On April 16, 2024, Mike Novogratz, the CEO of Galaxy Digital, discussed Bitcoin‘s price fluctuations, its function as a secure investment, and recommended strategies for the approaching Bitcoin halving on CNBC’s “Squawk Box” program.

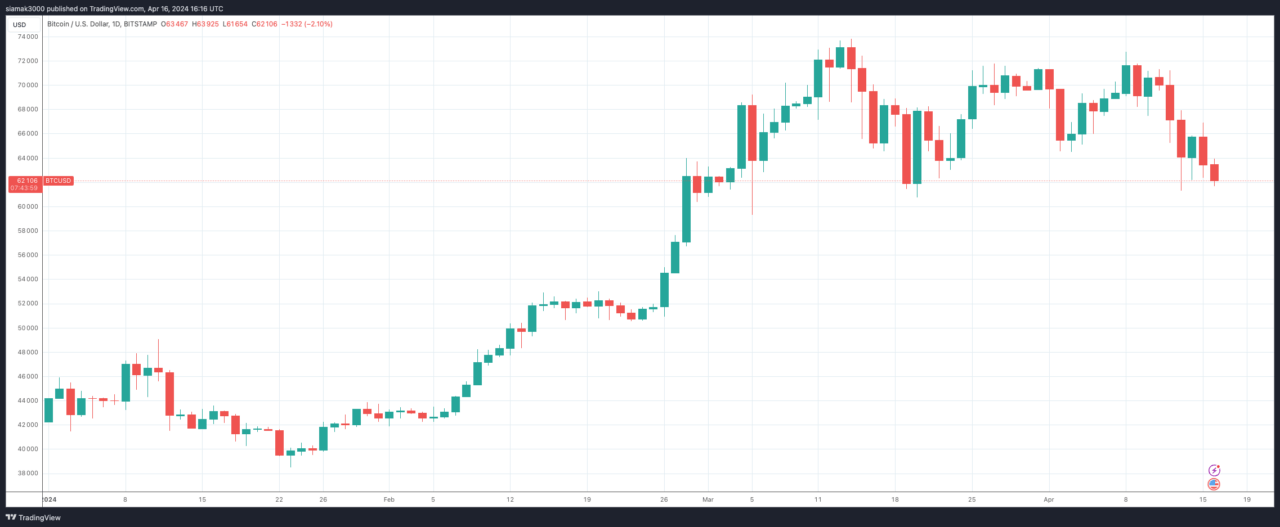

Novogratz acknowledged the recent decline in Bitcoin’s value, linked to geopolitical conflicts between Iran and Israel. However, he pointed out that Bitcoin had an impressive beginning to the year, increasing from $42,000 to $62,000. As a result, it stood out as one of the top-performing assets in 2021. He underlined that Bitcoin’s current position remains robust, despite the recent price instability.

During the discussion, the importance of Bitcoin as a safe-haven asset was among the main points raised. Novogratz explained how in times of crisis or instability, investors typically seek out safer investments such as US dollars and Treasury bills. As a result, riskier assets like stocks and cryptocurrencies may be sold off. However, Novogratz argued against the notion that Bitcoin should replace traditional safe-haven assets entirely. Even experienced investors, he pointed out, tend to revert to well-established safe havens during periods of extreme fear or uncertainty.

When markets experience downturns, individuals with high-risk investments, like those with leveraged positions in Bitcoin, often respond by cutting their losses. This selling pressure can impact various asset classes, including Bitcoin. Novogratz explained that the significant increase of Bitcoin’s price from $40,000 to $70,000 created substantial leverage within the market. He emphasized that this correction is a normal aspect of market fluctuations and does not diminish the long-term significance of Bitcoin.

Novogratz additionally talked about how US-traded Bitcoin ETFs influence the market. In his opinion, many ETF investors are new to Bitcoin and plan to hold their investments for an extended period, which generally benefits market stability. However, he distinguished this from the substantial leverage in crypto markets that can trigger massive sell-offs and price swings, as evidenced by over a billion dollars in liquidations during a single Saturday night.

As the Bitcoin halving, predicted around April 2021, draws near, Novogratz advises investors to consider the historical significance of this event. During a halving, the number of new Bitcoins generated gets reduced by half. This reduction in supply can potentially boost prices if demand remains robust. Yet, it’s crucial to take into account various other aspects such as economic trends and market sentiment when forecasting price fluctuations.

Read More

2024-04-16 19:31