It’s been a wild ride for nuclear energy investors, like if your stock portfolio had a reality TV show and suddenly everyone’s on a winning streak. The Global X Uranium ETF is up 61%, and Cameco (CCJ +7.38%)? It’s basically the office employee who got promoted, then quit to start their own business. But here’s the twist: the stock’s down 15% from its October peak and now trades under $100. Is it a “buy” or a “buyer’s remorse”? Let’s break it down like a corporate memo you’re forced to read.

Cameco isn’t just mining uranium; it’s the company that’s like, “Hey, I’ve got a stake in the future of nuclear power.” They own mines in Canada, Kazakhstan, and Australia, and they’re also part-owner of Westinghouse. Think of it as the corporate equivalent of joining a gym and then getting a personal trainer. The stakes are high, but so is the potential.

Here’s where it gets interesting: Cameco owns 49% of Westinghouse, which is like being the third wheel at a dinner party where everyone’s talking about reactors. Westinghouse is building reactors that require tons of uranium and fuel reloads. It’s like ordering a pizza and then realizing you need a subscription for the toppings. This partnership isn’t just a handshake-it’s a long-term bet on nuclear’s comeback, and Cameco is sitting at the table with a menu of options.

Westinghouse is also teaming up with the U.S. government to build 80 billion worth of reactors. It’s like when your boss says, “We’re going to revolutionize the industry,” and you’re like, “Sure, but can we at least get a raise?” The AP1000 reactor is the star of the show-licensed, modular, and so safe it’s basically the Tesla of nuclear power. And let’s not forget the profit-sharing deal with the government. If Westinghouse hits the jackpot, taxpayers get a slice. It’s like a group project where everyone’s on the same team, but no one’s actually doing the work.

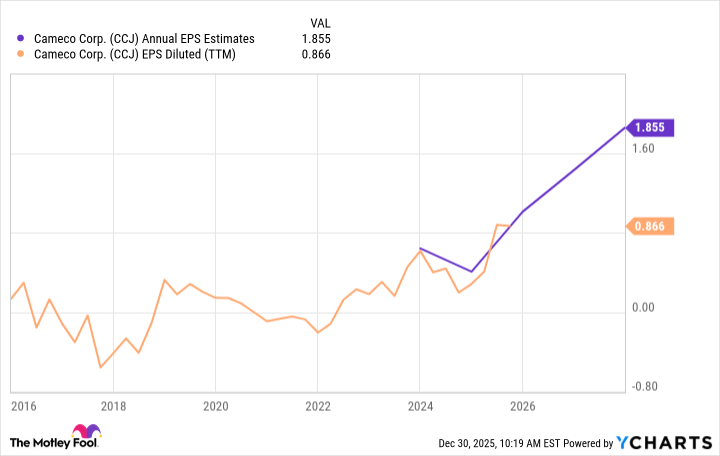

Cameco’s stock isn’t cheap. It’s trading at 92 times this year’s earnings and 65 times next year’s. But analysts are predicting a 47% jump in EPS next year. It’s like buying a lottery ticket with a 10% chance of winning, but the jackpot is bigger than your mortgage. If uranium prices stay flat, Cameco’s Westinghouse stake could still be the highlight of your portfolio. And if prices spike? You’ll be the one sipping champagne while everyone else is still trying to figure out what “low-enriched uranium” means.

In the end, Cameco is like that coworker who always says, “Trust me, this is a solid move.” It’s not for the faint of heart, but if you’re betting on nuclear’s comeback, this might be the seat at the table. Just don’t blame me if your portfolio starts looking like a spreadsheet from a 90s corporate training video.

💰

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- NEAR PREDICTION. NEAR cryptocurrency

- DOT PREDICTION. DOT cryptocurrency

- Wuthering Waves – Galbrena build and materials guide

- Silver Rate Forecast

- USD COP PREDICTION

- EUR UAH PREDICTION

- USD KRW PREDICTION

- Games That Faced Bans in Countries Over Political Themes

2026-01-02 22:41