In a world where even the most solemn of holidays cannot quell the insatiable appetite for profit, Bitcoin ETFs have gallantly extended their winning streak to a staggering nine days, amassing a jaw-dropping $385 million. Meanwhile, Ether ETFs, not to be outdone, have joined the fray with their own sixth consecutive day of inflows, adding a respectable $38.77 million to the mix. Who knew that while we were honoring our fallen, the bulls were busy charging ahead? 🐂💰

Bitcoin ETFs Defy Holiday Lull With $385 Million Inflow, Ether Funds Extend Streak

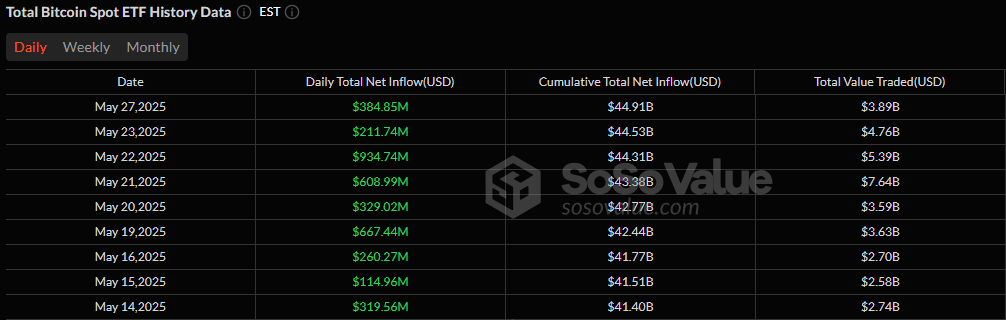

Not even the solemnity of Memorial Day could dampen the bullish momentum behind crypto exchange-traded funds (ETFs). As if the universe conspired to reward the audacious, Bitcoin ETFs notched their ninth consecutive day of inflows, hauling in a staggering $384.85 million. It seems the only thing more resilient than a bull market is the human spirit—especially when it comes to making a quick buck! 💸

Despite notable outflows from heavyweights like Ark 21Shares’ ARKB and Grayscale’s GBTC, Blackrock’s IBIT once again stole the spotlight, pulling in a whopping $409.26 million. It’s almost as if the market is saying, “Out with the old, in with the new!” Reinforcing its dominance as the go-to ETF for institutional flows, IBIT is the belle of the ball, while others are left standing awkwardly by the punch bowl. 🍹

Supporting this rally were Grayscale’s Bitcoin Mini Trust with $36.03 million, Vaneck’s HODL with $7.77 million, and Bitwise’s BITB with $1.79 million. Even with ARKB’s $38.34 million, GBTC’s $26.87 million, and Fidelity’s $4.79 million in outflows, the bulls had the upper hand. Total value traded hit a robust $3.90 billion, and total net assets climbed to an impressive $132.89 billion. It’s almost as if the market is saying, “Outflows? What outflows?” 😂

Meanwhile, Ether ETFs kept their hot streak alive, marking the sixth straight day of inflows with a $38.77 million boost. Blackrock’s ETHA contributed the lion’s share at $32.48 million, followed by Fidelity’s FETH with $3.35 million and Vaneck’s ETHV with $2.95 million. With daily volume topping $613 million, ether ETF net assets closed at a staggering $9.59 billion. Who knew that while we were busy grilling burgers, the crypto market was cooking up a storm? 🍔🔥

The takeaway? Markets are embracing crypto ETFs with conviction, holiday or not. It seems that in the grand theater of finance, the show must go on, and the bulls are the stars of the performance! 🎭

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Everything We Know About DOCTOR WHO Season 2

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- 9 Kings Early Access review: Blood for the Blood King

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2025-05-28 14:57