Investment firm Calamos has finally figured out how to make Bitcoin less risky, or at least that’s what they’re telling us. 🤷♂️

Bitcoin (BTC) is becoming the new black for institutions, but let’s face it, it’s still a wild ride. On June 7, global investment firm Calamos introduced its “protected Bitcoin” strategy, which is like a safety net for your crypto dreams. 🦸♂️

While Bitcoin has hit a $2 trillion valuation, institutional investors are still as nervous as a cat in a dog park. Most allocate just 1–2% of their portfolios to BTC to avoid getting burned. 🐱🔥

Calamos has cooked up a strategy that combines Bitcoin futures with U.S. Treasuries, which is like mixing a roller coaster with a comfy armchair. The firm buys zero-coupon U.S. Treasury bonds that mature at the end of the year, just in time for the holidays. 🎄

Calamos Pairs Treasuries with Bitcoin: A Match Made in Heaven or Hell?

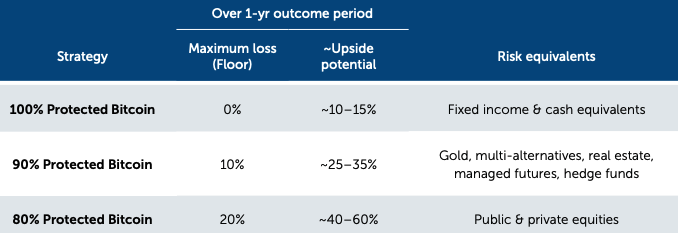

These Treasuries act as a protective floor in predefined worst-case scenarios, limiting losses to 0%, 10%, or 20%, depending on the risk tier. It’s like having a parachute, a safety net, and a trampoline all at once. 🪂🪑bounce

Simultaneously, Calamos buys call options on the Bitcoin Index to capture potential gains. To fund these, the firm also sells out-of-the-money call options, effectively capping the upside between 25% and 60%. It’s like playing the lottery, but with a guaranteed minimum prize. 🎟️💰

Each risk-return tier is benchmarked to familiar asset classes. The 100% protected Bitcoin tier mirrors the risk profile of Treasuries, offering capital preservation with virtually no downside risk. It’s like keeping your money under your mattress, but with a bit more flair. 💰🛏️

The second tier is comparable to gold or alternative assets, while the third tier aligns with equities in terms of expected returns and volatility. It’s like choosing between a steady jog, a sprint, or a marathon. 🏃♂️🏃♂️💨

Calamos believes this structured approach could make Bitcoin more appealing than a unicorn in a field of daisies. However, timing is everything. Traders must hold positions to maturity to benefit from the downside protection; early exits could result in loss of principal. And while it’s rare, there’s always the risk of a sovereign debt default, which the firm assures us is about as likely as a snowstorm in July. ❄️🌞

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gay Actors Who Are Notoriously Private About Their Lives

- The Weight of Choice: Chipotle and Dutch Bros

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-07-07 23:08