In the age when markets seem to frolic like giddy debutantes at their first ball-oh, how they twirl!-let us not forget the wise old sage himself, Warren Buffett. Back in October 2008, as the financial world crumbled with all the grace of a tipsy ballerina, he penned an op-ed for The New York Times reassuring investors: “Buy American. I Am.” A delightful proclamation, that was! Fear was rampant, gripping the chic and the ordinary alike. Yet, our dear Warren maintained that optimistic twinkle in his eye.

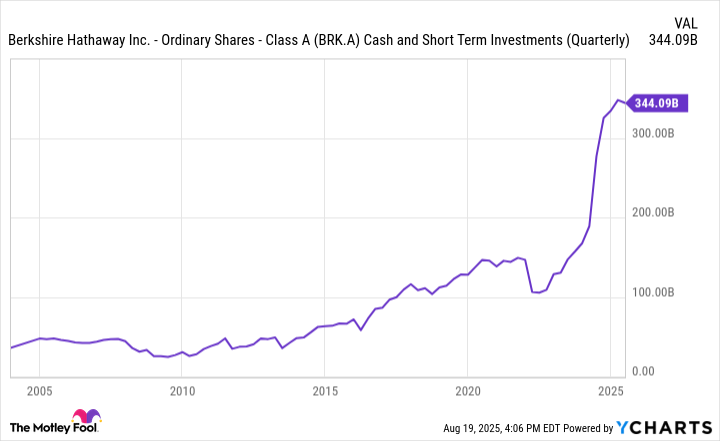

Fast forward to the present day, and while the S&P 500 (that tired old index) hovers near its zenith, investors parade about as if the future is a grand soirée-unfazed and seemingly reckless. Indeed, absent from our lettered pages, Buffett has opted to extend an elegant but pointed $344 billion warning.

Ah, the $344 billion not-so-subtle hint

To truly grasp Buffett’s sentiments about the current market climate, one scarcely needs a crystal ball-merely gaze upon Berkshire Hathaway‘s (BRK.A) (BRK.B) bulging coffers. A pint-sized fortune sits there, quietly simmering. A more bullish Buffett dabbles in investments, vacating his cash like a host at an endlessly dull dinner party. When he hoards cash, as he so artfully does now, one might surmise that he fears the skies might soon darken.

So, where does Buffett’s cash position stand today? By the close of Q2 2025, he cradled a staggering $344 billion-only a smidge less than his previous whimsy of $347.6 billion. How quaint!

Unsurprisingly, our dear Oracle of Omaha is hardly gallivanting into the stock markets these days. In fact, his cudgel has swung heavily against buying stocks, as he has only waltzed away from them for an astonishing eleven straight quarters. One might wonder if he has mistaken the stock market for an exceedingly dull theatre production.

The implication of Buffett’s behavior? It appears he believes that stock valuations have become rather unrefined. Oh, that age-old Buffett indicator, the grand measuring rod of market foolishness, stands at a staggering 210%. When this pompous figure struts too close to 200%, he might as well declare: “You’re playing with fire, darlings!”

Lessons from history-the ultimate party pooper

If history possesses any wisdom to impart, it may well be that fortunes are not reinvented overnight. Berkshire’s cash has never before flirted with these dizzying heights. Yet, how delightfully we recall mid-2005, when Berkshire’s cash peaked at a mere $48 billion, leading to a cheeky 30% rise in the S&P 500 by October 2007. Yet, just as one gets a bit too comfortable with one’s champagne, the grand calamity of 2008 ensued, dragging us all into a pit of despair.

Mind you, Buffett was not twiddling his thumbs in his op-ed back in 2008-he was, as such, quite busy snatching up American stocks as if preparing for an extravagant sale. His cash was soon down by almost 50%-how terribly pedestrian!

Another record cash pile in the third quarter of 2021 saw Berkshire frolicking with over $149 billion as the S&P 500 danced to a jaunty 10% gain by year-end, only to be shoveled into an abyss with a 20% drop the following year. Oh, the drama!

The juxtaposition here is that the Buffett indicator reached dizzy heights in 2000 just before the dot-com bubble burst into a confetti of regret. Fast forward to late 2021 when it again neared 200%, right before the misfortunes of 2022 tempestuously descended.

What’s a savvy investor to do, then?

Ignoring Buffett’s warning could be the most grievous error, akin to ignoring the late-night siren’s call. Always, always heed the whispers of wisdom-when a billionaire sniffs out excessive stock valuations, it pays to listen. History has taught that ignoring such warnings often leads to a rather precipitous plunge.

The best course may well be to embrace Buffett’s current methodology. Cash is king, they say, and Berkshire’s financial strategy affords him (or his charming successor, the ever-practical Greg Abel) the luxury of investing when market valuations become rather attractive.

Worry not, our venerable buffoon hasn’t stopped dallying with stocks altogether. In the second quarter of 2025, Berkshire pranced into shares of nine companies and flirted with three new positions. Yet, the selection process appears to be as discerning as choosing the finest caviar-selectivity is imperative amid such extravagant market valuations.

What’s essential, however, is recognizing that panic is not on Buffett’s agenda. Despite his current net-sell extravaganza, approximately $295 billion remains entangled in equities. A cautious gamble, perhaps? Nevertheless, optimism dances in the shadows-oh, how marvelously elegant it can be!

👑

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-08-24 12:34