yet, its Ichimoku Cloud and Exponential Moving Average (EMA) signs are still ambiguous.

Cardano Downtrend Could Be Losing Its Strength

The Cardano Average Directional Index (ADX) stands at 33.7 right now, marking a substantial drop compared to its high of 53.2 that was observed only three days back. ADX is a technical tool that gauges the intensity of a trend, be it upward or downward, ranging from 0 to 100.

Values greater than 25 usually signal a powerful trend, whereas values less than 20 suggest either a weak or non-existent trend. The decrease in ADA’s ADX suggests that the intensity of its prior downward trend has diminished, which lines up with its attempts to resume an uptrend following a bearish phase from January 7 to January 9.

At its present stage, the ADX indicates a relatively mild trend, suggesting that although the downward trend is weakening, the upward trend hasn’t quite taken firm root yet. If ADA maintains its buying power, the dropping ADX might signal an opportunity for a price increase as selling pressure lessens.

Even if there’s not much clear direction in the market, the price of ADA might stay in a holding pattern, waiting for more influential events to determine its next major trend shift.

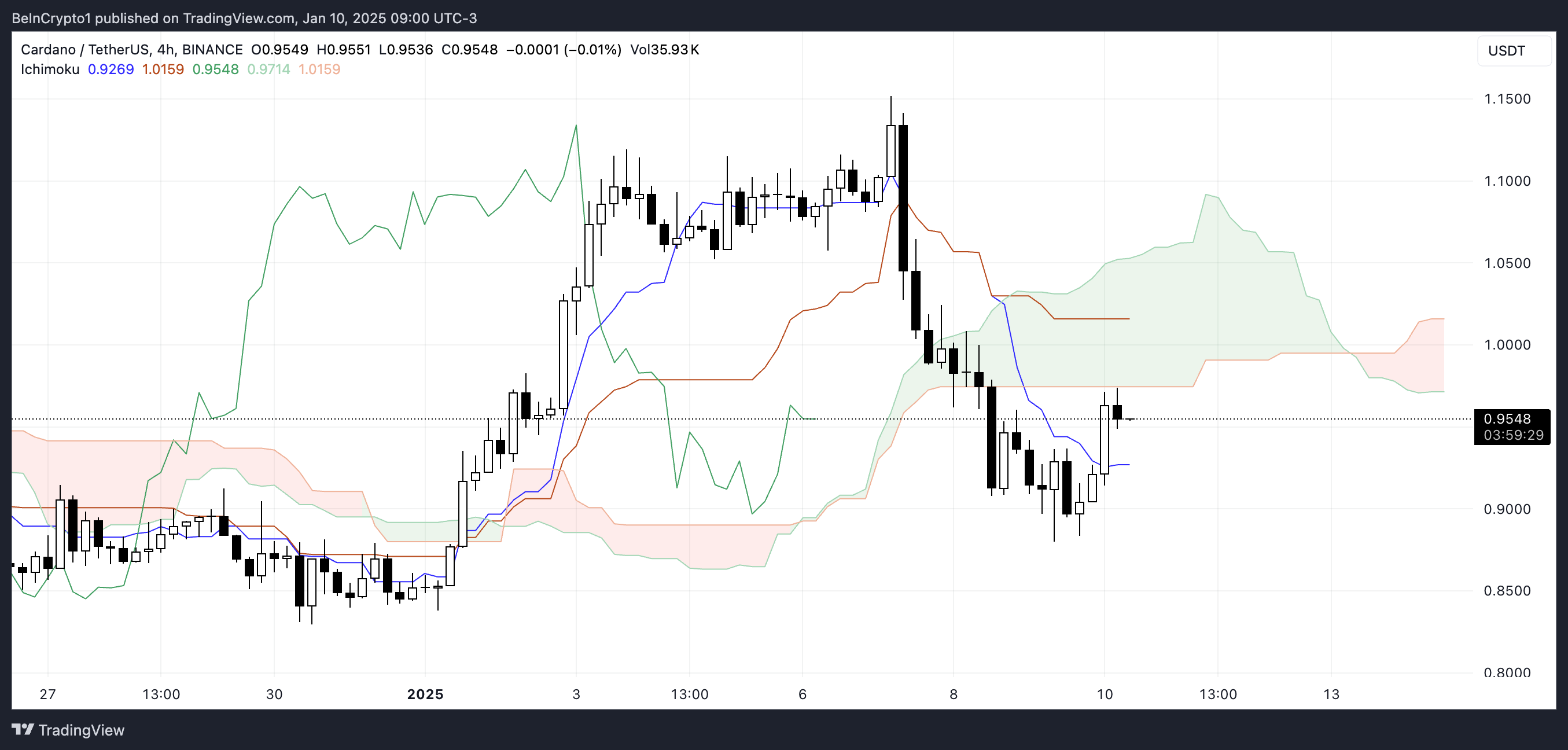

Ichimoku Cloud Still Shows a Bearish Setup

In simpler terms, the Ichimoku chart for Cardano is currently positioned under a red zone, which often indicates a negative trend or bear market. This red zone, created by two lines – the Senkou Span A (green line) and Senkou Span B (orange line), suggests a resistance level above it. The fact that this zone is sloping downward reinforces the idea of a bearish outlook.

The Tenkan-sen, or the blue line, sits a tad lower than the Kijun-sen, or the orange line, indicating that the current market trends haven’t shown sufficient strength to overturn the existing downward trend.

Furthermore, the Chikou Span line, which should typically lie above the price and the cloud, is found beneath them in this case. This placement underscores a potentially bearish trend.

If the price of ADA is to start climbing again, it needs to surpass the current resistance (the cloud) and display a positive pattern where the short-term average (Tenkan-sen) crosses above the long-term average (Kijun-sen), a bullish event. This might occur quite soon, as suggested by the chart.

ADA Price Prediction: A Potential 24% Upside

In simpler terms, the Exponential Moving Averages (EMA) for ADA’s price suggest a confusing and uncertain market condition. Yesterday, a ‘death cross’ occurred, which is when the short-term EMA dropped below the long-term EMA, hinting at possible downward pressure or bearish trends in the near future.

On the other hand, the backing of approximately 90 cents managed to halt additional drops, while the Exponential Moving Averages (EMA) are now closing in, indicating a weakened tendency in the overall direction.

As a researcher observing the market dynamics of ADA, if the Exponential Moving Average (EMA) in the short term drops below the long-term EMA once more, it could potentially put the $0.90 support level under strain. Should this crucial level fail to hold firm, we might see ADA testing the $0.82 mark, which would suggest an increased risk of further price decline.

In other words, if Experimental Moving Averages (EMAs) indicate a preference for an upward trend, the price of Cardano could attempt to surpass the $1.03 resistance barrier. Overcoming this barrier might trigger a move towards $1.18, potentially yielding a 24% increase from its current position.

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Does Oblivion Remastered have mod support?

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- DODO PREDICTION. DODO cryptocurrency

- Oblivion Remastered: How to get and cure Vampirism

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Summoners War Tier List – The Best Monsters to Recruit in 2025

2025-01-10 23:26