As a seasoned researcher with a keen eye for financial trends and a penchant for digital assets, I find myself intrigued by this latest development between Cantor Fitzgerald and Tether. With my background in economics and technology, I have witnessed firsthand the rapid evolution of the digital asset industry.

A well-known American financial services company, Cantor Fitzgerald, is broadening its partnership with Tether, a significant figure in the digital assets sector and the entity behind the world’s most extensive stablecoin.

Based on recent news, the company is set to purchase a 5% share in Tether, which is part of a wider partnership involving Bitcoin-supported loan programs.

Tether Mints $13 Billion USDT as Cantor Fitzgerald Deepens Tie

2023 saw the reported completion of negotiations that valued Tether’s 5% stake at around $600 million. This partnership is expected to provide strategic benefits for Tether, especially with Howard Lutnick, CEO of Cantor Fitzgerald, assuming his new position as Secretary of Commerce under President-elect Donald Trump.

Experts speculate that this nomination might lead to increased regulatory backing for Tether, a cryptocurrency firm under scrutiny for alleged sanctions and anti-money laundering law violations, which the company asserts is unfounded. Noteworthy, Lutnick has pledged to resign from his roles at Cantor upon Senate confirmation.

In addition to its equity share, Tether is anticipated to assist Cantor Fitzgerald’s Bitcoin lending project, a massive undertaking worth billions of dollars. This venture intends to provide Bitcoin-collateralized loans, starting with an initial $2 billion investment and planning for substantial growth in the future.

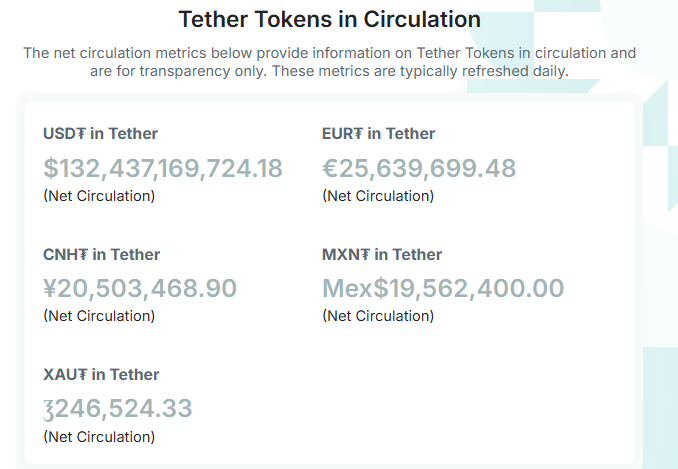

Currently, it’s known that Cantor Fitzgerald plays a crucial role in Tether’s operations, apparently managing a substantial chunk (approximately) of Tether’s $134 billion reserves, which are primarily invested in U.S. Treasury bills.

In their growing relationship with Tether, Cantor Fitzgerald has persistently increased its token production. On November 24, it was reported by blockchain analysis platform Lookonchain that the stablecoin company minted an extra $3 billion in USD Tethers, raising the total minted since November 8 to a staggering $13 billion. This surge has boosted the overall USDT supply to around $132 billion.

An expansion in USDT supply might be indicative of a rising interest in stablecoins, which are frequently utilized for safeguarding market positions or streamlining cryptocurrency transactions without the need to convert to traditional currencies. This surge in liquidity could lead to decreased volatility and improved price stability within the digital assets sector as a whole.

The increase in USDT supply occurs concurrently with a wider market uptrend driven by Bitcoin along with other digital currencies like Dogecoin and Solana, suggesting that investors’ trust in the cryptocurrency market is rekindling.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-11-24 21:17