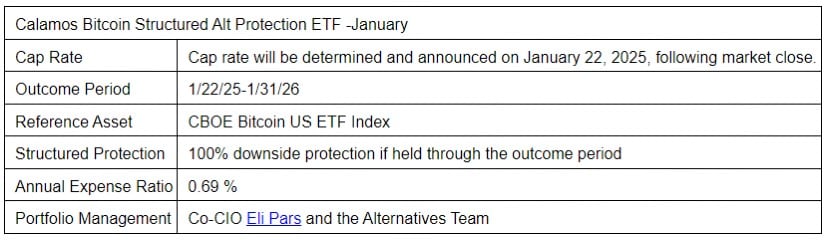

The announcement indicates that a Bitcoin exchange-traded fund (ETF) is set to be launched soon, providing complete protection against losses. This innovative product is planned to start trading on January 22, 2025, on the Chicago Board Options Exchange (CBOE), and will trade under the symbol CBOJ. The ETF promises a groundbreaking method to mitigate Bitcoin’s well-known price fluctuations.

The CBOJ ETF combines U.S. Treasury bonds with options linked to the CBOE Bitcoin US ETF Index, offering a distinctive investment opportunity that enables traders to experience Bitcoin exposure, but with reduced risks commonly associated with cryptocurrency. Unlike standard ETFs, CBOJ provides an annual reset for its downside protection, ensuring investors can look forward to a new limit on potential losses each year and protection from market downturns.

Numerous investors have shown reluctance towards bitcoin investment due to its significant price swings. Calamos aims to cater to the needs of advisors, institutions, and investors by offering strategies that leverage Bitcoin’s growth opportunities while reducing the historically high volatility and losses,” stated Matt Kaufman, Head of ETFs at Calamos.

CBOJ Breaks New Ground — A Trendsetter

The incorporation of CBOJ represents a wider movement among financial institutions, intending to link conventional investing with cryptocurrency markets. Lately, defined outcome products like buffer funds have been growing in popularity, particularly following the 2022 market crash that affected both stocks and bonds concurrently. By adopting strategies akin to equity ETFs, CBOJ is paving the way for future crypto investment trends.

It appears that there is growing interest in Bitcoin ETFs with a structured format. In January 2024, a new spot Bitcoin fund saw a remarkable launch, drawing billions of dollars in investments. This influx significantly boosted Bitcoin’s value, pushing it to a historic peak above $100,000. The iShares Bitcoin Trust ETF (IBIT), one of the leading options in this category, now manages over $50 billion in assets.

Despite its achievements, financial experts generally maintain a conservative stance towards it. Kaufman points out that Bitcoin’s volatile price fluctuations remain a significant concern for many professionals. “Those seeking involvement in this field often prefer to do so within a risk-controlled environment or an approach more suitable for their investment portfolios,” he clarified.

What Makes CBOJ Stand Out?

Unlike typical Bitcoin ETFs, the CBOJ’s annual reset feature guarantees investors continuous protection year after year. Each year’s maximum gain is calculated using options pricing, with the initial calculation scheduled for January 22, 2025. The investment period for this fund will extend from January 22, 2025, to January 31, 2026.

This defensive investment platform attracts cautious investors interested in venturing into the cryptocurrency market without jeopardizing their portfolio’s balance due to Bitcoin’s volatile price fluctuations. By blending Bitcoin options with the security of U.S. Treasury bonds, CBOJ provides a balanced strategy for crypto investing.

According to Kaufman, Calamos is aiming at a particular category of investors – those who are interested in capitalizing on Bitcoin’s growth while simultaneously seeking safety against potential losses. His team believes that the CBOJ could be invested alongside standalone Bitcoin ETFs, forming a diversified investment approach.

Crypto-ETFs Are Expanding

In this endeavor, Calamos isn’t the only one. Innovator, First Trust, and other ETF managers are also aiming to blend crypto exposure with innovative tactics. Notably, Grayscale and Roundhill have suggested Bitcoin funds that generate income, such as covered call ETFs. As cryptocurrency regulations continue to develop, it’s anticipated that more of these funds will enter the market by the year 2025.

It’s expected that Donald Trump’s upcoming administration may adopt a more welcoming approach towards cryptocurrencies, which could lead to an increase in crypto-related Exchange Traded Funds (ETFs). With fresh leadership at the Securities and Exchange Commission (SEC), there’s a possibility they might speed up the process of applications and approvals, thereby facilitating faster progress.

The introduction of the CBOJ ETF signifies a significant achievement, serving as a stride towards making cryptocurrency investment more approachable for traditional investors. Calamos’ decision could inspire other market participants to follow suit, potentially fostering additional advancements within the dynamic and rapidly growing crypto-ETF sector.

As a forward-thinking crypto investor, I’m optimistic that Bitcoin and various Crypto Exchange-Traded Funds (ETFs) will thrive in the year 2025 under a more supportive administration towards cryptocurrencies, presumably the Trump administration. The outlook for digital assets like XRP and meme coins such as Dogecoin remains bullish, with many experts predicting price increases in 2025.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 30 Best Couple/Wife Swap Movies You Need to See

- Persona 5: The Phantom X Navigator Tier List

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

2025-01-08 12:46