In the vast and ever-turning wheel of commerce, there exists a realm where silicon meets ambition, and circuits hum with the dreams of men. Nvidia (NVDA), that titan of the digital age, has long reigned supreme over the kingdom of artificial intelligence. Its graphics processing units, those metallic oracles of computation, have been the chosen tools of hyperscalers and visionaries alike. Yet as the sun sets on one era, a shadow stirs in the periphery-a rival not of AMD’s familiar ilk, but of Broadcom (AVGO), a company that whispers its designs into the ears of its clients rather than shouting them from the mountaintops. What is this new order, and what ghosts of progress does it summon?

The world knows Nvidia’s GPUs as the lifeblood of AI-a mosaic of parallel computation, their flexibility a mirror to humanity’s own yearning for adaptability. Yet such versatility is a double-edged sword. In the hands of a client who demands a single, unyielding purpose, these chips become like a master swordsman burdened by too many weapons. Here lies Broadcom’s cunning: to craft not for the many, but for the singular vision of the few. Their custom accelerators, born of collaboration and compromise, are not the jack-of-all-trades, but the master of one. And in this mastery, they threaten to unravel the very fabric of Nvidia’s dominion.

Let us peer into the hearts of men. The CEOs of these empires-those modern-day Caesars of the boardroom-are driven not merely by profit, but by a hunger to etch their names into the annals of history. Broadcom’s executives, with their quiet pragmatism, have chosen the path of the artisan, shaping silicon to the contours of their clients’ desires. Nvidia’s leaders, by contrast, stand as architects of universality, their GPUs cast in the mold of all possible futures. Yet is this not the paradox of our age? The more a tool embraces possibility, the less it serves necessity. The more it is all things, the more it becomes nothing.

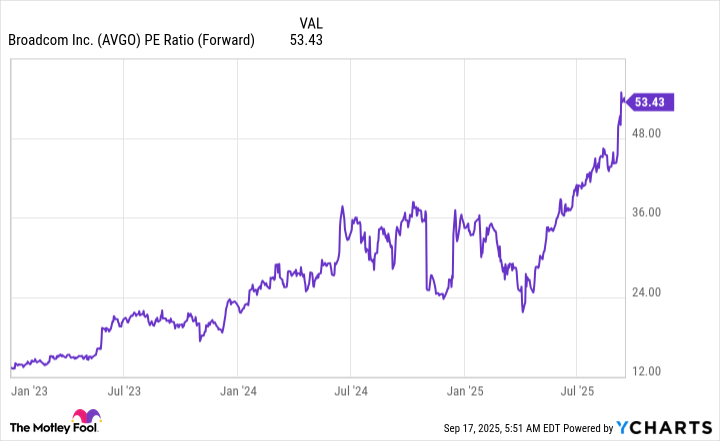

And so the market, that great and fickle oracle, has taken notice. When Broadcom announced a $10 billion order for its XPUs, its stock leapt as if galvanized by lightning. Yet this ascent carries the scent of hubris. At 53 times forward earnings, the company’s valuation now towers over even Nvidia’s 39. Is this the price of progress, or the folly of men who mistake promise for substance? The numbers tell a tale of their own: Broadcom’s AI revenue surged 63% in Q3, yet it remains dwarfed by Nvidia’s $46.7 billion haul. The former is a storm cloud; the latter, a thunderclap.

But let us not forget the broader canvas. Broadcom is no monolith of AI. Its networking wares for data centers serve both friend and foe, its empire built on layers of complexity that slow its ascent. The company’s total revenue, while rising, is but a ripple compared to the typhoon Nvidia commands. Yet in the quiet corridors of innovation, where custom chips are etched with the fingerprints of their users, a new philosophy is taking root. It asks not, “What can this tool do?” but “What must it do?”

As the year 2026 looms, investors stand at the crossroads of hope and skepticism. Shall they sell their Nvidia shares, or bet on the artisan’s quiet revolution? The answer lies not in the numbers alone, but in the deeper question: does humanity’s march toward AI demand the universality of GPUs, or the precision of the custom blade? For now, the market watches, and the world waits. Perhaps, in time, the circuits themselves will speak.

⏳

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Where to Change Hair Color in Where Winds Meet

2025-09-22 12:22