Over the last seven days, Cardano (ADA) experienced a 25% increase and breached a significant resistance point – the upper boundary of a descending triangle formation. This bullish breakout has ignited hope among traders, as they now anticipate a possible revisit to its two-year peak at $1.32.

Nevertheless, the momentum of the rally appears to have slowed down recently. Over the last two days, the demand for ADA seems to have lessened, leading to a tightening in its price range.

Cardano Loses Steam as Traders Watch From the Sidelines

Over the past week, Cardano’s surge propelled its value beyond the upper boundary of the bearish descending triangle structure it had been moving within earlier. According to BeInCrypto, this bullish breakout sparked initial optimism among traders, who are now looking forward to potentially recapturing the two-year peak of $1.32.

Over the last two days, ADA’s price has been holding steady in a tight band because of weakening demand. It has hit a ceiling at $1.11 and has received some buying interest at $1.05.

As a crypto investor, I’ve noticed that when an asset’s price remains within a tight band, it signals a time of market uncertainty, where buyers and sellers seem to be in balance. Typically, this period of consolidation sets the stage for a substantial price shift as traders watch for a breakout or breakdown to hint at the next direction of the trend. Recently, technical indicators suggest a decline in buying activity for ADA, which could potentially lead to a reduction in its recent gains.

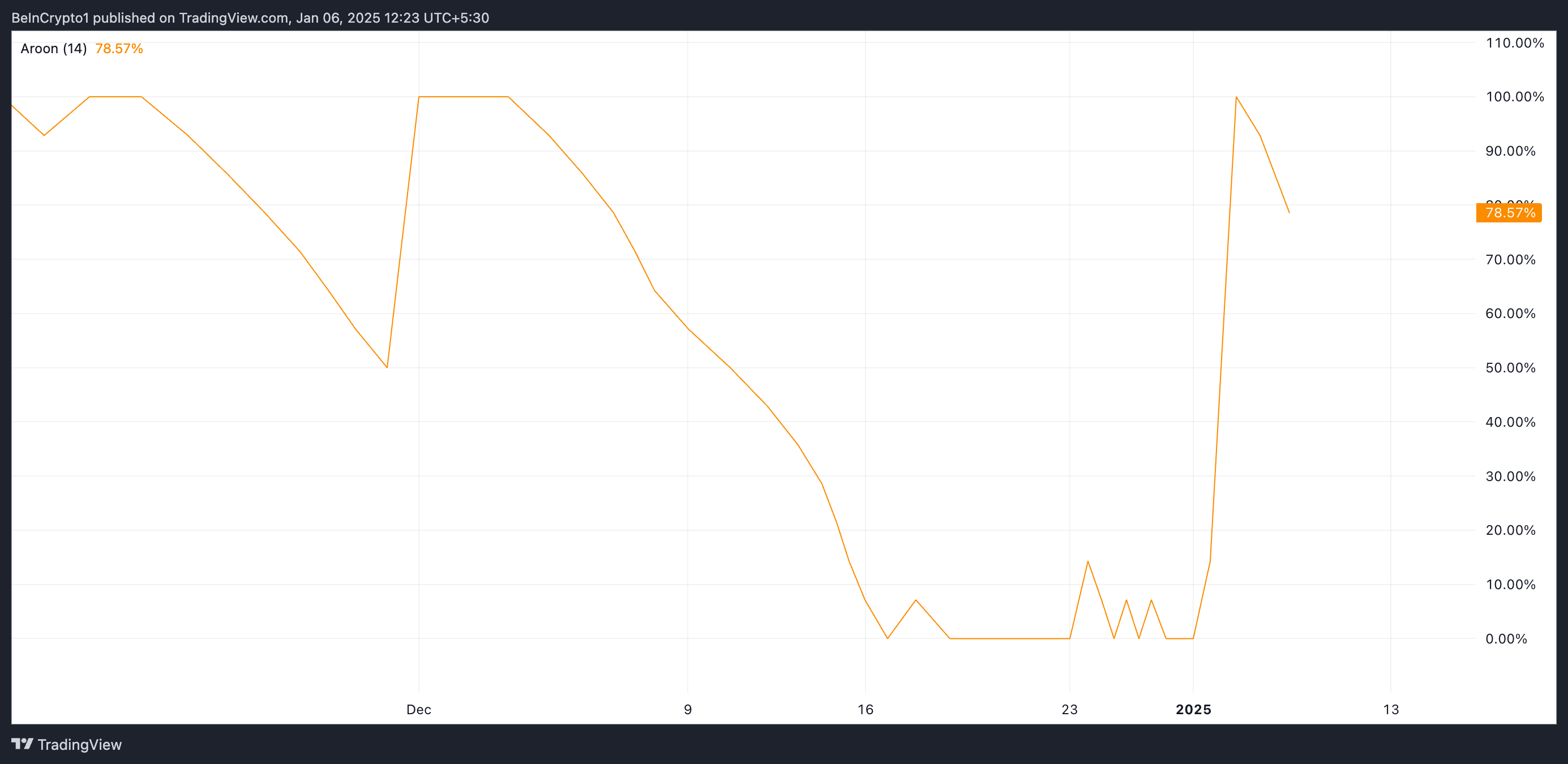

In simpler terms, the fact that the Aroon Up line, which usually indicates an uptrend, is currently decreasing, aligns with our bearish prediction. At present, this indicator is showing a downward trajectory, a trend it has maintained ever since the price stabilization began.

The Aroon indicator assesses a market trend’s intensity and direction by examining the elapsed time since an asset reached its latest high points (Aroon Up) and lowest points (Aroon Down). When the Aroon Up line falls, it means that the asset’s recent highs are occurring less frequently. This suggests a decrease in bullish power or a possible transition to a downward trend.

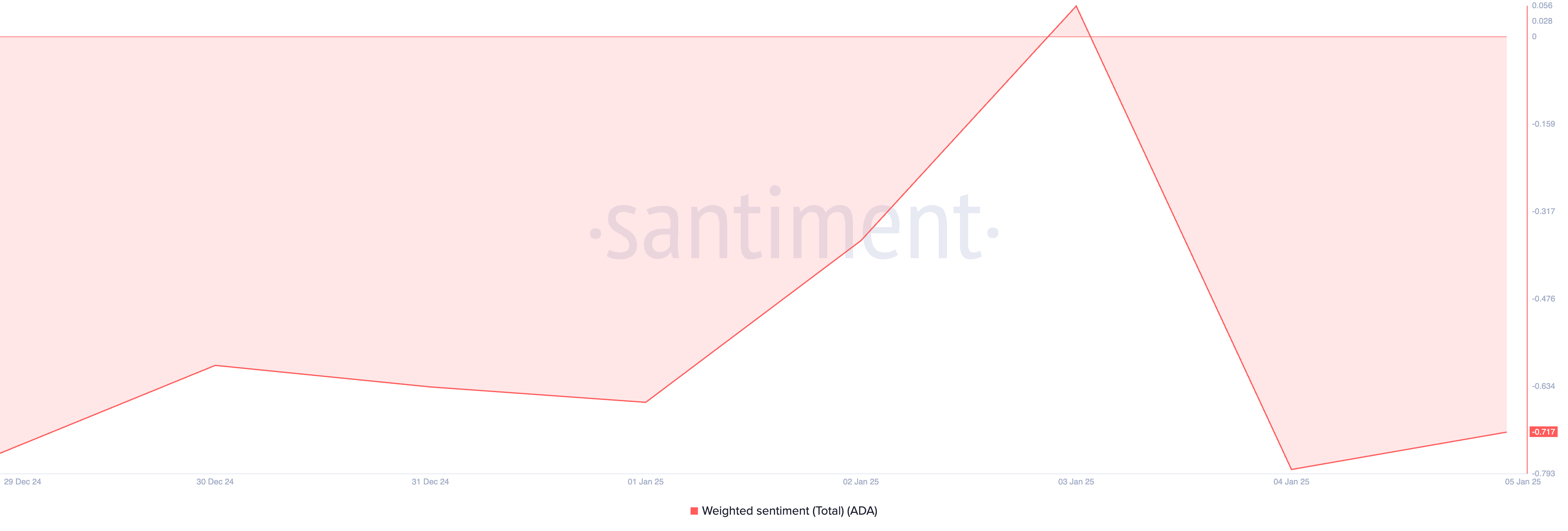

Additionally, the pessimistic sentiment analysis carried out by ADA indicates a rising skepticism towards the altcoin, currently measured at -0.71.

If a financial asset’s overall sentiment based on weighted analysis of social data is predominantly negative, it usually means that market sentiments lean towards pessimism rather than optimism. This tendency towards pessimism among traders and investors might influence the asset’s price trend in a downward direction.

ADA Price Prediction: Bullish Breakout or Further Decline?

Currently, ADA is being traded at $1.08. However, a rising negative sentiment towards the coin might lead it to approach the $1.05 support area. If the bulls are unable to maintain this level, the price of the coin could dip below $1.00, reaching $0.94.

From my perspective as an analyst, should the market mood swing towards optimism (bullish sentiment), there’s a possibility that the price of Cardano might surpass the current resistance at $1.11, potentially reaching its two-year peak of $1.32 once more.

Read More

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion Remastered: Best Paladin Build

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Everything We Know About DOCTOR WHO Season 2

2025-01-06 11:05