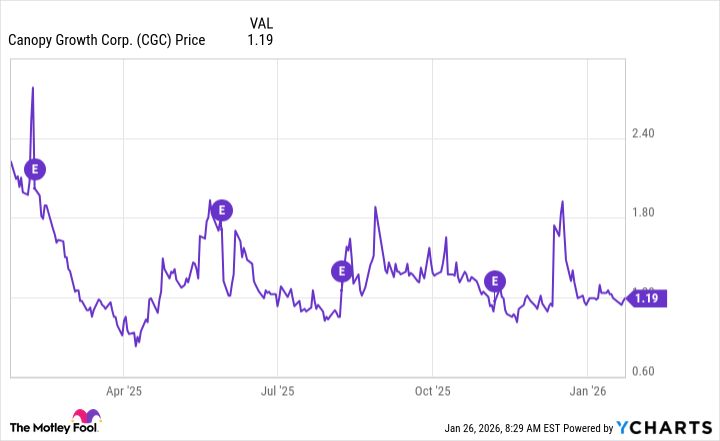

Canopy Growth. The name itself sounds like a promise – a flourishing, abundant yield. But look closer, and you see a field choked with weeds, a harvest perpetually deferred. Another year passes, and the share price, once touted as a golden opportunity, has withered by nearly sixty percent. The year before? A similar tale of decline. It’s a story repeated across these markets, isn’t it? Dreams sold, then left to rot. The grand talk of a burgeoning industry, of fortunes to be made, feels increasingly like a cruel jest.

They speak of an earnings report next week, February sixth. A chance for a reprieve, a flicker of hope. But hope, my friends, is a dangerous commodity. It sustains you only until the inevitable disappointment. The market, like a hungry beast, demands more than promises. It demands results. And Canopy Growth, for a long time, has offered little more than excuses.

A Brief Respite, Then Back to the Soil

There have been moments, fleeting and fragile, when the stock stirred. A brief surge after the last earnings announcement. A temporary illusion of recovery. But the earth doesn’t yield its bounty easily. These bursts are often followed by a deeper slump, a harsher reckoning. It’s the way of things. The market remembers, and it rarely forgives.

They report a slight increase in cannabis net revenue – twelve percent. A small victory, perhaps, but hardly a triumph. And the reduction in net loss? Achieved not through genuine growth, but through accounting maneuvers and reduced impairment charges. It’s a tightening of the belt, a postponement of the inevitable, not a sign of true vitality. They speak of “other income.” A vague phrase that often conceals a deeper trouble.

A Field of Broken Promises

Let us be blunt. Canopy Growth has been a poor investment. A drain on the pockets of those who dared to believe in the hype. A brief surge after the earnings report is likely, but it will be followed by the familiar descent. The fundamentals remain unchanged. The company continues to burn through capital – over eighty-eight million Canadian dollars in the last year. It’s a slow bleed, a wasting away. And those who cling to the hope of a turnaround are likely to be left holding nothing but dust.

They call it a growth stock. A cruel joke. It’s a stock built on speculation, on empty promises. A testament to the folly of chasing quick riches. There are better places to put your money. Places where honest work and genuine value are rewarded. This field, my friends, is barren. Steer clear, and seek fertile ground elsewhere.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- Where to Change Hair Color in Where Winds Meet

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

2026-01-30 16:32