In this most volatile of epochs, the noble coin BTC has rebounded from the $110K support line, buoyed by the grand accumulation of leviathans, the influx of institutions (those grand financial houses), and the post-halving theatrics, all while the market murmurs of a $200K crescendo. Yet, one must not place too much faith in the constancy of fortune, for technical signals squabble like an ill-matched couple at a ball. 🐳💸

The Perilous Dance of BTC at $110K

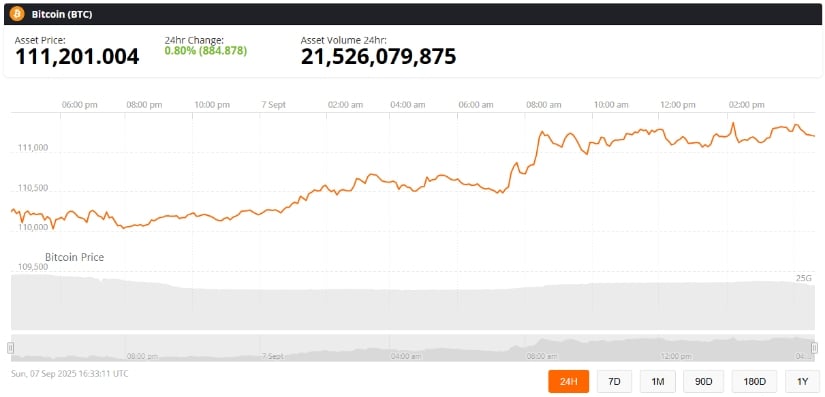

Presently, BTC waltzes above $111,000, a modest yet valiant resurgence after August’s tempests. By the 7th of September, 2025, it had gained 0.80% in a day, with $110K proving a steadfast partner in this dance. The short-term resistance, however, lies between $112K and $114K-a narrow corridor for the bulls to navigate. 🕺

At $111,201, BTC’s price gleams, a 0.80% rise in 24 hours. A most modest ascent, yet one that whispers of grander possibilities. (Brave New Coin, the oracle of such matters.)

CoinMarketCap’s data reveals a market cap of $2.21 trillion, with $25.14 billion in daily trading. Analysts, ever the dramatists, insist that $110K must be defended lest BTC retreat to less illustrious realms. 🛡️

The Bulls’ Gambit: Defending the $110K Stronghold

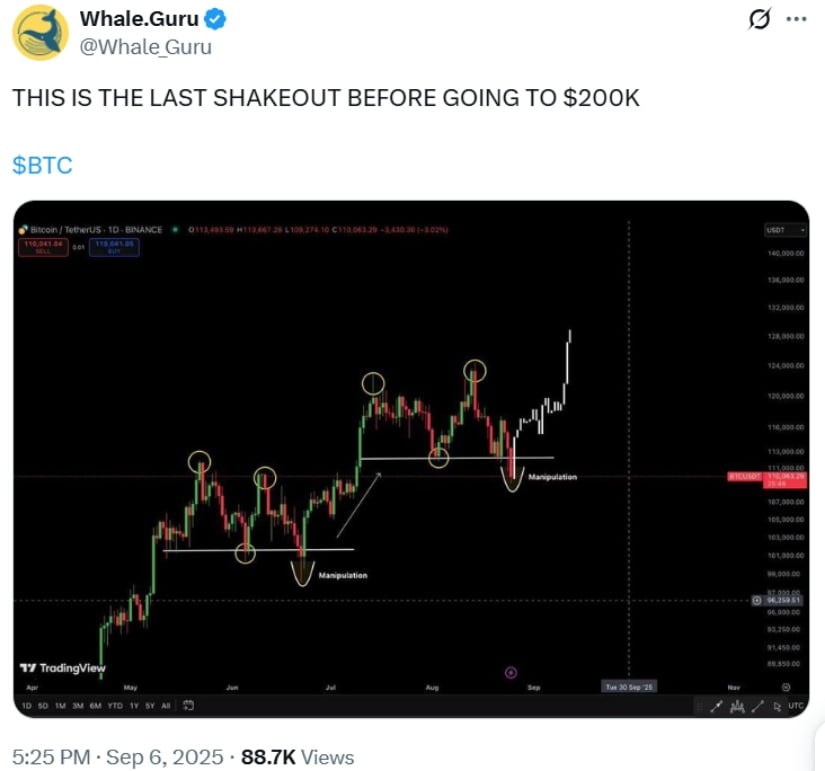

Recent charts suggest BTC has formed a bullish consolidation pattern, a delicate dance around $110K. Traders, ever hopeful, view this as a prelude to grander ambitions. Yet, the momentum wanes like a fading candle, and should BTC falter at $112K, it may descend to $108K or even $100K-a fate most unbecoming. 🕯️

A TradingView analysis from the 6th of September warns of a Head & Shoulders pattern, a portent of mixed fortunes. One must tread carefully in these matters, for the market is as fickle as a belle at a ball. 🤵♀️

Whales and Institutions: A Tale of Two Accumulators

Blockchain data reveals that BTC’s leviathans have devoured $3 billion in recent months, their appetite for the coin insatiable. These titans, one suspects, are the true architects of BTC’s fate, buying when others tremble and selling when others swoon. 🐳

Meanwhile, institutions-those grand financial houses-have embraced BTC with open arms. ETFs, now the darlings of pension funds and hedge funds alike, have drawn billions into the fold. A 2025 study notes corporate BTC reserves have tripled, a testament to their growing affection for the coin. 💼

The Halving’s Role in BTC’s Grand Odyssey

The 2024 halving, that most pivotal of events, continues to loom large. By halving miner rewards, it tightens the supply of BTC, a move that history suggests precedes bull markets. Analysts, ever the optimists, argue this scarcity will ignite a parabolic rally-if BTC surges past $150K, the path to $200K may be clear. 🚀

One imagines the consternation of the market’s more timid participants, who cling to the hope that BTC will not repeat its past follies. Alas, history is a fickle guide. 📜

BTC vs. the Rest: A Kingdom of Coins

BTC, the undisputed monarch of digital assets, reigns supreme as the market’s “digital gold.” While Ethereum and others vie for attention, BTC’s post-halving momentum grants it the clearest path to glory. Meanwhile, MAGACOIN FINANCE, that most speculative of upstarts, has drawn the eyes of the adventurous, though BTC’s crown remains unchallenged. 👑

Final Thoughts: BTC at the Edge of a Precipice

Predictions for BTC in 2025 remain as divided as the opinions of Lady Catherine de Bourgh. A $200K-$250K supercycle may yet unfold, driven by whales, ETFs, and the halving’s alchemy. Yet, short-term turbulence may yet test the mettle of even the boldest bulls. 🌪️

With BTC clinging to $110K, the market watches with bated breath. Should it breach $150K, the door to $200K may swing wide-though one must not forget the perils of hubris. 🚪

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Top 15 Insanely Popular Android Games

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-09-08 01:17