As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have witnessed the ebb and flow of numerous digital assets. The recent surge in Cardano‘s (ADA) price has been intriguing, to say the least. However, my analysis suggests a potential downturn might be on the horizon.

On Wednesday, December 11, the value of Cardano (ADA) dipped to $1.01, however, it’s seen a rise of around 15% in the past day. This upward trend has rekindled optimism amongst altcoin investors, indicating that it might sustain its uptrend.

However, recent on-chain data indicates that this might not be the case.

Cardano Investors Are Unconvinced

In the past 30 days, Cardano has stood out as one of the leading cryptocurrencies. Over this time frame, its token value surged to a two-year peak of $1.25, then took a brief dip, but experienced another rise just yesterday.

As a crypto investor, I’ve noticed an intriguing surge in the price of Cardano recently. Yet, there are two compelling reasons that make me question if this upward trend might not persist. Primarily, the duration that investors hold their transaction coins has noticeably shortened. Essentially, the coin holding time refers to the length a cryptocurrency has been kept without being offloaded.

If it continues to rise, it suggests that investors are choosing to keep their ADA assets. Conversely, a decrease indicates a different scenario, and that’s what we’re seeing with ADA now. If this trend persists or strengthens, ADA’s price may struggle to maintain its position above $1.16.

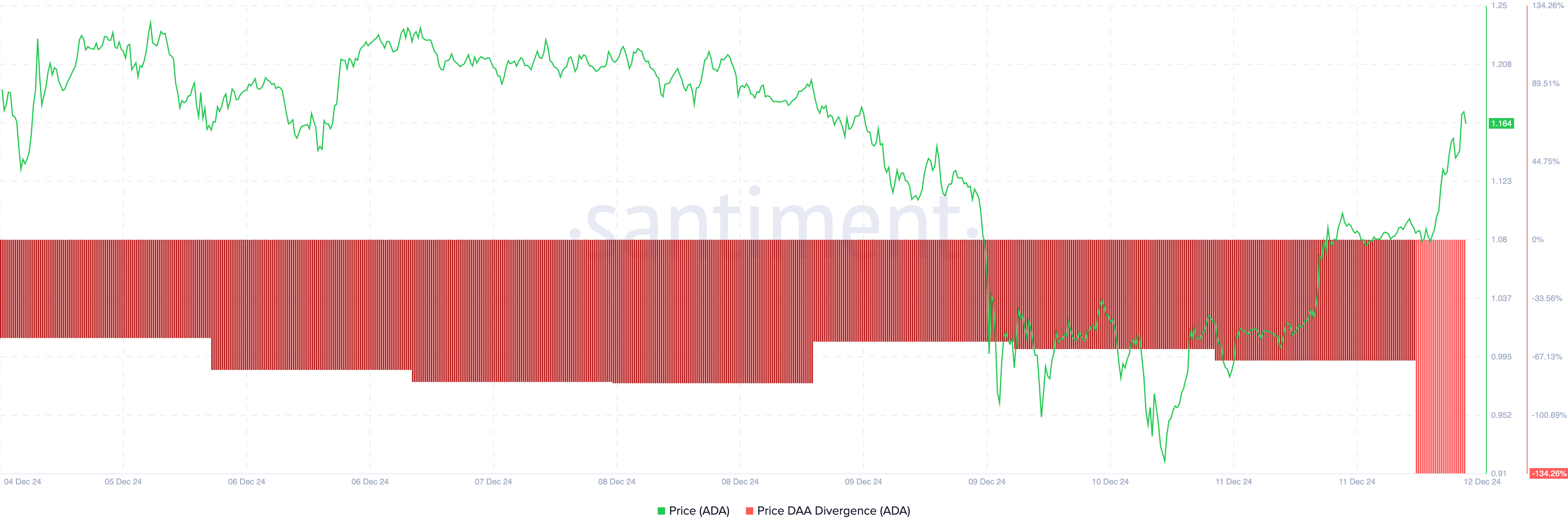

Additionally, the discrepancy between price and Daily Active Addresses (DAA) indicates that Cardano’s price surge could be temporary. This measurement examines the correlation between network activity and price fluctuations.

Generally speaking, an increase in a market’s price tends to draw in more investors, thereby heightening demand and appraisal. In the same vein, a growth in active wallet addresses usually indicates greater investor attention, which is generally positive for the associated cryptocurrency.

Conversely, it appears from Santiment data that the gap between Cardano’s price and DAA (Developer Activity) has dropped by 134.26%. This suggests that while the cost of ADA rose, active addresses decreased – a bearish sign implying the rally might not have strong backing. Consequently, there could be an upcoming correction for ADA.

ADA Price Prediction: To Go Under $1 Again?

The current ADA/USD chart appears to point towards a bearish trend, with the Moving Average Convergence Divergence (MACD) serving as a significant piece of evidence for this perspective. This technical indicator gauges market momentum by calculating the disparity between the 12-day and 26-day Exponential Moving Averages (EMA).

When the indicator shows a positive reading, it implies a bullish trend. However, in this situation, the MACD signal indicates that the momentum related to the token is bearish instead. Given these circumstances, the recent surge in Cardano’s price towards $1.16 may struggle to continue its upward movement.

In this situation, the price of ADA might drop to $0.98, but if positive momentum develops, it could lead to an upward trend. If that occurs, ADA may rise to $1.33 and potentially advance toward the $2 level.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-12-12 11:35