The market’s recent stumble reads less like a collapse and more like a poet pausing for breath-a fleeting sigh before the next stanza. Buyers, armed with digital pitchforks, have fortified the trenches of support, whispering to the charts: “The bull trend lives, though perhaps it’s just napping.” Analysts, those modern-day soothsayers in crypto togas, squint at the data like Tolstoy deciphering war plans, hoping for a breakout that feels less like a revolution and more like a well-timed punchline.

Consolidation: The Bull’s Nap, Not Its Burial

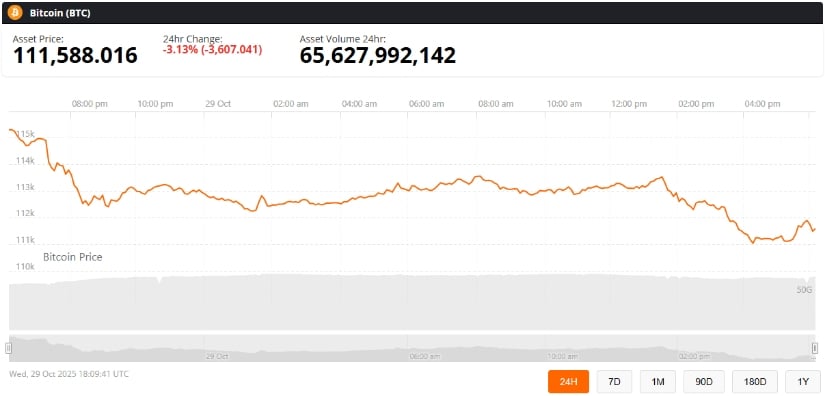

BTC recently tested the $112K threshold, where buyers materialized like ghosts at a séance, fending off a deeper descent. The chart’s higher lows resemble a drunkard’s upward stumble-clumsy, but persistent. If this dance continues, $118K-$122K might not be a mirage, but a poorly written love letter from the market to itself.

Michaël van de Poppe, a crypto oracle with a penchant for dramatics, declared, “So far, so good for Bitcoin. The retest of lower levels has summoned buying pressure like a siren song.” One wonders if he’s ever slept, or if he’s just perpetually caffeinated on bear-market dreams.

This pattern? A temporary breather, not a funeral. The charts, now scribbled with bullish graffiti, suggest buyers are plotting a long-term romance with BTC, despite the occasional heartburn from volatility.

Institutional Hype: Whales Wearing Suits

Institutional inflows, that grand symphony of finance, continue to hum. On October 29, U.S. spot Bitcoin ETFs pocketed $207 million, as if Wall Street had finally learned how to tie a blockchain to its shoelaces. Whales, those leviathans of the crypto sea, are now distributing their BTC to ETFs like confetti at a digital parade. BlackRock’s ETF, now a favored vessel, may soon become the Titanic of tokenized assets-sinking or soaring, who knows?

Ted (@TedPillows), an on-chain seer, noted, “Old whales are distributing their tokens to ETFs-institutions with a flair for holding assets like they’re heirlooms.” If this cycle stretches to 2026, one wonders if the calendar will be printed in Bitcoin ink.

Thus, the four-year Bitcoin cycle, once a rigid clock, now waltzes with uncertainty, led by institutions and the quiet resignation of retail traders who’ve accepted their fate: to HODL, or to perish.

Resistance: The Market’s Final Boss Fight

On the upside, BTC faces resistance between $115.6K and $116.2K-a digital fortress guarded by algorithmic dragons. Breakthrough here could unlock the gates to $119K-$122K, but let’s not get ahead of ourselves. After all, reaching $300K would require miracles, or a stock market that forgot its own rules.

MrMartin_11, a trader with the wisdom of a thousand candlestick charts, warned: “Extraordinary catalysts? Please. The market’s just playing dress-up with numbers.” But hey, if it’s undervalued, maybe it’s just being modest-or overly optimistic.

Support holds like a lover’s promise: fragile, but not yet broken. Break it, and the abyss near $107K-$109K awaits. But if the bulls rally, the market might just forget how to feel fear.

Final Thoughts: A Bull’s Tale

Bitcoin’s short-term narrative? A bullish lullaby, sung by support zones and ETFs. Traders, those modern-day gamblers, should keep their eyes peeled for inflow trends and support levels-though nothing says “fun” like a market that breaks its promises mid-sentence.

In the end, BTC’s journey is a chiaroscuro masterpiece: light and dark, hope and panic, all painted in the ink of institutional bets and retail dreams. Whether it dances to $122K or stumbles into oblivion, one truth remains: crypto is less a market and more a surreal novel-written by the market, for the market, and about the market. 🚀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

- Gay Actors Who Are Notoriously Private About Their Lives

2025-10-30 03:03