Somewhere in the far reaches of 2025, C3.ai (AI) shares decided to perform what can only be described as an elegant, slow-motion nosedive, shedding 50% of their value with the subtlety of a Vogon poetry recital. Investors who had been quietly humming along to the tune of artificial intelligence growth suddenly found themselves wondering if they had accidentally purchased tickets for a roller coaster designed by committee and a physicist who failed high school physics.

On August 9, after the release of preliminary fiscal Q1 results for 2026 (which, contrary to popular belief, are not a form of avant-garde modern art), C3.ai stock lost over a quarter of its value in a single day. Investors, in an impressive display of synchronized panic, collectively hit the sell button as if it were the “Do Not Push” lever in a spaceship control panel.

C3.ai’s Q1: A Lesson in Cosmic Disappointment

C3.ai is in the business of selling enterprise AI software that allows large organizations (and occasionally the federal government) to conjure bespoke AI agents, which, ideally, do not develop sentience or a penchant for unsolicited poetry. Recent quarters had shown that the company was gathering customers at a pleasing pace, hinting at the tantalizingly vast market for AI wizardry.

Then came the preliminary results. Revenue for the quarter was reported at just over $70 million, comfortably beneath the modestly ambitious guidance of $100-109 million. Meanwhile, the non-GAAP operating loss of nearly $58 million managed to exceed expectations in a way that would make even the most seasoned accountants gasp with something resembling horror (or mild curiosity, depending on the day).

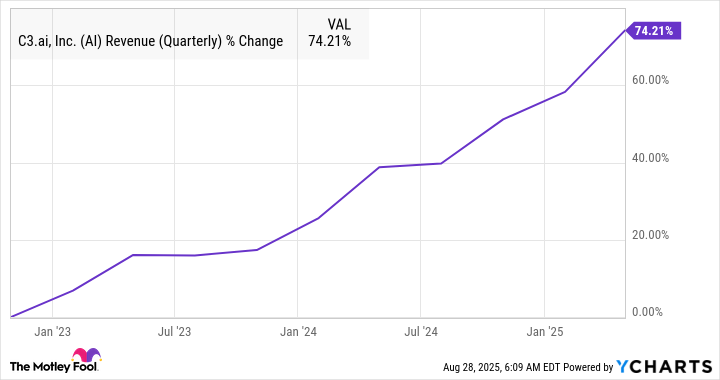

For context, revenue a year ago stood at $87 million, with a non-GAAP loss of $16.6 million. It is, therefore, clear that the company’s trajectory is temporarily resembling a confused comet rather than a steadily ascending star, despite the market itself being delightfully poised for AI expansion.

CEO Thomas Siebel attributes this interlude of cosmic chaos to two main factors: a “disruptive” reorganization (which, to the uninitiated, is a corporate euphemism meaning “somebody moved the chairs around”) and his own temporary withdrawal from sales activities due to health concerns. Apparently, his absence had a more significant impact than anticipated, demonstrating that even in high-tech AI firms, human frailty retains a stubborn relevance.

The search for a new CEO is underway. Whether this will be a graceful handoff or resemble a poorly directed pantomime remains to be seen. Meanwhile, new leaders are integrating into the company, and the process may involve a series of trial-and-error maneuvers reminiscent of teaching a particularly stubborn octopus to tap dance.

Investor Guidance from the Observant Market Watcher

Given the current uncertainties, C3.ai is best considered a high-risk puzzle with promising aesthetics rather than a sure-fire investment. While the company touts a completely restructured sales organization and ambitious plans to accelerate growth, a prudent market watcher would wait for tangible signals before committing more capital to this particular interstellar voyage.

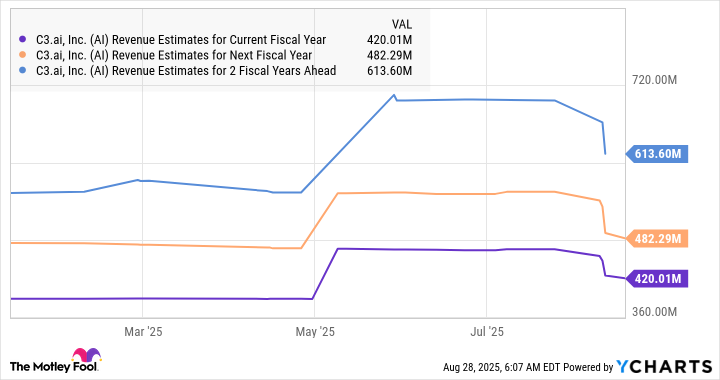

On the bright side, C3.ai recently inked a contract with Brazil’s Eletrobras and launched new agentic AI solutions, which could serve as stabilizing forces-or at least mild distractions from ongoing losses. Analysts, however, have adjusted their expectations downward, reflecting a universe in which optimism is often tempered by reality.

For the adventurous, keeping C3.ai on a watchlist might be akin to monitoring a distant star that occasionally twinkles in unusual colors. The AI market is growing at a compound annual rate of 25% through 2030, and any operational miracles-or minor acts of corporate wizardry-could once again endow the stock with investor favor. Until then, caution and a small, wry smile are recommended. 🚀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

2025-08-30 16:12