Bitcoin has become a significant force in the financial world. Its unique characteristic of being decentralized sets it apart, yet it’s also famous for its extreme price fluctuations and strong reaction to global occurrences.

In simpler terms, this study investigates the impact of geopolitical tensions and conflicts on Bitcoin’s worth, drawing parallels between its price movements and those of conventional financial markets during significant historical episodes.

Historical Context: Bitcoin and COVID-19

The COVID-19 pandemic brought about major fluctuations in stock markets worldwide. At the start, there were substantial market swings and declines. However, to everyone’s surprise, these downturns were followed by a relatively swift bounce back. Let’s delve deeper into the evolution of share markets and Bitcoin’s behavior since the emergence of COVID-19.

Initial Impact (Early 2020)

In response to the global spread of COVID-19 in early 2020, financial markets experienced a sharp downturn due to the ensuing economic concerns.

- Major global indices, including the Dow Jones Industrial Average (DJIA), S&P 500, and NASDAQ, as well as international markets, experienced sharp declines.

Despite a record decline in March 2020, the DOW recovered quickly. Source MSN.com

- March 2020 Crash: March saw one of the swiftest and deepest stock market crashes in history. On March 16, 2020, the Dow fell by nearly 35%, marking its worst single-day point drop ever. Over this period, the S&P 500 and other major indices fell into a bear market, defined as a 20% decline from recent highs, at unprecedented speeds.

- Trading Halts: Due to extreme volatility, trading was halted multiple times in March to curb panic selling, under mechanisms known as “circuit breakers” that are designed to provide a pause during massive sell-offs.

- Bitcoin too was hit hard by Covid 19 in March of 2020 – losing nearly 41% of its value in seven days.

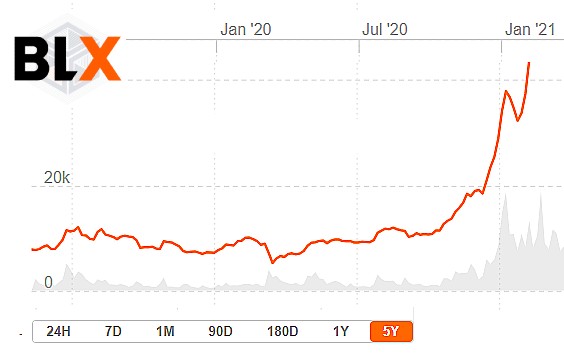

Similar to the Dow Jones Index, Bitcoins experienced a significant drop but subsequently bounced back at a rapid pace due to government stimulus measures. (Source: Bitcoin Liquid Index)

In contrast, during the initial months of the COVID-19 pandemic, gold displayed consistent growth.

Covid Response and Rapid Recover for Risk Assets

In the face of market instability and economic upheaval, governments and central banks around the world took significant actions. For instance, the Federal Reserve in the United States reduced interest rates almost to zero and initiated quantitative easing programs, which involved purchasing corporate bonds and providing direct support to various industries. Consequently, there was a swift “V-shaped” rebound.

Starting in late March and early April 2020, as depicted in the graphs, markets initiated a swift bounce-back, thanks to extraordinary stimulus measures. The NASDAQ spearheaded the recovery, with tech and biotech sectors powering its surge, eventually hitting new record highs in the subsequent months. By early May, Bitcoin had regained its previous value.

During the period spanning from late 2020 to early 2021, both stock markets and Bitcoin persisted in their uptrend. Notably, the S&P 500 and NASDAQ consistently reached new peaks, defying economic hardships such as elevated unemployment rates and ailing sectors including travel and hospitality.

Several governments, including the United States, have distributed large amounts of aid to their citizens without specific targets. As a result, numerous individuals took advantage of this financial influx by investing and increasing their spending. It’s debatable that the Covid stimulus packages contributed significantly to Bitcoin reaching new all-time highs within the following year.

Historical Context: Bitcoin and Ukraine War

In the wake of Russia’s invasion of Ukraine on February 22, 2022, Bitcoin momentarily proved to be a worthwhile safe-haven investment. The price of BTC surged by approximately 18% within a week, climbing from $37,068 to $44,357. In contrast, the Dow Jones Industrial Average remained mostly unscathed during this period. However, in the ensuing months, the US Federal Reserve initiated a series of interest rate hikes as part of an effort to curb inflation triggered by the excessive liquidity injected into the market due to the Covid-19 pandemic.

From March 16, 2022, to December 14, 2022, the Fed increased interest rates a total of seven times. The range started at 0.25%-0.50% in March and ended at 4.25%-4.50% in December. Simultaneously, Bitcoin’s price dropped more than 65% from its peak of $47,062 on March 31 to a low of $16,818 on December 22. The Dow Jones Industrial Average also experienced a decline, dropping from 34,678 on March 31 to 28,725 on September 30, representing approximately a 17% decrease and its lowest point for the year.

War and Calamity – What Will Bitcoin Do?

During the Covid pandemic and the Ukraine war, the Bitcoin price has been known to react dramatically and swiftly based on shifting public sentiment. For instance, the Bitcoin price dropped significantly due to Covid, whereas it skyrocketed following the Ukraine invasion. Notably, in both instances, the price eventually reverted back to its previous level. Nevertheless, what truly influenced the price trends in these situations was government fiscal policy. The massive Covid stimulus packages caused a significant price surge for Bitcoin in 2020, while interest rate hikes in 2022 led to a price decrease.

On April 14th, occurrences in the Middle East caused a typical price fluctuation and subsequent bounce-back for Bitcoin. Currently, on April 15th, the value of Bitcoin has risen by almost 6% since its low of $61,896 reached on that day.

Will further military actions in the region cause continued fluctuations in Bitcoin’s price? Based on history, such as the Covid and Ukraine crises, we’ve seen sudden, volatile price changes following specific events, only to bounce back to previous levels relatively quickly. With the US government currently unlikely to change fiscal policies, and plans for more quantitative easing later this year – a past boon for Bitcoin’s price – it seems unlikely that significant price shifts will occur in this arena.

If the US government maintains its current fiscal policies, the occurrences of April 14th are not expected to significantly affect Bitcoin’s price in the long term. Instead, the approaching Bitcoin halving holds greater potential for causing notable price fluctuations.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- All 6 ‘Final Destination’ Movies in Order

- Every Minecraft update ranked from worst to best

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

2024-04-17 10:55