As the infernal machine known as Bitcoin shudders through another week of sideways purgatory, two spectral on-chain indicators whisper of a breakout—though whether it leads to paradise or perdition remains unclear. 🤡

- The MVRV ratio, that elusive gremlin of metrics, nears its 365-day MA—a rendezvous historically followed by rallies (or spectacular collapses, but let’s stay optimistic!). 🎢

- Futures market cools—because nothing says “health” like a dash of frost in the inferno of speculation. ❄️

- Technical indicators flirt with support levels, as if BTC is psyching itself up for a leap… or a faceplant. 🤹♂️

In a missive dated July 31, the soothsayer of CryptoQuant, one CoinCare, pondered the Market Value to Realized Value ratio—now 2.2, creeping toward its 365-day MA. History, that unreliable narrator, claims such convergence precedes rallies. The metric allegedly ascends to overvaluation zones (~3.7), where bulls don golden horns and bears flee screaming. 🐂

“Aha!” exclaims CoinCare, channeling Dow Theory’s ghost, “BTC’s price cannot loiter near long-term averages forever—markets demand drama!” 🎭

Bitcoin futures: A tango of chill and zeal

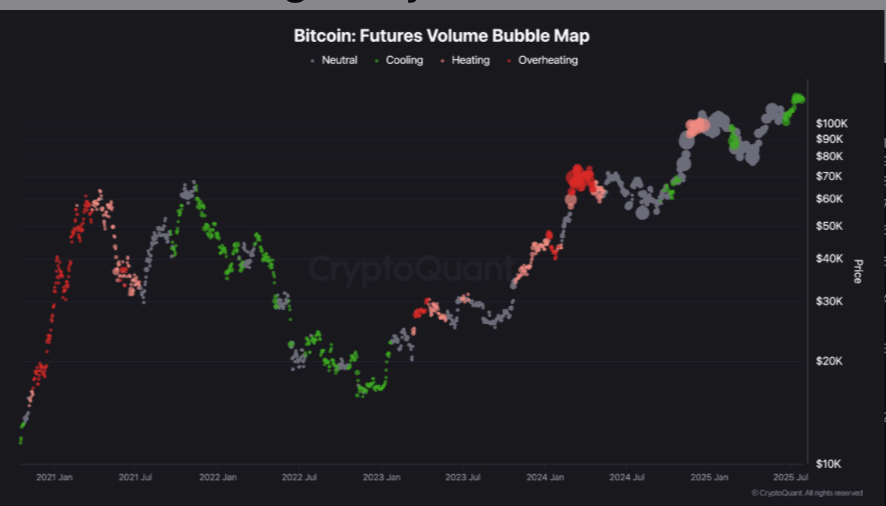

On July 30, the augur of CryptoQuant, ShayanMarkets, noted a curious frostbite in the futures bazaar. Despite BTC’s dalliance with $123,000, the volume bubble map retreats from hellish red into tepid neutrality. 🌡️

Bitcoin’s crawl above $100,000 and this “cooling” spectacle suggest the rally’s fueled by sober demand, not leveraged lunatics. Revolutionary! 🚨

Currently, BTC trades at $118,313 (↑0.1%), trapped in its July 31 rut of $115K–$119.5K. Still nursing a 3.7% bruise from its July 14 peak ($122,838), it clings to a 10% monthly gain. Resilient? Or merely stubborn? 🤔

Technical analysis: Bollinger’s velvet restraints

On the daily chart, BTC nuzzles the 20-day Bollinger Band’s median nerve (~$118,327), a sign of “bullish pressure” moderate enough to avoid indigestion. The narrowing bands? A coiled spring—or a sigh of boredom? 🧐

The RSI, that fickle oracle, hovers at 59.32—neutral, but winking at bulls. The next act hinges on breaching $119,900 (Bollinger’s cap) or a plunge below $116,700 (Bollinger’s trapdoor). Spoiler: Hell may freeze over. 🧊

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

- Top gainers and losers

2025-07-31 10:36