It is not in Warren Buffett’s nature to spread despair; his approach, though, is one of quiet, unyielding optimism, even as the shadows of 2026 loom ever closer. Yet, the man who has long been a beacon of rationality now moves with the precision of a clockwork mechanism, his actions a cipher to those who dare to decipher them.

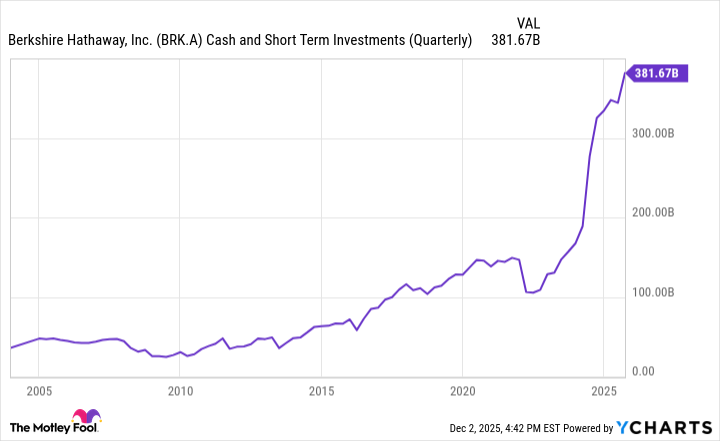

Buffett, the enigmatic figure at the helm of Berkshire Hathaway, has engaged in a systematic, unrelenting sale of equities for twelve consecutive quarters, a maneuver that defies precedent and signals an unsettling undercurrent in the financial cosmos. This is not a mere fluctuation but a calculated withdrawal, a retreat into the unknown, as if the very act of selling were a ritual to ward off some indistinct, encroaching malady.

The Oracle of Omaha, that paragon of fiscal wisdom, has not spoken in riddles or proclamations. His silence is a language of its own, a void that hums with the weight of unspoken truths. Yet, his portfolio-a labyrinth of holdings-reveals a narrative of quiet dread. The question is not what he fears, but why he fears it, and whether the fear is a reflection of reality or a shadow cast by his own mind.

There is a peculiar logic to the investor’s plight, a logic that bends and twists like the corridors of a bureaucratic nightmare. To panic is to surrender to the chaos of the moment, yet to remain composed is to risk becoming a pawn in a game whose rules are written in ink that dries too quickly to read. Buffett’s adage-fear when others are greedy, greed when others are fearful-now feels less like a strategy and more like a riddle, its answer obscured by the fog of time.

The investor, caught in the labyrinth of market fluctuations, must resist the siren call of panic, for in the abyss of uncertainty, the only solace lies in the measured steps of reason. Yet, the act of selling, though methodical, is not a frenzy. It is a slow, deliberate unraveling, a shedding of assets that may one day be deemed obsolete, their value eroded by the relentless march of time.

To build cash is to prepare for a storm that may never arrive, yet the storm is always a possibility, a specter that haunts the investor’s dreams. Buffett’s $382 billion reserve, a fortress of liquidity, is both a shield and a burden, a testament to foresight that may outlast the very markets it seeks to protect. In this, the investor finds a paradox: to hold cash is to wait, and to wait is to be trapped in a state of perpetual anticipation.

To buy selectively is to navigate a minefield of uncertainty, where every decision is a gamble against the future. Buffett’s criteria, once a beacon of clarity, now seem like a series of arbitrary thresholds, a system that demands precision in a world that thrives on chaos. The investor, like a bureaucrat in a foreign land, must decipher the rules of valuation, knowing that the rules themselves may shift with the wind.

In the end, the investor is left with a choice: to conform to the system’s demands or to defy them, a choice that echoes the existential struggles of those who have come before. The market, that great machine of capital and fear, continues its inexorable march, and the investor, like a character in a Kafkaesque tale, must find meaning in the madness.

💼

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-12-07 21:12