It was one of those nights—a kind of dark, smoky dusk where every shadow seemed to whisper secrets. In the underbelly of Wall Street, the Oracle himself, Buffett, had poured nearly $78 billion into his own stock over the past seven years. But now, as the ticker tap danced its mournful waltz, his favorite asset was slumping—down over 10% from its peak. It made you wonder: had the master lost his touch?

Most investors track Buffett’s moves through Berkshire Hathaway’s quarterly 13F filings. But that’s just the tip of the iceberg. The real story is hidden in the quarterly operating reports—buried on the final pages, just before the executive certifications. There, in plain sight for those who know where to look, lies the gritty detail of his buyback program: shares of Berkshire Hathaway itself.

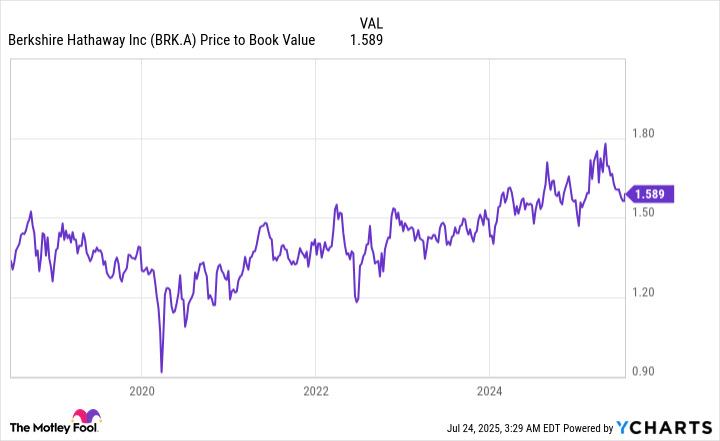

For years, Buffett was chained to a rule: he could only repurchase Berkshire’s shares when they dipped to 120% of book value—a 20% discount at best. But on July 17, 2018, the board unlocked the vault. Now, as long as Berkshire has at least $30 billion in cash, cash equivalents, and U.S. Treasuries, Buffett could buy back shares whenever he thought they were cheap. And cheap they were, until the premium soared to a staggering 60%–80%.

This slump isn’t a sign of weakness. It’s a badge of honor—a grim reminder that even legends can be gun-shy when the numbers don’t add up. In a market bloated with speculation, the Oracle’s patience is as rare as honesty in a crooked town. He’s not chasing overpriced dreams; he’s waiting for the true value to reappear.

Berkshire Hathaway’s slump is a sign of Buffett’s resolve and shouldn’t be confused with weakness

Buffett’s investment philosophy has always been simple: buy only when the numbers make sense. Even when the market tempted him with short-term arbitrage—like his brief dalliance with Activision Blizzard in 2022—he never strayed from the path of value. And now, with Berkshire trading at a premium far above its intrinsic worth, Buffett has stayed his hand.

For 10 consecutive quarters, Buffett has been a net seller of equities—unloading stocks with the precision of a surgeon. In total, he’s sold $174.4 billion more than he’s bought. It’s a cold reminder that even legends can fold when the odds sour.

Buffett once championed the market-cap-to-GDP ratio as the best single measure of valuations. Today, that Buffett Indicator has soared to a record high of 212.23%. In a world where value is as scarce as truth in a den of liars, it’s no wonder that the Oracle is holding his cards close.

But here’s the rub: this isn’t a sign that Buffett’s magic has faded—it’s a reaffirmation of his unwavering principles. As an activist investor, I’ve seen boards asleep at the wheel, but Buffett’s resolve is as clear as the smoky air in a cheap gin joint. He’s waiting for valuations to fall back to earth, and history suggests that patience in this game can be as profitable as it is infuriating.

So, as the market churns and the numbers tell their tale, one must ask: is this the calm before the storm or the final curtain call for a legend? Only time will tell. And in the meantime, I’ll keep my eyes peeled—for in this game, the biggest gamble is the one you don’t take. 💰

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Top gainers and losers

- The Weight of Choice: Chipotle and Dutch Bros

2025-07-28 11:16