Thursday, 3rd October – Right, here’s the thing. I’ve been staring at my screen for hours (literally-my Fitbit says I’ve only moved three steps since breakfast), trying to figure out why Warren Buffett has gone and bought shares in Lennar (LEN) when Wall Street seems to think it’s about as appealing as last week’s leftover quiche. Honestly, is he onto something? Or is this just another one of those “What does he know that we don’t?” moments?

Units of Coffee Consumed Today: 5. Hours Spent Researching Homebuilders: Too many. Number of Times I’ve Questioned My Life Choices: Infinite.

A Little Background on the Oracle

So, let’s start with the basics because even though I’m a stock market enthusiast (and by enthusiast, I mean someone who occasionally buys ETFs while pretending they’re some kind of financial genius), I still need reminding sometimes. Warren Buffett doesn’t care what other people are doing. He never has. While everyone else is busy panicking over housing market data or obsessing over mortgage rates like they’re tracking calories, Buffett calmly swoops in and buys great companies at bargain prices. It’s infuriatingly simple-and yet, nobody else seems able to pull it off quite like him.

Last month, Berkshire Hathaway added small stakes in ten stocks, including Lennar, which, fun fact, happens to be America’s second-largest homebuilder. Not exactly lighting up Wall Street right now-15 out of 21 analysts covering the stock have slapped it with a “hold” rating, and its median price target is sitting 13% below where it currently trades. But oh no, not Warren. He sees opportunity where others see despair. Classic Buffett move.

The Housing Market Drama

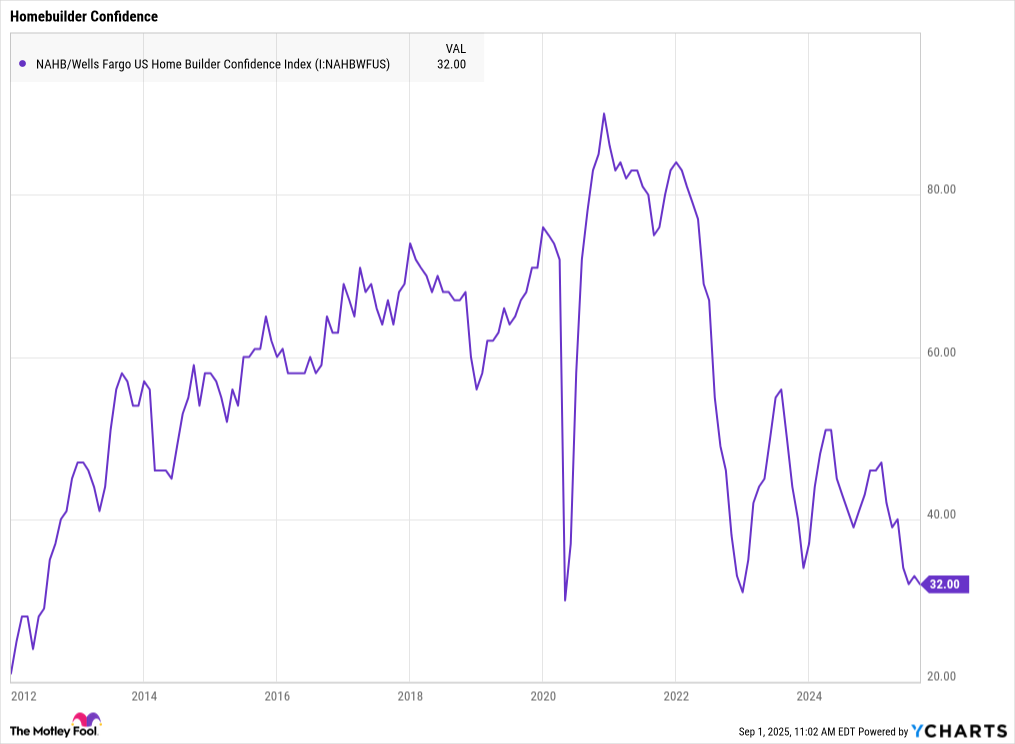

Now, here’s the part where I admit I might have underestimated how grim things really are for homebuilders. Mortgage rates? Hovering between 6.5% and 7%. Home prices? Still sky-high despite fewer buyers. Confidence among builders? At 32 in August, which is basically their version of lying on the couch eating ice cream straight from the tub. The Multiple Listing Service says U.S. homebuyers are at their lowest levels since… well, forever, except for that weird blip during the pandemic.

And poor Lennar! Their gross margins shrank by 460 basis points in a year. Revenue slid 7% last quarter. And if you thought that was bad, wait until you hear about D.R. Horton, another builder Buffett snapped up. Same story, slightly better numbers-but still not great. No wonder Wall Street looks at these stocks like they’re ex-boyfriends showing up uninvited to dinner.

But Wait… What If Buffett Knows Something We Don’t?

This is where I started pacing around my flat (okay, fine, just walking back and forth between my desk and the kettle). Because maybe-just maybe-Buffett isn’t being reckless. Maybe he’s playing the long game again. You see, Lennar isn’t new to this whole “housing crisis” thing. They’ve been building homes since 1954, surviving slowdowns, recessions, and whatever else life throws at them. This time, instead of protecting profit margins at all costs, they’re focusing on volume. Why? Because once you lose momentum in this business, apparently it’s harder than convincing your cat to eat vegetables.

Plus, there’s the glaring issue of America’s housing shortage. Zillow reckons there were 4.7 million more families needing homes than available ones in 2023. That’s a lot of potential customers for Lennar, especially if they keep targeting entry-level buyers and offering incentives like rate buy-downs. Sure, profit margins may take a hit now, but Buffett’s clearly betting on brighter days ahead. As interest rates drop and the economy stabilizes, demand will pick up, and Lennar will be ready to capitalize.

Why Am I Still Obsessing Over This?

I suppose what fascinates me most is the disconnect between short-term thinking and long-term vision. Analysts base their price targets on the next 12 months, but Buffett? Oh, he’s looking years down the road. To him, Lennar isn’t just a struggling homebuilder-it’s a company poised to benefit from an inevitable surge in demand. And at 1.8 times tangible book value, the stock isn’t screaming “cheap,” but it’s hardly overpriced either. Especially considering Lennar’s efforts to streamline its balance sheet using land options contracts rather than outright purchases.

All of this leads me to ask myself: Should I follow Buffett’s lead? Or should I stick to my usual strategy of buying index funds and hoping for the best? Honestly, I don’t know. But I do know this much-I’ll probably spend another hour Googling “Lennar stock forecast” before finally deciding to do nothing.

Units of Self-Doubt Accumulated: 100. Decisions Made: Zero. 😊

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- The Weight of First Steps

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-09-05 13:42