Right then. Let’s talk about fizzy drinks. Not because I want to, mind you. I have a perfectly good life avoiding things that are mostly sugar and artificial flavoring. But the financial scribes are at it again, wringing their hands over which purveyor of sweetened water is the ‘better’ investment. As if choosing between two empires built on encouraging mild addiction is a moral high ground. Still, a job’s a job. And this particular job involves pointing out the slightly less appalling of the two.

PepsiCo, bless its heart, tries so very hard. It’s a bit like a slightly over-enthusiastic apprentice wizard attempting to summon a decent profit margin. It offers a dividend yield that, on the surface, looks a bit more generous than Coca-Cola’s. A shiny bauble to distract you from the fact that it’s been raising those payouts faster simply because it started from a lower base. Like building a tower on quicksand; you might get it higher faster, but you’re still building on quicksand.

1. The Illusion of Growth

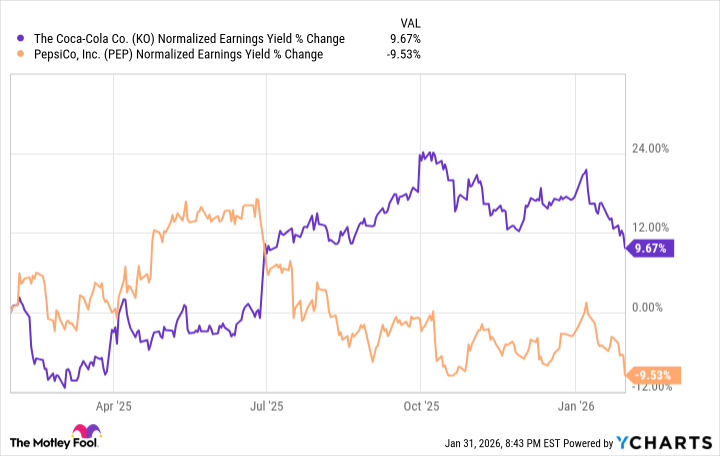

Last quarter, Coca-Cola managed to report earnings growth of 30%. Thirty percent! It’s enough to make a seasoned accountant briefly suspect they’ve accidentally stumbled into a benevolent dictatorship. PepsiCo, meanwhile, experienced a rather more subdued 11% retreat. A retreat, mind you, not a tactical withdrawal. The difference, naturally, is explained away with ‘adjustments.’ Adjustments to account for acquisitions. Both companies are frantically buying up anything that isn’t nailed down, trying to diversify away from the inconvenient truth that fewer people are guzzling sugary beverages. It’s like a dragon attempting to become a florist; a noble effort, perhaps, but ultimately…unlikely.

And this isn’t a fluke. Coca-Cola’s earnings have been gently ascending, while PepsiCo’s have been…well, let’s just say they’ve been experiencing a more ‘dynamic’ trajectory.1

This suggests Coca-Cola’s core business – convincing people to consume flavored sugar water – is still expanding profitability. A truly remarkable feat of marketing, if you ask me.

2. The Profit Margin Paradox

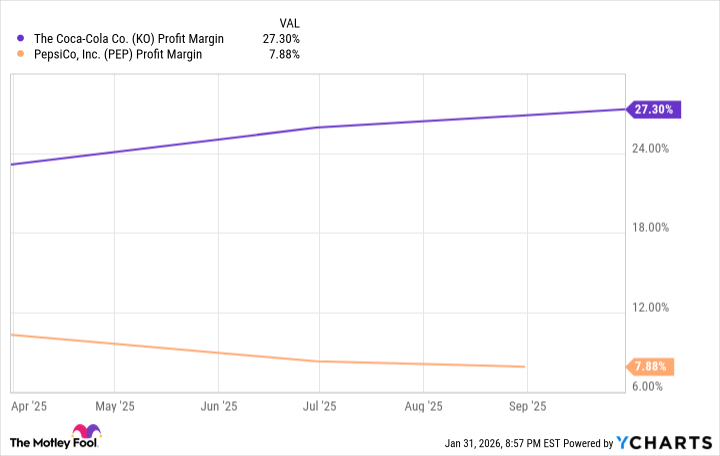

The average profit margin in the soft drink industry is, apparently, 13.4%. A perfectly respectable number for selling essentially flavored water. Coca-Cola, however, towers above this at 27.3%. PepsiCo, in contrast, languishes at a paltry 7.8%. One can only assume they’re giving it away with the crisps. Or perhaps they’ve discovered a previously unknown dimension where accounting rules are…different.

Growing profit margins, in the consumer discretionary sector, are often indicative of pricing power and efficiency. Or, in this case, a superior brand and a relentless commitment to convincing people they need another fizzy drink.2

3. The Dividend Danger Zone

Both companies are ‘Dividend Kings’ – those rare creatures that have been consistently increasing their dividends for over 50 years. It’s a badge of honor, of sorts. A testament to resilience, good management, and a healthy dose of luck. But even kings fall. Take Leggett & Platt, who recently had their 52-year dividend streak unceremoniously terminated. The share price, predictably, cratered. A cautionary tale for those who believe in the permanence of anything.

PepsiCo’s dividend payout ratio currently stands at 105%. Meaning they’re spending more on dividends than they’re earning in net income. A rather unsustainable situation, wouldn’t you agree? They do generate a decent amount of operating cash flow – enough to cover the current dividend payments. But if those profit margins don’t improve, that dividend could be facing a rather abrupt ending.

Coca-Cola, with a payout ratio of just 66%, doesn’t have this problem. Their growing profit margin, growing earnings, and generally stronger fundamentals make them the slightly less terrible option. It’s not a ringing endorsement, I’ll admit. But in a world of questionable choices, sometimes you just have to pick the least objectionable one.

1 ‘Dynamic’ in this context meaning ‘erratic and prone to unexpected dips.’

2 It’s also possible they have a secret laboratory where they’re extracting happiness directly from consumers. But that’s just a theory.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The Best Actors Who Have Played Hamlet, Ranked

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-02-03 23:32