As a researcher with a background in digital asset investment, I find Markus Thielen’s insights on Bitcoin and inflation data intriguing. Thielen’s extensive experience as the CEO of 10x Research and Head of Research and Strategy at Matrixport makes him a highly respected voice in the industry.

Markus Thielen holds a notable position in the world of digital asset investments, recognized for his proficient analytical and strategic abilities. At present, he assumes the role of CEO at 10x Research, a company specializing in comprehensive research and valuable insights on digital assets, primarily catering to institutional investors. Furthermore, Thielen is also the Head of Research and Strategy at Matrixport, a prominent player in the digital asset investment sector.

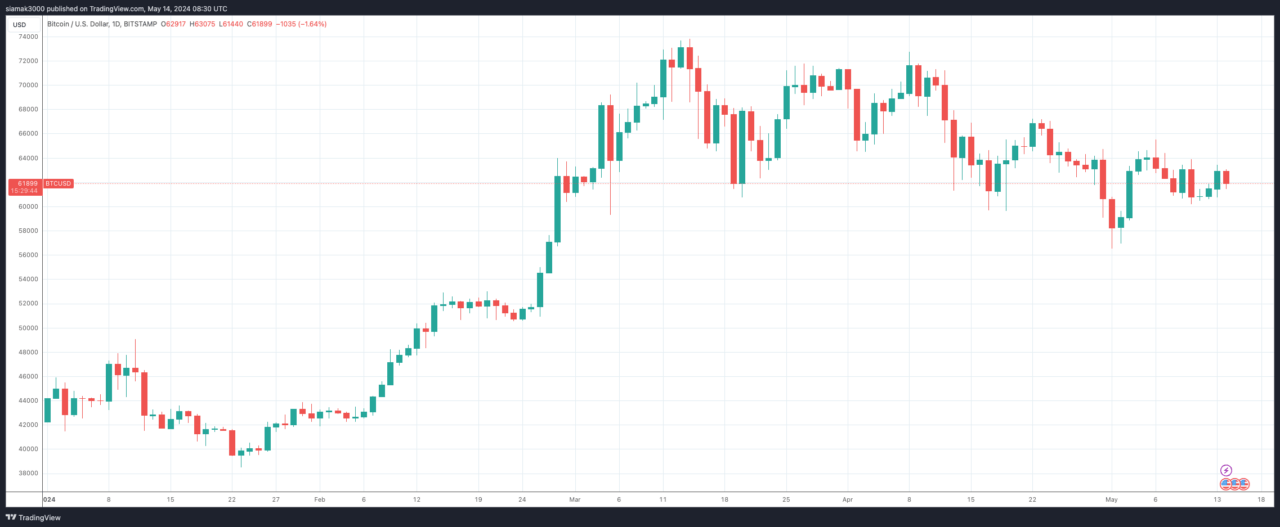

As a crypto investor, I’ve been closely following Thielen’s insights on LinkedIn today. He brought up some interesting points regarding the potential impact of this week’s inflation data on Bitcoin. According to him, traders are anticipating a significant price move by the end of the week. The catalyst for this volatility lies in the upcoming release of the Producer Price Index (PPI) data tonight and the more critical Consumer Price Index (CPI) data tomorrow. As producers and consumers ourselves, we all know that these metrics are essential indicators of inflation. Specifically, the PPI measures the average change in prices received by domestic producers for their output over time, while the CPI tracks the average change in prices paid by consumers for goods and services. Therefore, keeping an eye on these figures could provide valuable insights into Bitcoin’s price action.

As a researcher studying the Bitcoin market, I’ve noticed that traders anticipate a potential price swing of around plus or minus 6% for Bitcoin in response to upcoming inflation reports. However, I found it intriguing that the implied volatility, which stands at 52.8%, is higher than other maturities but not considered excessive. The implied volatility is an important metric derived from the pricing of Bitcoin options, reflecting market expectations for future price fluctuations. Despite this slightly elevated level, I observed that realized volatility – a measure of Bitcoin’s historical volatility based on past price movements – was slightly below 50%.

As a researcher, I’d put forth that in Thielen’s assessment, Bitcoin is presently undergoing a crucial test at the support zone encompassing $60,800 and $61,400. Support levels signify significant price points where an asset typically experiences purchasing demand, thereby halting its downward trend. Thielen issued a caution that should Bitcoin breach this support band, it might trigger a slide in prices. Furthermore, he brought attention to the fact that the typical entry cost for spot Bitcoin ETF holdings lies around $57,000. Consequently, if the Bitcoin price dips below $60,000, it could potentially instigate anxiety among these investors. The spot Bitcoin ETF functions as a medium for investors to derive exposure to Bitcoin without physically owning the asset, and its reported inflows have exhibited a slowdown following Bitcoin’s recent unsuccessful attempts to surge.

As I pen this down (at 8:30 a.m. UTC on May 14), Bitcoin hovers near $61,857, representing a 1.5% decrease in value over the preceding 24 hours.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- Everything We Know About DOCTOR WHO Season 2

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 10 Shows Like ‘MobLand’ You Have to Binge

- All 6 ‘Final Destination’ Movies in Order

2024-05-14 11:44