Although Netflix (NFLX) might not seem like the high-growth stock it once was a decade ago, it has been performing exceptionally well in recent years, bucking the general view that it is a fully matured company.

Following a consecutive two-quarter drop in subscribers in 2022, which led to a decline in its stock value, the company decided to take a fresh approach. They introduced an advertising tier, marking a departure from their longstanding stance against it. Additionally, they tightened up on password-sharing and started exploring live events such as sports.

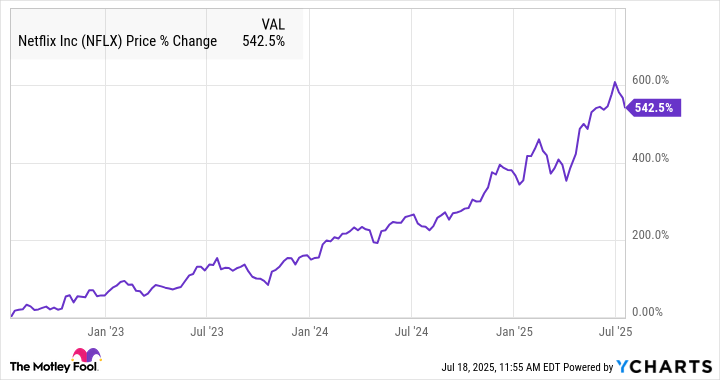

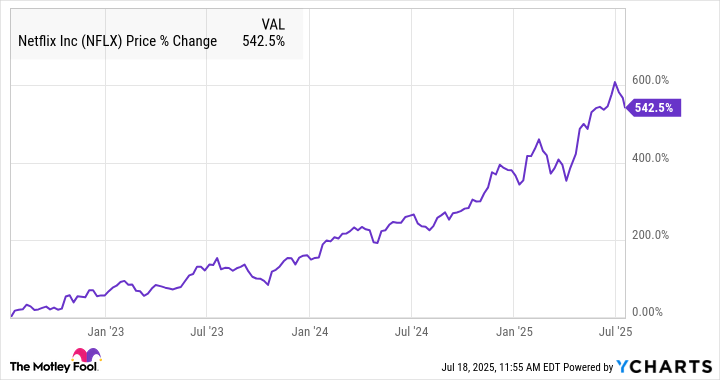

Over the past three years, I’ve been thrilled to witness my investment soar! The graph clearly demonstrates a staggering increase of over 500% – a remarkable growth that has left me in awe!

Over the next three years, Netflix might not manage to replicate that remarkable success without significantly expanding its operations, but achieving a “double” (doubling its current market value) appears attainable. Here’s what investors can glean from its most recent financial report to determine if it’s on track.

Q2 was a hit with viewers, but not investors

On a personal note, I felt a slight dip as Netflix’s stock dipped by 5% on Friday following the release of our second-quarter report. While the numbers showed robust growth – with revenue soaring 16% to an impressive $11.1 billion – it seems that the recent surge in our share price had set the bar high, leading to a slight letdown despite matching estimates. This marks our fastest growth rate in four quarters, but it’s important to remember that every upward move sets new expectations, and this is no exception!

Due to a halt in the streamer’s disclosure of subscriber numbers, tracking the factors contributing to business expansion has become more challenging. However, management clarified that this growth is primarily influenced by an increase in subscribers, the expansion of their ad business, and price increases in regions such as North America. Notably, the company has expanded its use of its own advertising technology platform, Netflix Ads Suite, across all markets, indicating a swift adoption of advertising as a key component fueling its growth.

Due to its subscription-based approach, the company’s operating margin is increasing as it expands, with its advertising business possibly boosting this growth. This is because the company can now generate revenue from its content in a novel manner and attract cost-conscious subscribers who prefer the ad-supported tier over the ad-free one. The operating margin increased from 27.2% in the previous quarter to 34.1%, and earnings per share (EPS) surged from $4.88 to $7.19, even exceeding the predicted $7.06.

The company’s leadership has cautioned that the profit margins will decrease during the latter part of the year due to increased costs associated with content production. For instance, their projected third-quarter operating margin stands at 31.5%, but they have also raised their full-year revenue projection from $43.5 billion to $44.5 billion, up to a new range of $44.8 billion to $45.2 billion. They now anticipate that their currency-adjusted operating margin will rise to 29.5%, an improvement over the earlier prediction of 29%.

The company appears to be thriving across all areas, especially with their advertising platform gaining momentum. Meanwhile, Netflix consistently broadens its content library, launching numerous series and movies that attract over 50 million viewers each quarter.

In the initial part of the year, viewers collectively watched approximately 95 billion hours, marking a 1% rise, and it’s evident that the company’s local content strategy is proving successful. Currently, non-English content comprises over a third of their total viewing time. These developments are promising indicators for the company’s growth over the following three years.

Can Netflix stock get to $2,500?

Netflix’s significant growth over the past three years can largely be attributed to enhancements within its business model, yet it has also profited from multiple expansions. This is evident in the graph, albeit it does not encompass the latest quarter.

Considering the earnings from the second quarter, Netflix’s Price-to-Earnings (P/E) ratio could approach around 50. However, this is quite expensive, particularly given that this stock used to be considered mature not too long ago.

To double its current value, Netflix probably needs to demonstrate impressive independent performance, as evidenced by the stock drop following its latest earnings release. This dip suggests that investors believe the company’s growth potential is already factored into its price, making additional increases challenging.

It’s possible for Netflix to nearly double its earnings per share, but this might require more than three years to achieve. Given its robust revenue growth, improving operational profits, and prospects for expanding into additional industries, it appears reasonable to expect that their earnings per share could double within the next five years.

By the year 2028, it seems the stock I’m observing in the streaming sector might just double its current value. However, reaching that level will undoubtedly prove challenging given the already lofty heights it has scaled.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- The Weight of First Steps

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-22 10:57