As a seasoned analyst with years of experience navigating the cryptocurrency market, I’ve seen more than a few bull runs and corrections. The current uptrend for Cardano (ADA) is impressive, but it appears to be losing steam based on several technical indicators.

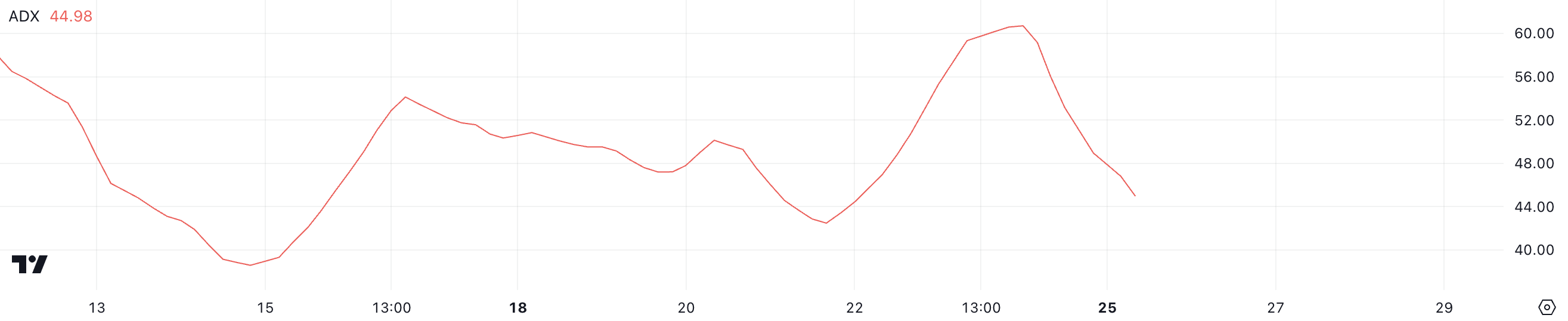

Over the last month, Cardano‘s (ADA) price has soared by an impressive 193.65% and increased by 37.82% just in the past week. However, signs are pointing towards a potential slowdown in its upward trajectory. The ADX, a tool used to gauge trend strength, has decreased from over 60 to around 45, suggesting that the momentum behind this uptrend might be waning, even though it still persists.

As the build-up of whales in the market seems to be leveling off and prices are nearing significant Exponential Moving Average (EMA) thresholds, Cardano (ADA) stands at a pivotal juncture. If bullish sentiment continues, it might challenge its highest price point since 2021. However, if bearish pressure intensifies, there’s a possibility of a significant 48% correction in ADA’s value.

ADA Uptrend Appears to Be Losing Steam

At present, Cardano’s ADX stands close to 45, marking a drop from over 60 a few days back. The ADX, short for Average Directional Index, gauges the intensity of a trend. When its value surpasses 25, it indicates a substantial trend, while a value above 40 suggests an exceptionally strong one.

As a crypto investor, I’ve noticed that although an Average Directional Index (ADX) of 45 suggests strong momentum, the decline from 60 indicates a lessening in the trend’s force, despite the fact that the overall direction remains consistent.

At present, ADA is experiencing an upward trend, which is reinforced by its directional indicators. However, a decrease in ADX implies that although the upswing remains robust, the bullish power might be weakening slightly. If the ADX continues to fall, it could potentially signal that the ongoing uptrend may either flatten or possibly reverse if buying pressure wanes and selling pressure increases.

Despite the ADX being significantly over 25, the current trend continues to hold significance, suggesting that the price of Cardano might maintain its positive trajectory in the short term. A significant reversal would be needed for this bullish outlook to change.

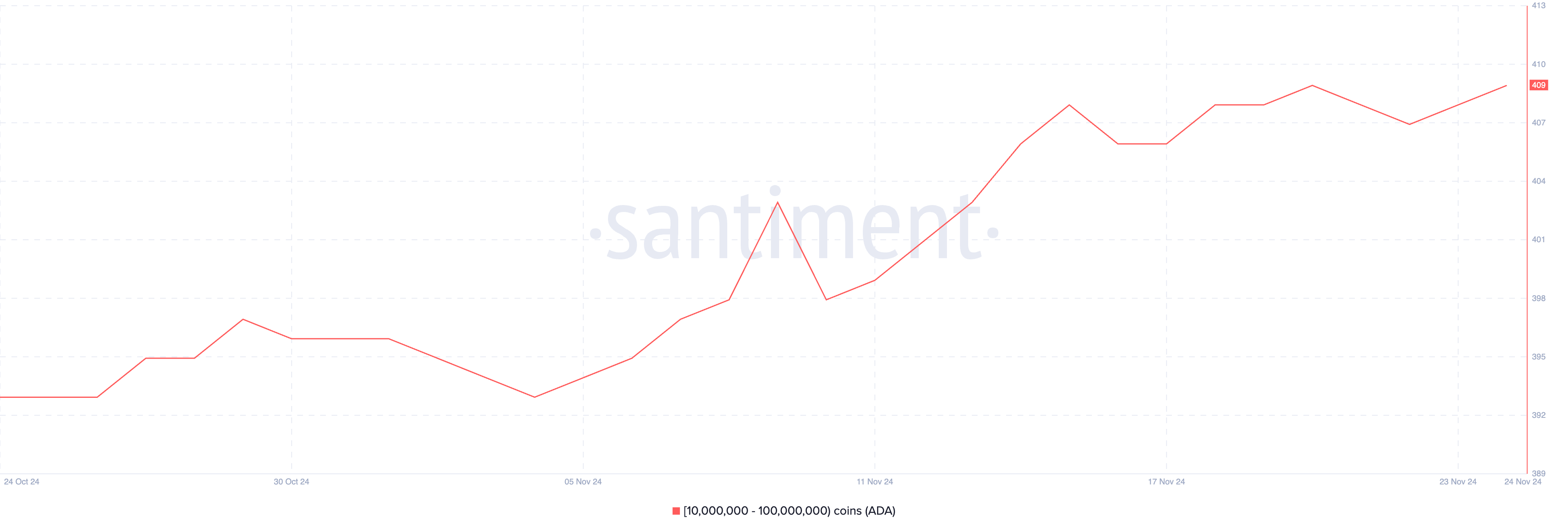

Cardano Whales Stopped Accumulating

Starting on November 10th, it appears that whales (large investors) started amassing a significant amount of Cardano. By November 15th, the number of wallets containing between 10 million and 100 million ADA tokens increased from 398 to 408. Keeping an eye on these big players is important because their actions can have a substantial impact on market trends.

Their buying behavior can indicate growing confidence in the asset and potentially fuel price surges, while their selling may trigger downward pressure.

Starting from November 15th, the quantity of these ‘whale’ wallets has remained fairly steady, fluctuating slightly between 407 and 409. This consistent buildup implies that these whales are maintaining their holdings, indicating a stance that leans more towards neutral to bullish.

If whales keep their investments steady without much fluctuation, the Cardano (ADA) price might show reduced fluctuations. The market could then be in a state of anticipation, waiting for fresh triggers to determine the next shift in direction.

ADA Price Prediction: Highest Price Since 2021 Or a Strong Correction?

In simpler terms, the moving average lines in Cardano are still suggesting a positive trend, as the temporary averages sit above the long-term ones. Yet, the current price isn’t much higher than the shorter-term moving averages, which indicates that the initial bullish power might be diminishing.

This close position indicates that the upward momentum may be weakening, and the Cardano price is nearing a significant level. At this juncture, the price might bounce back or fall beneath these thresholds, hinting at a possible change in trend direction.

Should the upward trend continue to gain momentum, it’s possible that Cardano (ADA) could challenge prices exceeding $1.155, potentially even reaching $1.16 – a level not seen since March 2021. Yet, given the falling Average Directional Movement Index (ADX), the present trend seems to be weakening, raising the possibility of a shift in direction.

If the market trend becomes negative, the lowest point where Cardano (ADA) might find some support is around $0.519. This level signifies a notable decrease of approximately 48% compared to its present values.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-11-25 21:34