Warren Buffett, that old shrewd cat, built his empire on dividend stocks and income investing. For six decades, he’s herded a financial flock that lays golden eggs-hundreds of millions in dividends. Now 95, he still adjusts his portfolio like a man rearranging furniture in a house he’s never planning to leave. He likes companies with good managers, dominant positions, and the decency to hand shareholders a few bucks. Occidental Petroleum (OXY), with its 2.1% yield, fits the bill. So it goes.

A closer look at Occidental

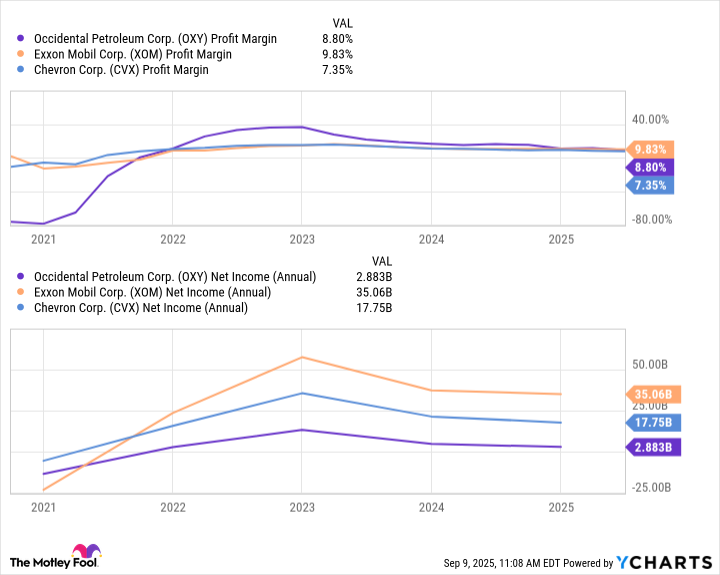

Occidental is a big oil producer in the U.S., with assets in the Denver-Julesberg and Permian basins. It also drills offshore in the Gulf of Mexico, North Africa, and the Middle East. As an integrated energy company, it plays in upstream, midstream, and downstream-like a one-stop shop for oil and gas. Its profit margins are competitive with ExxonMobil and Chevron, even if its revenue isn’t. Size doesn’t matter if you know how to count. So it goes.

Oil companies are having a rough year. Prices have slumped from $110 to $65 a barrel, and OPEC’s production plans threaten to push them lower. Occidental’s net income dropped from $992 million to $288 million in a year. Its revenue? Down 43%. But then, what’s new? The oil business is a rollercoaster. Buckle up. So it goes.

Why does Occidental stand out from other Buffett stocks?

Buffett first bet on Occidental in 2019 to help fund its takeover of Anadarko-a move that forced a dividend cut. But the dividend is back, growing like a weed. In 2022, Buffett read the earnings call transcript and declared, “She’s running the company the right way,” about CEO Vicki Hollub. He’s not wrong. Berkshire now owns 26.9% of Occidental, with regulatory permission to take 50%. But Buffett, ever the cautious gambler, says no to that. So it goes.

| Period | Shares Acquired |

|---|---|

| Q1 2022 | 136,373,000 |

| Q2 2022 | 22,176,729 |

| Q3 2022 | 35,891,921 |

| Q1 2023 | 17,355,469 |

| Q2 2023 | 12,422,073 |

| Q3 2023 | 19,586,612 |

| Q1 2024 | 4,302,324 |

| Q2 2024 | 7,263,396 |

| Q4 2024 | 8,896,890 |

| Q1 2025 | 763,017 |

The takeaway

Occidental is a Buffett stock, through and through. It has solid management, a decent position in energy, and a dividend that won’t quit. Sure, the stock is down 7% this year. But Buffett’s not a man to panic. He’s betting on the long game, the same way he bets on death and taxes. For income investors, Occidental is a quiet revolution. It doesn’t shout. It just works. So it goes. 🚀

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-13 15:28