The recent abdication of Warren Buffett from the helm of Berkshire Hathaway – a rather pedestrian conglomerate, if one discards the hagiography – has left a void. Not of leadership, mind you, but of narrative. Sixty years he spent accumulating capital, and a reputation for shrewdness. Now, the acolytes sift through the holdings, seeking epiphanies in the mundane. A sort of financial divination, really. The assumption, of course, being that a man who enjoyed the good fortune of timing, possesses some occult knowledge of future markets. A charming delusion.

One finds, then, a pair of companies frequently touted as inheritors of the Buffettian spirit. Amazon and American Express. Both, undeniably, successful. Though success, as any seasoned observer knows, is often merely the prolonged postponement of failure, elegantly disguised. Let us dissect these specimens, shall we?

1. Amazon: The Everything Store and Its Peculiar Fragility

Amazon. A name that now evokes not a river, but a relentless, algorithmic hunger. Buffett, initially skeptical – a rare display of independent thought – eventually succumbed to its gravitational pull. A late conversion, admittedly, but one that has, for the moment, proven profitable. Though the past year has seen a deceleration, a mere pause in the upward trajectory, naturally. A five percent increase is hardly catastrophic, merely… uninspired. Especially when juxtaposed with the exuberant, if ultimately unsustainable, performance of its “Magnificent Seven” peers.

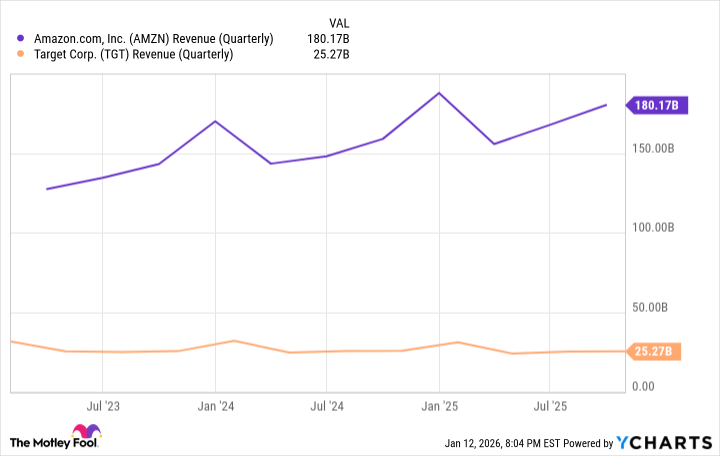

The company’s trifecta – e-commerce, cloud computing, advertising – is often cited as its strength. A rather obvious observation, wouldn’t you agree? The e-commerce division, a behemoth that has reshaped retail, continues to generate prodigious cash flow. The North American segment alone, in the third quarter of 2025, amassed $106.3 billion. Enough, one notes with a touch of morbid fascination, to eclipse the total revenue of Target over four consecutive quarters. A rather brutal comparison, but one that underscores the sheer scale of Amazon’s dominance.

However, it is Amazon Web Services – AWS – that truly powers the machine. The world’s largest cloud platform, a digital infrastructure upon which much of the modern world precariously balances. A rather ominous thought, when one considers the potential for systemic failure. But let us not dwell on dystopias. AWS, despite a recent slowdown – inevitable, given its sheer size – remains a formidable force. And, of course, the burgeoning field of artificial intelligence promises a fresh wave of demand for computing power. A convenient narrative, neatly aligning with Amazon’s existing capabilities.

Yet, the most intriguing aspect of Amazon may be its advertising business. A stealthy, rapidly expanding division that operates with significantly higher margins than its e-commerce and cloud counterparts. A delightful irony, isn’t it? The company that once disrupted traditional retail is now actively participating in the very advertising ecosystem it once sought to bypass. A testament, perhaps, to the enduring power of capitalism, or simply a pragmatic adaptation to market realities.

The stock, currently experiencing a period of stagnation, belies the underlying dynamism of the company. A temporary lull, no doubt. Or perhaps a harbinger of more turbulent times. One can never be entirely certain, can one?

2. American Express: The Allure of Exclusivity

American Express. Berkshire’s second-largest holding, comprising a substantial 17.4% of its portfolio (151,610,700 shares as of September 30, 2025). A brand meticulously cultivated to evoke prestige and exclusivity. A rather effective marketing strategy, appealing to the aspirational desires of the affluent. Buffett, predictably, appreciates this “competitive moat.” A rather pedestrian term for a rather sophisticated phenomenon.

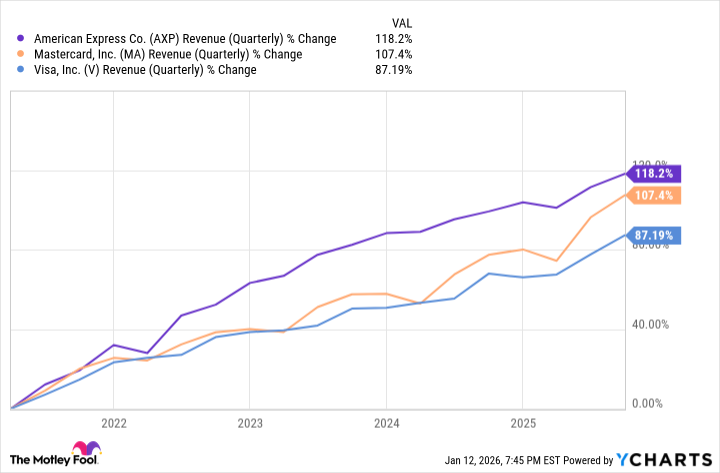

Unlike Visa and Mastercard, which merely facilitate transactions, American Express operates as both a payment network and a direct lender. A more ambitious, and inherently riskier, undertaking. The company assumes the burden of consumer defaults, but also reaps the rewards of interest payments and transaction fees. A calculated gamble, which, thus far, has proven profitable. Its revenue growth over the past five years has consistently outpaced that of its rivals. A rather impressive feat, though hardly indicative of invincibility.

The company is also adept at attracting younger demographics. Millennials and Gen Z account for approximately 64% of new account openings. And, predictably, they exhibit a higher transaction volume than their older counterparts. A rather cynical observation, perhaps, but one cannot deny the power of targeted marketing. By cultivating a loyal base of young consumers, American Express ensures a steady stream of revenue for years to come. A rather predictable, and ultimately uninspired, strategy.

American Express, therefore, appears poised to remain a prominent fixture in the financial landscape. A testament, perhaps, to the enduring appeal of exclusivity, or simply a consequence of effective marketing and shrewd financial management. One can never be entirely certain, can one? The markets, after all, are notoriously unpredictable. And the illusion of control is often more comforting than the reality of chaos.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-01-16 15:53