In a most unfortunate turn of events, Bybit has experienced a rather dramatic nosedive in its asset reserves, shedding a staggering $5 billion in the blink of an eye, all thanks to a rather audacious $1.5 billion hack.

Yet, in the face of calamity, the exchange’s crisis management has been met with a chorus of applause from the industry’s elite—who knew financial disasters could be so entertaining?

Massive Withdrawals Test Bybit’s Stability

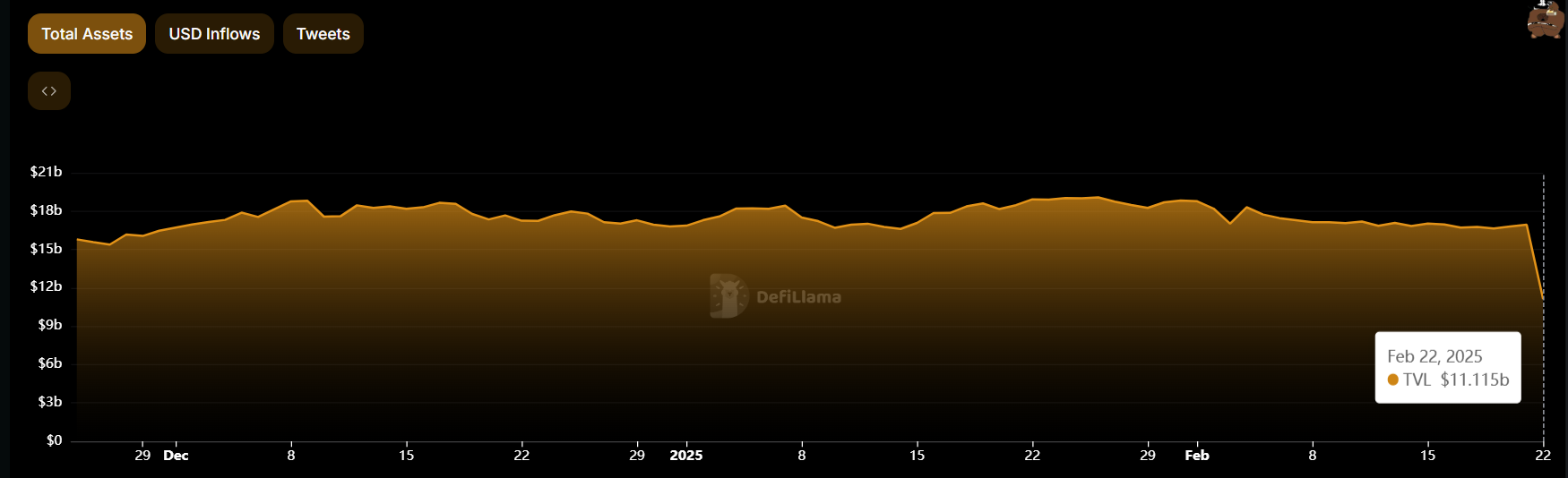

According to the ever-reliable DeFiLlama, Bybit’s reserves have plummeted by approximately $5.2 billion in a mere 24 hours. However, fear not! On-chain data reassures us that the exchange still clings to over $11.4 billion in assets, like a cat to a warm lap.

The dramatic plunge was preceded by a veritable flood of withdrawal requests—over 350,000 transactions inundated the platform. CEO Ben Zhou, in a display of tireless dedication, reported that his team worked through the night, perhaps fueled by copious amounts of coffee, to clear the backlog. He later reassured users that withdrawals had returned to their usual pace, much like a well-rehearsed play.

“Twelve hours post the worst hack in history, and all withdrawals have been processed. Our withdrawal system is now back to normal speed; you can withdraw any amount without delay. All Bybit functions remain operational, and the entire team has been awake all night to address client queries,” Zhou proclaimed, likely with a hint of pride.

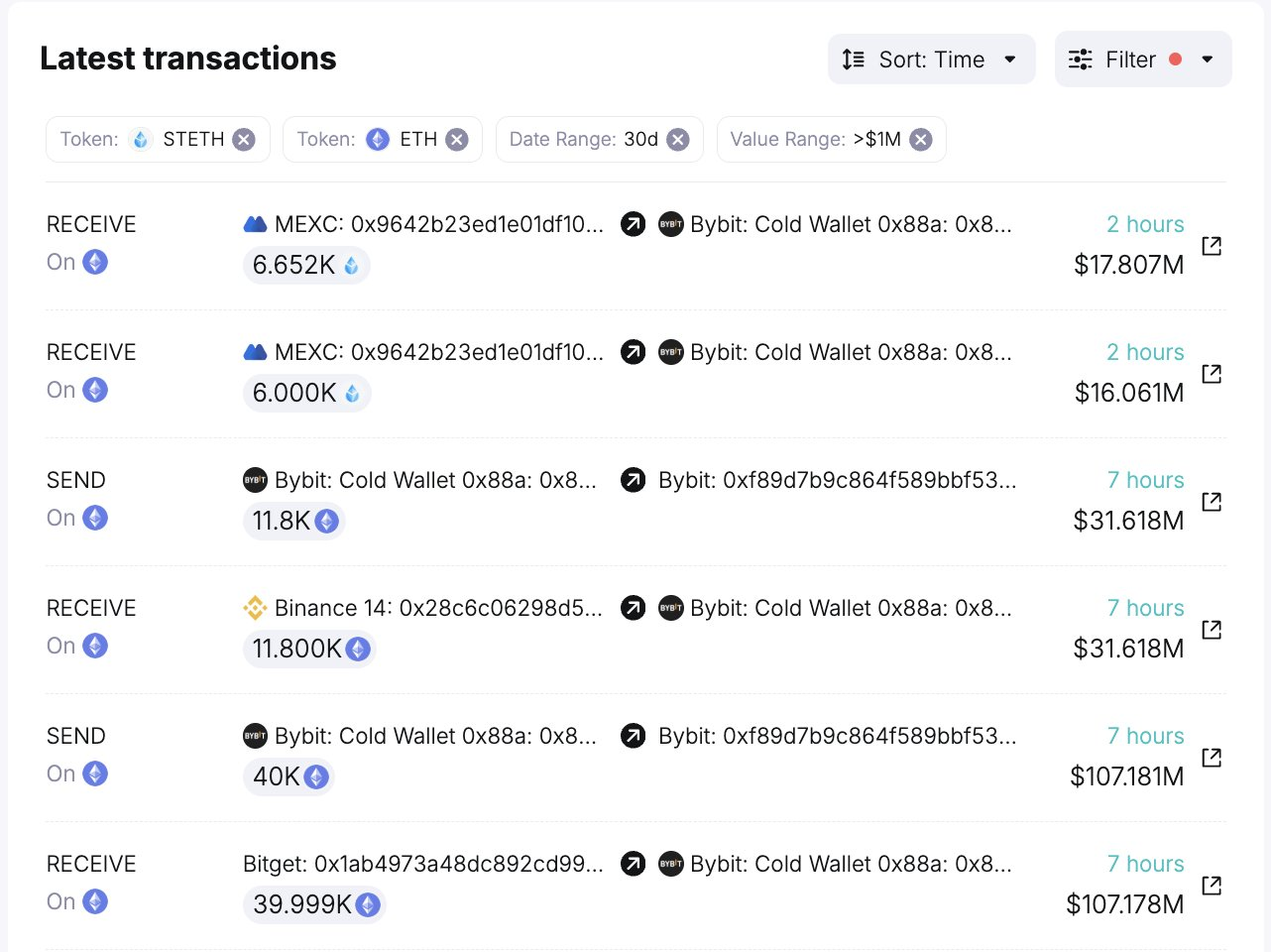

In a stroke of financial wizardry, Bybit secured $172.5 million in emergency loans within a mere seven hours, reinforcing its reserves. Blockchain analytical firm SpotOnChain reported that these funds were sourced from a veritable who’s who of platforms, including Binance, Bitget, and MEXC—talk about a financial lifeline!

On February 21, a security breach compromised Bybit’s Ethereum multisig cold wallet. Zhou explained that the attack was the result of a cleverly disguised transaction that moved funds from a cold wallet to a warm wallet, granting the hacker unauthorized access—clever, but not clever enough!

Unlike many exchanges that freeze withdrawals post-attack, Bybit opted for a more daring approach, allowing transactions to continue, thus averting widespread panic among users. Bravo!

Industry Applauds Bybit’s Response

Bybit’s swift and transparent handling of this crisis has garnered praise from key industry figures, who seem to relish the drama.

Casey Taylor, Dragonfly’s global support lead, dubbed the exchange’s response a “masterclass in crisis communication.” Taylor noted how Zhou personally addressed the situation within 30 minutes of the first public report, effectively quelling market speculation—talk about a timely intervention!

“Bybit’s response was fast, transparent, and well-executed… instead of merely reacting, they executed a playbook. The result is clear—people believed this was handled masterfully,” Taylor elaborated, perhaps with a hint of admiration.

Guy Young, founder of Ethena Labs, echoed this sentiment, declaring Bybit’s crisis management an industry benchmark—high praise indeed!

“I don’t think I’ve ever seen a team handle crisis communications as well as they did. They stood up to face the music immediately, providing transparent answers to the community. An example for us all to aspire to,” Young remarked, likely with a twinkle in his eye.

Austin Federa, co-founder of Double Zero, also commended the exchange for its quick and transparent approach. He emphasized that traditional crisis management tactics often falter in the Web3 realm, making Bybit’s response a model for others to emulate.

“These situations are extremely challenging, but the Bybit team responded quickly, with empathy, and with the facts they knew to be true… The only strategy in Web3 is transparency, humility, and clarity,” Federa stated, perhaps while shaking his head in disbelief.

Reports have confirmed that North Korea’s notorious Lazarus Group was behind the Bybit hack. Recovering such colossal sums from a nation-state actor like Lazarus

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 10 Shows Like ‘MobLand’ You Have to Binge

2025-02-22 13:53