Well, look at that! Solana’s back in the spotlight, like a tired actor trying to make a comeback. Right now, it’s sitting right under that pesky $239 to $250 resistance zone. After weeks of steady accumulation (and some institutional buyers probably scratching their heads in confusion), all eyes are on whether SOL can finally bulldoze its way through this range. Hold your breath, folks-this could get interesting. 🚀

Solana’s Cup and Handle: More Than Just a Pretty Pattern

Here’s the good stuff: the higher-timeframe chart is looking like one of those fancy “cup and handle” setups you read about in all the best market analysis textbooks. SOL’s price is consolidating just under the $250 neckline. The left side of the cup? A long, slow corrective phase from the 2021 highs. The bottom? A rounded curve that shows how buyers have been gobbling up supply. And that handle? Oh, just a lovely little consolidation waiting to break out. A breakout here could send SOL flying-straight into the arms of bulls everywhere. 💥

Now, let’s talk about analyst Kamran Asghar. He’s been looking into his crystal ball and, surprise! The target for this pattern might be around $500, which would basically double Solana’s current value if it pulls off the magic trick. So, if the bulls manage to break above that $239 zone and close with a solid volume, we might just witness a bullish Solana price prediction that no one saw coming. 🤑

The $239 Wall: The Real Boss Battle

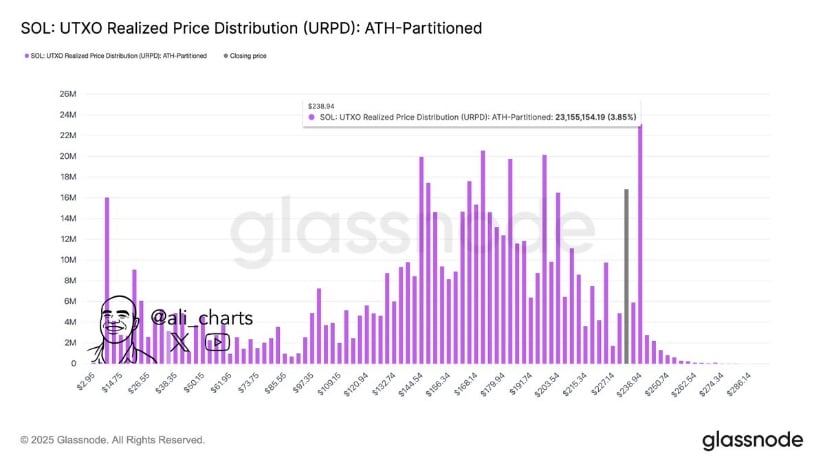

If there’s one thing that’ll give you nightmares in the Solana world, it’s the $239 resistance. That’s where the market’s been stalled, like a car that refuses to start. Sellers who bought in earlier might just be waiting for any excuse to unload their positions. So, passing through this price zone will be a Herculean task. But-oh, glorious day!-if SOL makes it through without breaking a sweat, the path above is much clearer. Those pesky resistance levels will be nothing but a faint memory. 📉

Ali Martinez is all over this. He says breaking $239 is key to keeping that cup-and-handle setup intact. So, if buyers can absorb the selling pressure here (maybe with a deep breath and a prayer), the next stop could be the $250 neckline breakout. 🙏

ETFs and Institutional Demand: Money Is Talking

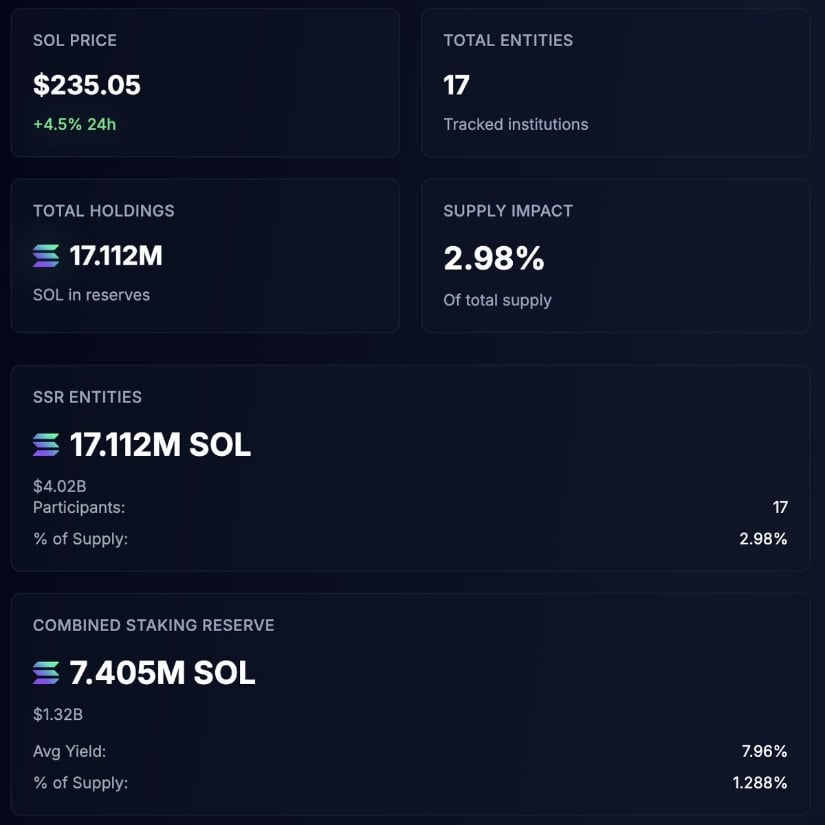

Ah, but wait-there’s more! ETFs have started pouring money into Solana like it’s a party, and everyone’s invited. According to Cointelegraph, Solana funds saw a record-breaking $145M in daily inflows, pushing the total assets under management to a cool $4.1B. Sounds like a good time, right? But that’s not all. Institutional players are buying in like it’s the hottest club in town. Treasury firms now hold 17.1M SOL, which is nearly 3% of the circulating supply. Forward Industries put $1.65B into Solana’s DeFi ecosystem, and Galaxy bought $1.55B worth of SOL in five days. Money talks, and right now, it’s shouting “BUY!” 📈

These institutional moves could be just what Solana needs to break through its resistance levels. If the demand continues at this pace, we might just see Solana soar to new heights-and that $500 price prediction might become a reality faster than you can say “blockchain.” 💸

Solana’s Future: Can It Keep Up the Momentum?

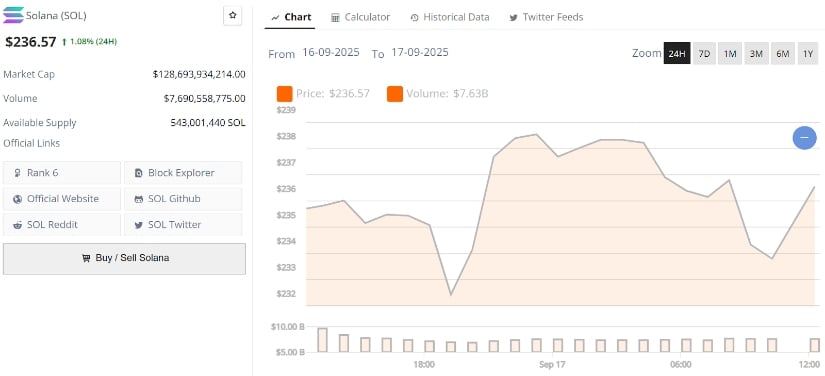

Right now, Solana is trading at $236.57, up a modest 1.08% in the last 24 hours, with daily trading volume at $7.69B and a market cap of roughly $128.6B. It’s still hanging below the crucial $239 resistance-like a dog trying to get the treat just out of reach. But fear not, the bulls are still in the game, defending those higher lows. It looks like momentum is still on the up, despite the market’s short-term fluctuations. 🐂

In short, if Solana can power through that $239 resistance, we could see the $250 neckline breakout and maybe, just maybe, witness a climb back to those glorious all-time highs. But don’t get too comfortable; this road is paved with resistance, and we’ve got a long way to go before we reach the promised land of $500. Hold onto your hats, folks-it’s going to be one heck of a ride. 🎢

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Top 15 Insanely Popular Android Games

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

2025-09-18 12:26