Now, old man Buffett—a fellow who’s made a considerable fortune simply by not doin’ foolish things—has stepped down from runnin’ Berkshire Hathaway. Seems a body can’t wrangle a company the size of a small nation forever, though I reckon his influence’ll linger like the smell of woodsmoke on a cool autumn evenin’. He always had a knack for seein’ things plain, and his principles—holdin’ onto a good thing for the long haul, mostly—are bound to stick with the company, and with folks lookin’ to make a honest dollar.

Buffett, you see, always preached a simple truth: patience. Not the kind a preacher talks about, mind you, but the kind that lets a good investment ripen like a peach on the tree. And so, I’ve been ponderin’ on a couple of his favorites—shares a body could tuck away and forget about, and still find ’em growin’ when the time comes. Not get-rich-quick schemes, no sir. Just solid, sensible investments—the kind that don’t keep a man up at night worryin’.

1. Coca-Cola: A Sweet History

Berkshire Hathaway’s got a hefty stake in Coca-Cola—nearly a tenth of the whole kit and caboodle—and they’ve been holdin’ onto it since ’88. Buffett himself once said he favored holdin’ stocks “forever,” and I reckon Coca-Cola fits that bill nicely. It’s a sugary concoction, yes, and a body ought not make a habit of swillin’ it all day, but it’s a powerful thing, this Coca-Cola. It seems folks will reach for a bottle whether times are good or bad. They might trade down to the cheaper brands, of course, but the desire for a bit of fizz and sweetness remains constant, like the Mississippi River flowin’ to the sea.

The cleverness of Coca-Cola, you see, ain’t in makin’ the syrup itself, but in lettin’ others do the bottlin’ and distributin’. They sell the concentrate, and the local fellas handle the rest. It’s a right smart way to get your product into every corner of the world without havin’ to build a fleet of wagons and hire an army of drivers. It’s a system that’s worked for ’em for a good long while, and I don’t expect they’ll be changin’ it anytime soon.

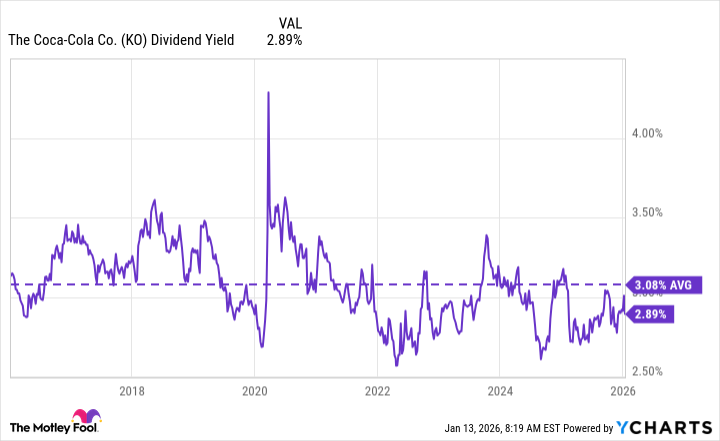

Now, don’t go expectin’ Coca-Cola to double your money overnight. It ain’t a rocket ship, this stock. But it’s a steady earner, payin’ out dividends for sixty-three years straight. A “Dividend King,” they call it—a rare breed indeed. As of late, the yield’s around 2.9%, a tad below its average, but a reliable income stream nonetheless. There are stocks that offer higher yields, to be sure, but few come with a guarantee as solid as Coca-Cola’s.

A body wants a stock they can hold onto for the long haul, somethin’ that’ll keep payin’ out even when the world’s gone topsy-turvy. Coca-Cola, with its history of consistent dividends, offers just that—a bit of peace of mind in a world full of uncertainty.

2. Visa: The Magic Card

Visa, now that’s a different sort of beast altogether. It ain’t the biggest holdin’ in Berkshire’s portfolio—just under a percent—but it’s a powerful one. It’s the largest payment processor in the world, and Buffett always did have a fondness for companies with a “moat”—somethin’ that keeps the competition at bay.

Visa’s moat, you see, is its reach. Over 175 million merchants accept it, and they processed a cool $16.7 trillion in transactions last year. That’s a heap of money, even for a fella like me to contemplate. This reach is thanks to somethin’ called the “network effect”—the more people use Visa, the more valuable it becomes for everyone involved. Merchants want to accept it because that’s what folks are usin’, and folks want to use it because that’s what merchants accept. It’s a virtuous cycle, and a powerful one.

Visa’s business model is remarkably simple: take a small slice of every transaction that goes through its network. Once the infrastructure’s in place, they don’t have to spend a fortune to keep it runnin’. It’s like buildin’ a railroad—the initial cost is high, but once the tracks are laid, the profits keep rollin’ in.

As the world moves away from cash and towards digital payments—cards, wallets, online commerce—Visa’s position will only grow stronger. It’s becomin’ the foundation of the global payment ecosystem, and I reckon it’ll stay that way for a good long time. They’re investin’ wisely to stay ahead of the curve, ensurin’ they remain the preferred choice for merchants and consumers alike.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-01-16 12:43