As a researcher with a keen interest in both traditional finance and emerging technologies, I find myself intrigued by this recent development between Tether and Cantor Fitzgerald. On one hand, the potential acquisition represents a significant stride for institutional involvement in the cryptocurrency space, particularly when considering Cantor’s established reputation in traditional financial markets. However, it also raises several red flags that demand our attention.

The reported deal estimates Tether’s worth at around $12 billion, with a potential transaction value of $600 million. This news underscores the continuous blend between conventional financial systems and the cryptocurrency sector, yet it has sparked queries regarding transparency, regulation, and strategic impacts on both parties.

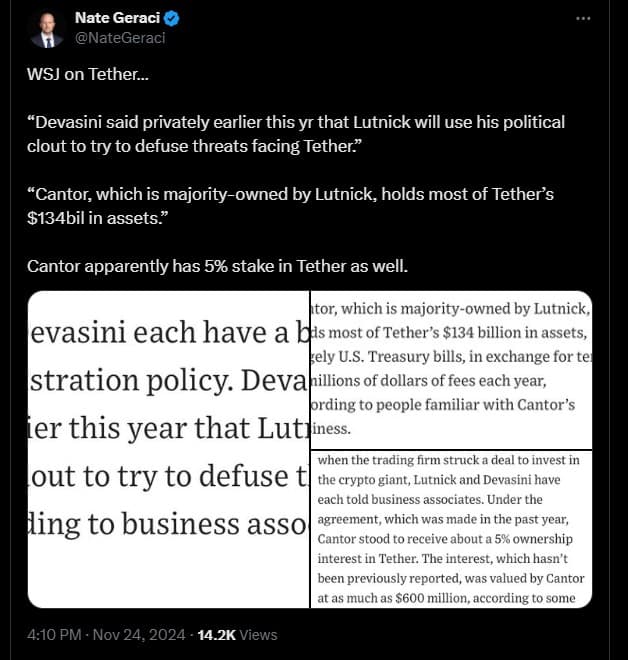

In the world of digital currencies, Tether plays a leading part, acting as a link between traditional money and digital assets. The value of its reserves, believed to be supported by U.S. Treasury bills and other easily convertible resources, surpasses $134 billion. This acquisition by Cantor Fitzgerald marks an increase in their activity within the cryptocurrency market, as they have been managing a substantial portion of Tether’s reserves.

Howard Lutnick, CEO of Cantor Fitzgerald, has previously expressed confidence in stablecoins’ potential for economic utility, particularly in emerging markets facing currency devaluation. However, these statements come amid growing scrutiny of Tether’s transparency regarding its reserves and its exposure to regulatory risks.

Regulatory and Ethical Concerns

Tether has long been accused of enabling illegal activities, including possible money laundering and sponsorship of terrorism. The absence of thorough reserve audits has raised concerns, despite Tether’s officials’ denials of these allegations. With lawmakers from all over the world striving to create precise regulations controlling the supply and functioning of stablecoins, this issue is very relevant.

U.S. Senators Cynthia Lummis and Kirsten Gillibrand propose stricter rules for companies that issue stablecoins, aiming to enhance market stability and consumer protection. Meanwhile, countries like the United Kingdom and Singapore are already establishing regulatory systems for these digital assets.

This deal highlights Lutnick’s political influence, given his nomination for the U.S. Secretary of Commerce under President-elect Donald Trump. His dual roles might create conflict-of-interest issues, as his position could potentially impact policies concerning Tether, especially since the stablecoin is facing increased regulatory scrutiny.

Cantor Fitzgerald’s Operational Issues

As an analyst, I’m sharing that the recent business agreement I’m involved with takes place amidst our own company, Cantor Fitzgerald, dealing with internal hurdles. Notably, we’ve taken legal action against a data migration service provider, ITC, claiming unprofessional conduct during the shift to an Oracle-based system.

Based on court documents, Cantor has alleged that ITC has been overcharging fees and causing disturbances that affected their operations. The company is aiming for more than $2.3 million in compensation related to these problems. This legal dispute suggests potential vulnerabilities in Cantor Fitzgerald’s operational robustness, which could potentially influence the firm’s ability to handle new ventures like cryptocurrency investments effectively.

Cantor Fitzgerald made an investment in Tether at a time when stablecoins are coming under more scrutiny. The acquisition highlights the significance of tackling the inherent risks connected with the industry, even as it reflects increased institutional interest in digital assets. Tether’s continuing expansion into traditional banking raises worries about whether its operational and reserve transparency will match the higher requirements demanded by regulated financial markets.

Read More

2024-11-26 13:42