In this text, I’ll discuss crypto analyst Alan Santana’s prediction of a Bitcoin drop to around $30,000 and its implications for investors.

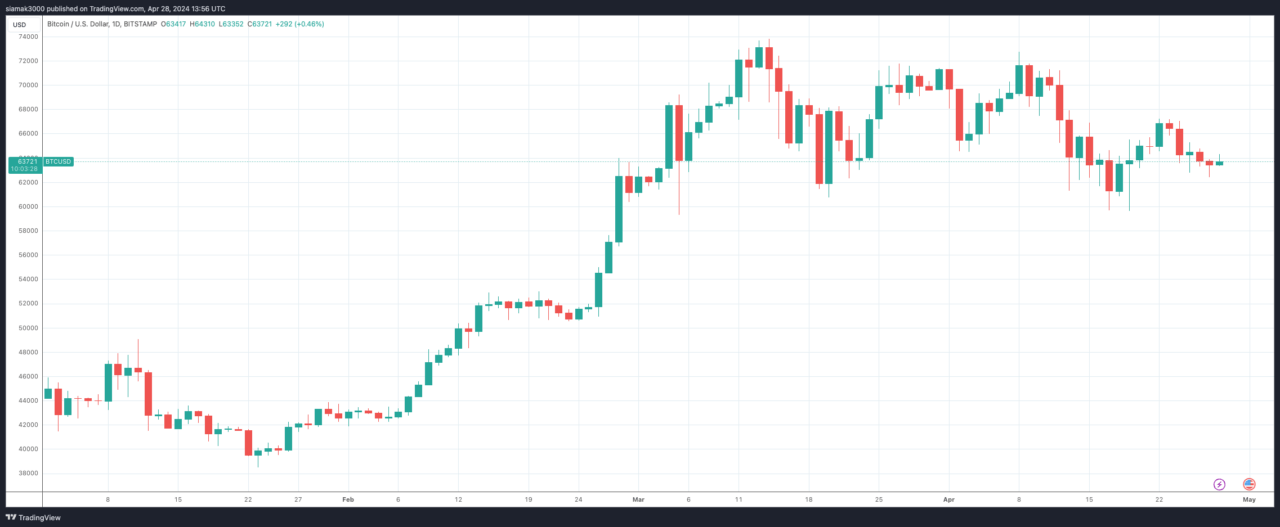

On April 27, crypto analyst Alan Santana issued a warning on TradingView about Bitcoin‘s impending decline. According to his analysis, Bitcoin might experience a major sell-off in the near future and could fall as low as $30,000. This article delves into Santana’s predictions, the techniques he employed, and the consequences for investors.

Understanding the Capitulation Drop to $30,000

Alan Santana employs a simple method to estimate Bitcoin’s possible surrender price. By calculating the average trading value of Bitcoin over the past month and a half, which is roughly around $66,600, and then dividing this amount in half, Santana derives an approximate capitulation level near $33,300. Nevertheless, his overall forecast anticipates a decline towards approximately $30,000.

The Timing and Impact of the Drop

Santana points out that May, which is often a difficult month for cryptocurrencies following a price peak, could see a major price correction. He explains this anticipated timing by referring to Bitcoin’s recent market trends – it has been trading at record highs and has been in a distribution phase lasting almost two months. Although these phases can last up to six months, Santana is convinced that the recent Bitcoin halving event will speed up the sell-off process.

Market Indicators and Technical Observations

Santana highlights several technical indicators:

- Volume and RSI: He points out that volume continues to decrease while the Relative Strength Index (RSI) weakens daily, signaling a loss of bullish momentum.

- EMA Levels: Bitcoin’s failure to hold above the Exponential Moving Average (EMA) levels, particularly EMA10/21 and EMA50, supports his bearish outlook. As of April 24, Bitcoin moved back below EMA50, which Santana interprets as confirmation of a strong short-term bearish bias.

The Recovery and Bull Market Forecast

In spite of the predicted sharp decline, Santana remains hopeful regarding Bitcoin’s future. He envisions a swift bounce back following any major sell-off, implying that Bitcoin may surge by approximately 30-50% from its flash crash bottoms. Subsequently, this increase, starting around $45K, will take shape as consistent and sustained progression over the next 6 to 8 months. Towards the end of Q1 or Q2 in 2025, this advancement is expected to gain momentum, leading Bitcoin back towards record-breaking highs.

Strategic Advice for Investors

As a researcher studying investment trends, I would recommend that investors heed Santana’s advice and prepare themselves for the upcoming market fluctuations. This means taking both practical and mental steps in anticipation of buying opportunities during market downturns and selling at the peak of bullish waves. Santana’s analysis indicates that significant volatility lies ahead, but also substantial potential profits for those who are well-prepared and ready to seize the moment.

As I pen this down (1:55 p.m. UTC, April 28), Bitcoin hovers near $63,736, marking a 0.8% increase within the previous 24 hours.

Read More

2024-04-28 17:09