As a seasoned researcher with a penchant for all things tech and finance, I’ve witnessed the rise of Bitcoin from the sidelines, marveling at its meteoric journey while observing the cautious approach of traditional players like Microsoft. Michael Saylor’s audacious move to convert MicroStrategy’s treasury into BTC was indeed a gamble, but one that seems to be paying off—at least when the Bitcoin roller coaster isn’t in full swing.

It’s a bold suggestion, but this isn’t Saylor’s first rodeo. He’s been banging the Bitcoin drum louder than a festival DJ since MicroStrategy famously went all-in, converting its treasury into BTC. Depending on your perspective, this move was either a masterstroke or the tech-world equivalent of betting your house on a horse named “Digital Gold.” So far, Saylor’s wager seems to be paying off—at least on days when Bitcoin’s price isn’t mimicking a roller coaster at Six Flags.

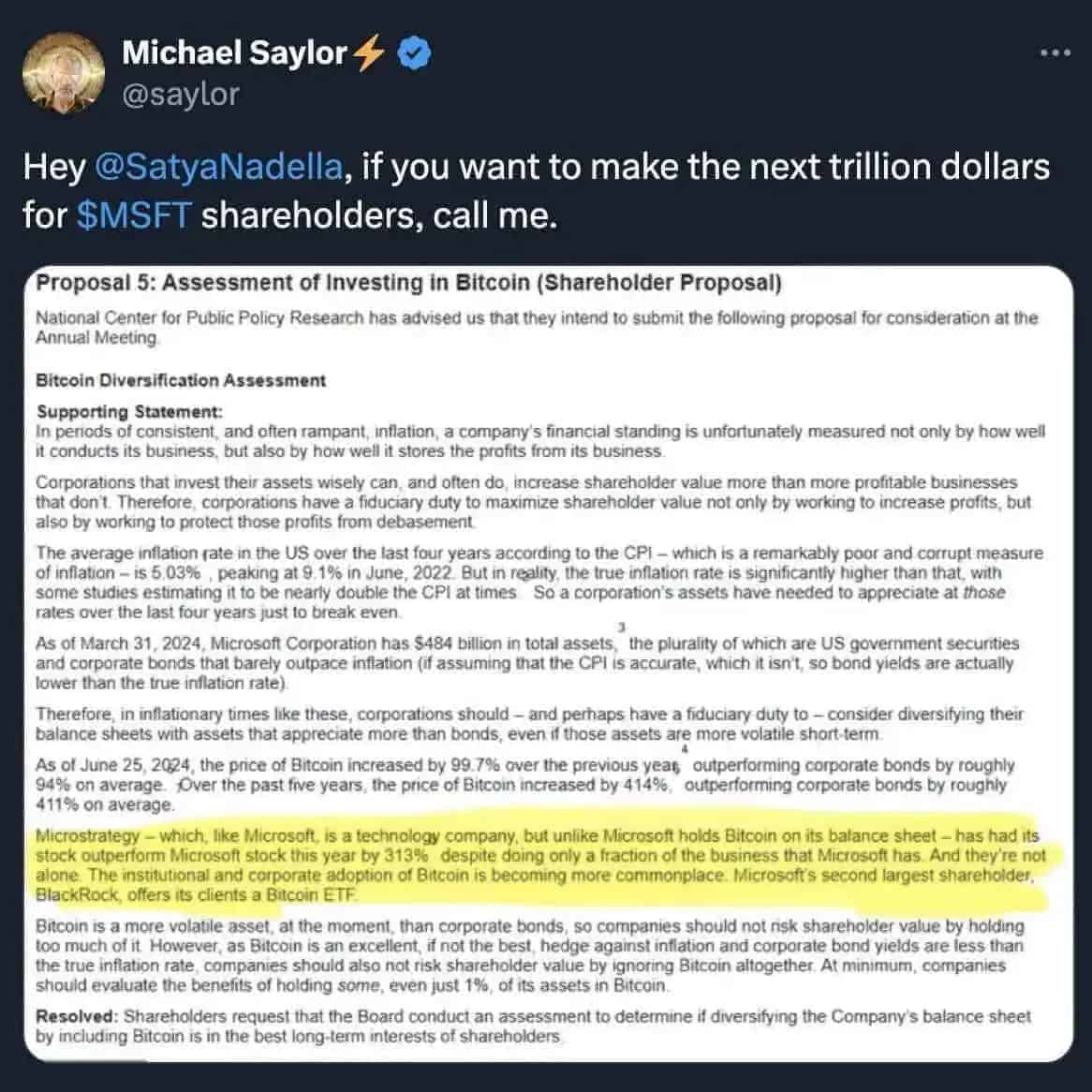

At a recent gathering organized by X Spaces and moderated by VanEck, Michael Saylor hinted at an exciting development: he plans to persuade Microsoft’s board to incorporate Bitcoin into their financial records. The catch? He’ll only have three minutes to present his argument.

The Elevator Pitch

Saylor plans to cut straight to the heart of his argument: Bitcoin could make Microsoft a “more stable and less risky stock.” Despite having previously sought a private audience with Microsoft CEO Satya Nadella to broach the subject, Saylor’s pitch is now set to go directly to the company’s board of directors.

During the conversation, Saylor mentioned that the activist who proposed the idea requested him to deliver it, which he consented to do. He will therefore prepare a three-minute presentation – the maximum time permitted – for the board of directors.

This crucial presentation takes place concurrently with a shareholder proposal led by the National Center for Public Policy Research (NCPPR), scheduled for voting in December. The proposal encourages Microsoft to assess the possible advantages of investing in Bitcoin, using MicroStrategy’s own Bitcoin strategy as an example of success.

It’s not surprising that Microsoft’s board is advising shareholders to oppose the proposal. They argue that the corporation asserts it is already scrutinizing a broad spectrum of potential investments, which suggests they have looked into Bitcoin, but haven’t discovered it convincing enough to take action.

Instead of merely monitoring assets without actively investing, might that approach be a successful strategy? It’s similar to watching others race past you while you remain on the sidelines. A clear example is MicroStrategy. This business intelligence firm has significantly outperformed Microsoft this year by more than 300% through their aggressive Bitcoin investment strategy. Remarkably, they’ve achieved this feat with only a small portion of Microsoft’s resources, staff, and influence.

A Risky Bet, or the Future of Treasury Management?

Saylor’s three-minute presentation will highlight how Bitcoin’s limited supply and robustness can protect against inflation and currency devaluation, making Microsoft more attractive to investors searching for long-term value. Some might consider his argument overly optimistic, but the results from MicroStrategy’s Bitcoin trial are hard to ignore. The real question is whether Microsoft, with its trillion-dollar market value and conservative image, will take a chance on a similar approach.

If Saylor’s argument fails to convince the board, it won’t be because there’s a lack of proof. Instead, the question becomes whether Microsoft can afford to overlook a possible financial transformation if others are already benefiting from being early adopters.

The Case for Microsoft Diving In

Saylor’s stance isn’t merely fear of missing out (FOMO). He views Bitcoin as the ultimate safeguard against the erosion of fiat currency value. With inflation trying to overshadow central banks, Bitcoin’s fixed supply of 21 million coins provides what conventional assets lack: absolute rarity. If you agree with his perspective, Microsoft’s vast cash reserves are essentially losing their purchasing power day by day, much like melting ice cubes.

For Microsoft, adopting Bitcoin could be seen as visionary. Picture Nadella and team cruising towards the future on Bitcoin’s lightning network while other companies are stuck with stacks of USD balances that may not hold as much value over time. In this scenario, Microsoft wouldn’t just buy Bitcoin; they’d be cementing their status as digital trailblazers.

In the video below, Saylor explains his thinking in detail. It’s convincing.

The Risks: Volatility, Regulation, and PR

Absolutely, transitioning into Bitcoin isn’t without its risks, and these aren’t minor ones. The volatility that Bitcoin is known for could make Microsoft’s earnings discussions resemble chaotic crypto Reddit conversations during a market downturn. Additionally, regulators, similar to overzealous school monitors, might choose to take notice and potentially impose penalties on any corporation that ventures too deeply into Bitcoin.

And let’s not forget the optics. Microsoft has spent years crafting an image as a stable, forward-thinking behemoth. Tying its fortunes to what many still consider a “speculative asset” could provoke skepticism, if not outright ridicule. It’s one thing for a mid-cap company like MicroStrategy to roll the dice; it’s another for a trillion-dollar titan to do the same.

Is Bitcoin the Next Azure?

The real question here isn’t whether Microsoft can buy Bitcoin—it’s whether they should. On one hand, the company has the financial muscle to absorb any short-term pain from Bitcoin’s volatility. On the other, its existing dominance in cloud computing, AI, and enterprise software means it doesn’t exactly need Bitcoin to remain relevant.

As an analyst, I pondered a perspective: What if Bitcoin isn’t merely an investment, but a significant stride towards digitalizing value, similar to how Azure revolutionized cloud computing?

The Verdict

Microsoft’s board needs to exercise caution when seeking financial guidance from an individual whose business morphed into a symbol of Bitcoin extremism. However, there’s a twist: if Bitcoin truly is the future of finance, Microsoft’s early adoption could later be hailed as a stroke of genius. Saylor’s argument may appear sales-oriented, but it essentially urges alignment with a significant and potentially revolutionary change in global finance.

“Will Microsoft make a move in this field? If they do, it could cause significant reactions on Wall Street and within the crypto community. But if not, there’s always the possibility of discussion at their next quarterly board meeting, with Saylor likely to continue advocating.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-11-25 12:46