Warren Buffett has never displayed much enthusiasm for gold. This is not a matter of personal preference, but of a reasoned, if often unheeded, assessment of its place – or rather, its lack of place – in a sensible portfolio. He builds wealth by acquiring productive assets; gold, he argues, is merely a store of potential decay.

During the 2018 Berkshire Hathaway shareholder meeting, Buffett presented a historical comparison. It wasn’t a boast, but a blunt statement of fact. He posited a simple question: given $10,000 in 1942, would it yield greater returns in the stock market, or locked away in gold bullion? The year itself was deliberate; a time of widespread anxiety, when the urge to seek refuge in tangible assets was strong. It remains a recurring pattern in times of fear.

The answer, then as now, is stark. That $10,000, invested in the S&P 500, would have blossomed into approximately $51 million by 2018. The same sum, committed to gold, would have grown to a comparatively modest $400,000. The difference isn’t merely a matter of percentage points; it’s a demonstration of the power of compounding returns from productive enterprise. Gold, while retaining some value, simply doesn’t produce anything.

Buffett’s point, often lost in the clamor for ‘safe havens,’ is that wealth isn’t created by hoarding, but by participation in economic growth. Gold offers the illusion of security, but provides no inherent value beyond its speculative price. It is, in essence, a passive observer, while businesses reinvest, innovate, and generate returns.

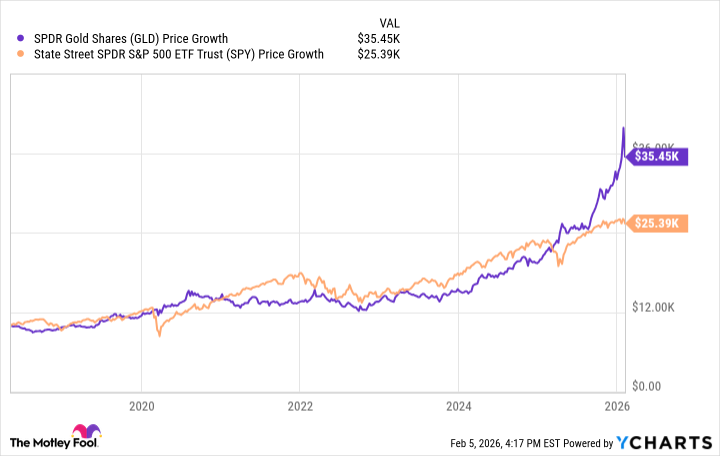

Recently, I revisited these arguments, prompted by the renewed interest in gold. The price has risen, fueled by anxieties about inflation and geopolitical instability. I examined the performance of gold, specifically through the SPDR Gold Shares ETF (NYSEMKT: GLD), against the SPDR S&P 500 ETF Trust (SPY) since that 2018 Berkshire Hathaway meeting.

The results, while surprising to some, are revealing. An initial $10,000 investment in the gold ETF has increased roughly threefold. This is not insignificant. However, the same amount invested in the S&P 500 ETF has yielded considerably more, exceeding $25,000. The narrative of gold as a superior investment, even in times of crisis, does not withstand scrutiny.

Some will argue that Buffett was simply ‘wrong’ this time. But this is a superficial assessment. His critique of gold isn’t based on short-term market fluctuations, but on fundamental principles. He made similar arguments in 2011, and the results have been consistent. A $10,000 investment in 2011 would be worth approximately $29,000 in gold today, compared to $49,700 in the S&P 500.

The lesson, if one is to be drawn, is this: wealth is built, not discovered. It requires active participation in the creation of value, not passive reliance on the perceived safety of inert metal. Buffett’s long-term track record suggests he understands this principle rather well. To ignore it is to embrace a comforting illusion at the expense of genuine prosperity.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-08 11:53