So, nuclear power. It’s having a bit of a moment, you see. Not in the mushroom cloud sense, thankfully, but in the ‘everyone suddenly realizes we need reliable, non-wind-dependent electricity’ sense. It’s rather like discovering you quite fancy Brussels sprouts after years of avoiding them – a late, but welcome, appreciation. And underpinning this whole revival, as it always does, is uranium. That faintly glowing, yellow rock that, quite frankly, seems like something out of a science fiction novel. It’s a bit unnerving to think that so much energy is locked up inside something you could, theoretically, keep on your desk (though I wouldn’t recommend it).

Artificial intelligence, with its insatiable appetite for power, is a major driver. But it’s also a growing realization that solar and wind, while admirable, aren’t always… available. The sun doesn’t shine at night, and the wind, bless its fickle heart, doesn’t always blow. This leaves us with a rather pressing need for something dependable. And that, my friends, is where uranium, and companies like Cameco, come in.

Now, Cameco (CCJ +1.95%), based in Saskatoon, Saskatchewan – a place I must admit I hadn’t given a great deal of thought to before – is, as far as I can gather, a rather significant player in this uranium game. The stock has been on a bit of a tear, up 128% in the last year. It recently dipped below $120, though, which, if you’re inclined to believe these things, might present a buying opportunity. Let’s have a look, shall we?

Yellow Gold, Indeed

Cameco’s core business, at its heart, is surprisingly straightforward. They dig uranium out of the ground, refine it, and sell it to people who build nuclear reactors. It’s a bit like being a very specialized rock merchant, really. But there’s a little more to it than that. For starters, they’re the second largest uranium producer globally, trailing only Kazakhstan’s Kazatomprom. That’s a substantial slice of the world’s uranium supply – about 15% last year. Think of it as controlling a rather important piece of the energy puzzle.

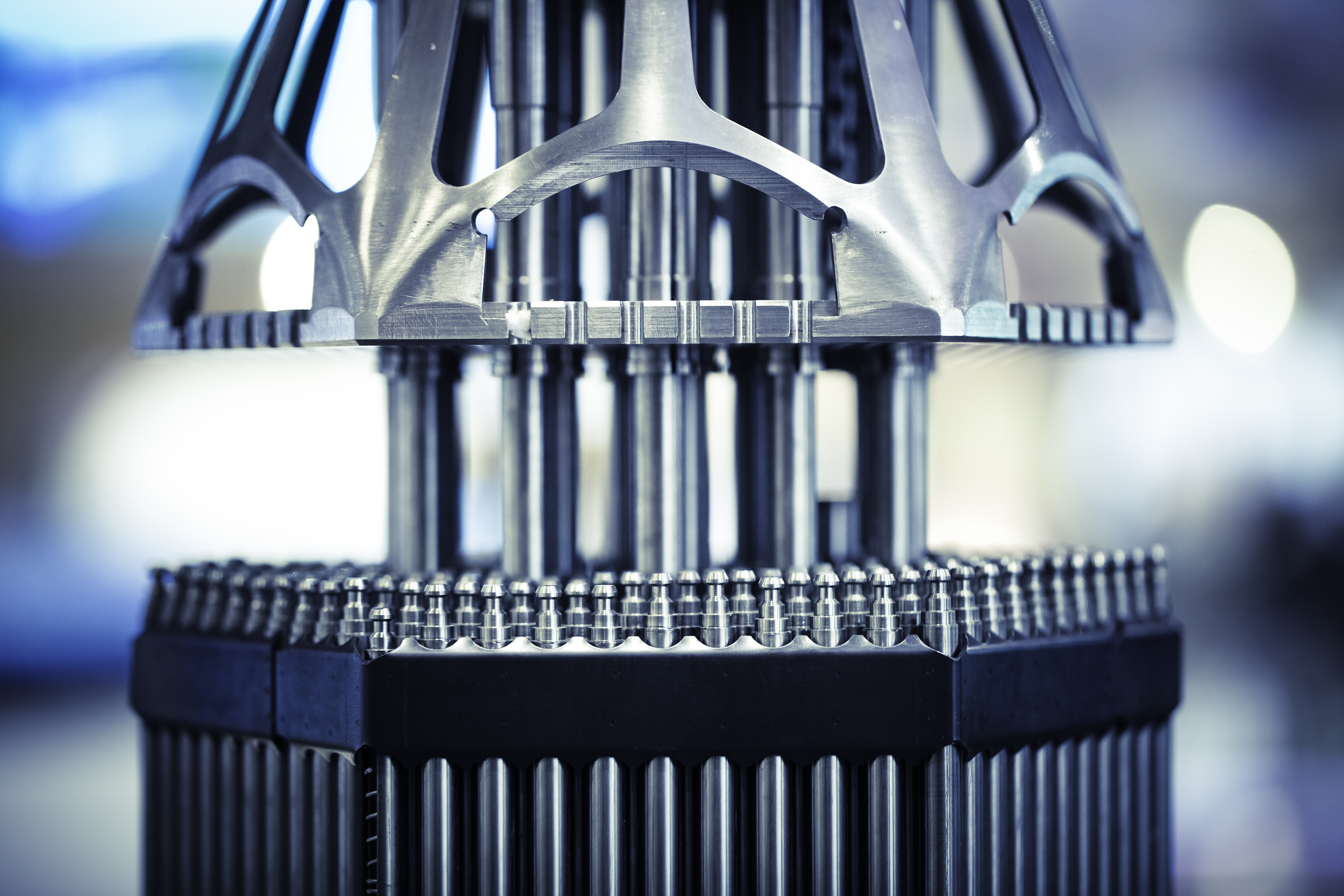

They also happen to own some remarkably rich uranium mines. Cigar Lake, for instance, boasts some of the highest-grade uranium deposits anywhere. And then there’s MacArthur River/Key Lake, which is, apparently, the world’s largest high-grade uranium mine. It’s a bit like discovering you’ve inherited a particularly lucrative patch of land – only instead of potatoes, you’re growing energy.

But Cameco doesn’t just dig things up. They’re also involved in the reactor business, owning 49% of Westinghouse. Westinghouse, for those unfamiliar, builds nuclear reactors. And not just any reactors, mind you, but the AP 1000 – which is, apparently, a rather advanced piece of kit. They’re even developing a smaller modular reactor, the AP 300. It’s a bit like being a one-stop shop for nuclear power – from the fuel to the furnace, so to speak.

The company is well-positioned to benefit from the U.S. Department of Energy’s plan to triple nuclear energy generation by 2050. And, rather cleverly, Canadian uranium enjoys a preferential tariff rate in the U.S. – 10% compared to 25% for other sources. It’s a bit like having a secret handshake with Uncle Sam. They’ve even secured an $80 billion deal with Brookfield Asset Management to supply new AP 1000 reactors. And it’s not just the U.S. – China, Poland, Bulgaria, Ukraine, and India are all building reactors powered by Westinghouse technology. It’s a global affair, this nuclear renaissance.

Atomic Profits

In the most recent quarter, Cameco beat earnings expectations by 13.6%. It’s always good to see that. Revenues grew 11% to $3.48 billion, and earnings per share exploded 246% to $1.35. Their cash position grew to $1.2 billion, with total debt at $1 billion. These are numbers that suggest a company firing on all cylinders. They’ve even raised their dividend by 50%, though the yield remains a modest 0.15%. It’s not a reason to buy the stock, but it’s a nice bonus.

Of course, like all mining companies, Cameco is at the mercy of market prices. But given their recent results and the current uranium bull market, I don’t foresee that being a huge problem. It’s a bit like being a skilled sailor – you can’t control the weather, but you can navigate the waves. So, if you’re looking for a company with a solid foundation, a promising future, and a rather fascinating business, Cameco might be worth a look – especially while it’s down a bit.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Where to Change Hair Color in Where Winds Meet

2026-02-21 09:13