One might say Nvidia has been the beau ideal of the semiconductor set these past few seasons, its GPUs the veritable pièce de résistance at every AI banquet. Much like a particularly dashing debutante, its graphics chips have swept the globe, leaving rivals gasping in their wake while investors clutched their pearls in delight. But lo! A new contender emerges from the wings-Broadcom, that sprightly chap with a knack for turning up precisely when the plot thickens.

Now, the City chaps reckon Nvidia’s coffers will swell by 58% this fiscal year, a feat akin to teaching a goldfish to play the piano. Impressive, to be sure. Yet while the market’s darling has been busy basking in its $206 billion glow, Broadcom’s shares have pirouetted upward by 48%, a performance so sprightly it might make a ballet master weep. And mark my words, dear reader-the best is yet to come.

Enter the year 2026, when the stage shall be set for a grand technological tableau vivant. Picture, if you will, custom AI chips-those specialized little marvels-stealing the spotlight like understudies who’ve finally learned their lines. Where Nvidia’s GPUs resemble versatile Swiss Army knives (excellent for opening wine bottles or repelling vampires), Broadcom’s ASICs are the stiletto heels at a ballet recital: precision-engineered, ruthlessly focused, and rather splendid at avoiding collateral damage.

The Plot Thickens: Custom Chips Take Center Stage

OpenAI, that paragon of innovation, once relied on Nvidia’s A100s as though they were the last morsels at a banquet. But now? They’ve eloped with Broadcom in a most scandalous fashion, pledging to purchase 10 gigawatts of custom silicon by 2026. One might liken this to swapping a trusty umbrella for a jetpack-risky, perhaps, but dashedly exciting.

Let us not mince words: $60 billion in potential revenue over three years is the sort of figure that makes even the most stoic bean-counter blush. Broadcom’s ASICs, you see, are the talk of the town among hyperscalers. Why, they’re so efficient they’d make a Swiss watch blush! Inference tasks? Positively très chic. Power savings? Enough to make an environmentalist weep tears of joy.

While GPUs lumber along at a stately 16% growth rate next year, Broadcom’s ASICs are expected to gallop ahead at 45%, a pace that would leave even the most sprightly racehorse panting. And with a backlog of $110 billion-enough to purchase a small island nation, one imagines-the company’s order book resembles a very popular hat shop during a snowstorm.

Broadcom’s Bonanza: A Revenue Juggernaut

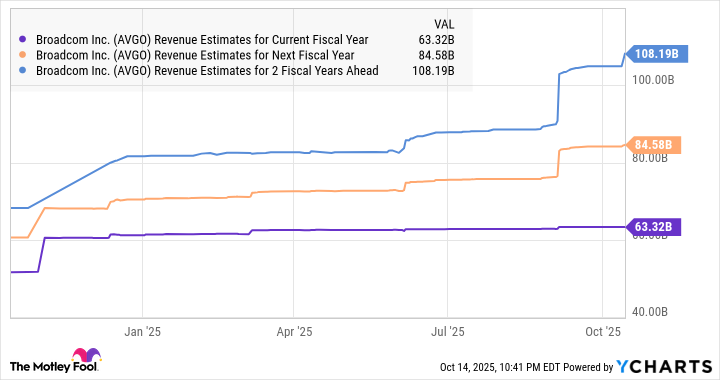

By year’s end, Broadcom’s AI division shall have raked in $20 billion, a 64% leap from yesteryear. The chaps on Wall Street, ever the cautious lot, predict 33% growth for next year. But between us? They’re likely underestimating the fellow. This is a chap who’s just discovered a hidden staircase to the ballroom, after all.

With OpenAI’s contract fattening the order book and an unnamed client tossing in another $10 billion-because why not?-Broadcom’s addressable market has ballooned to proportions that would make a hungry hippopotamus blush. The company’s previous $60-90 billion estimate now seems as quaint as a sundial at a rocket launch.

In conclusion, dear investor, one might say Broadcom’s prospects gleam like a freshly polished monocle in the sunlight. While Nvidia’s GPUs remain the toast of the town, the shift toward specialized silicon plays to Broadcom’s strengths like a symphony to a conductor’s baton. The road to 2026 promises fireworks, and this particular stock appears poised to light the fuse. 🚀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- Gold Rate Forecast

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

2025-10-20 02:02