Dear Diary,

Another day, another press conference in the Oval Office. Apple’s Tim Cook-charming as ever-announced a $100 billion splurge on U.S. manufacturing. Yes, darling, billion with a B. This is on top of their previous $500 billion pledge for domestic infrastructure. As an activist investor with my eye firmly glued to Broadcom (AVGO), I find myself torn between excitement and existential dread. Let’s break it down.

Cupcakes eaten while researching this article: 3. Hours spent Googling “hyperscalers”: 2. Number of times I’ve whispered “Broadcom” to myself like a mantra: approximately 47.

Here’s why Apple’s investment matters more than you think:

- Increased Demand for Chips: Apple expanding its U.S. footprint equals more chips needed. And who supplies those? Oh, just little old Broadcom, quietly sitting there like the dependable friend everyone forgets to thank at weddings.

- AI Networking Wizardry: If AI were a dinner party, Broadcom wouldn’t be the flashy guest hogging the spotlight-it would be the one ensuring the Wi-Fi doesn’t crash and everyone can Instagram their avocado toast. Their role in next-gen networking is criminally underrated.

Why Broadcom Is the Unsung Hero of Hyperscalers

Let’s talk about hyperscalers. No, they’re not some new breed of fitness influencers. They’re tech giants like Alphabet (Google’s parent company) that need massive computing power to train AI models. And guess what? Broadcom has been cozying up to them for years. Their portfolio includes custom silicon, networking switches, and optical interconnects-the plumbing of the digital age.

I once tried to explain this to my mother over Sunday lunch. She stared at me blankly before asking if Broadcom made dishwashers. I nearly cried into my shepherd’s pie.

But here’s the kicker: Broadcom isn’t just dabbling in consumer electronics or enterprise-grade AI; it’s doing both. It’s like being invited to two exclusive clubs simultaneously-one where people sip artisanal coffee and discuss iPhones, and another where data scientists wear hoodies and mutter things about neural networks. This dual membership makes Broadcom uniquely positioned to thrive.

The Quiet Beneficiary of AI Hype

Everyone’s obsessed with Nvidia, AMD, and Taiwan Semiconductor Manufacturing Company (TSMC). And fair enough-they’re dazzling. But let’s not forget Broadcom, shall we? While others build GPUs that get all the headlines, Broadcom designs the connective tissue keeping everything running smoothly. Without it, even the fanciest GPU would sulk in the corner like a neglected karaoke machine.

It reminds me of my university days when I dated a drummer. Everyone swooned over the lead singer, but without the rhythm section, the whole band fell apart. Lesson learned: never underestimate the quiet ones.

Is Broadcom Stock Worth Buying?

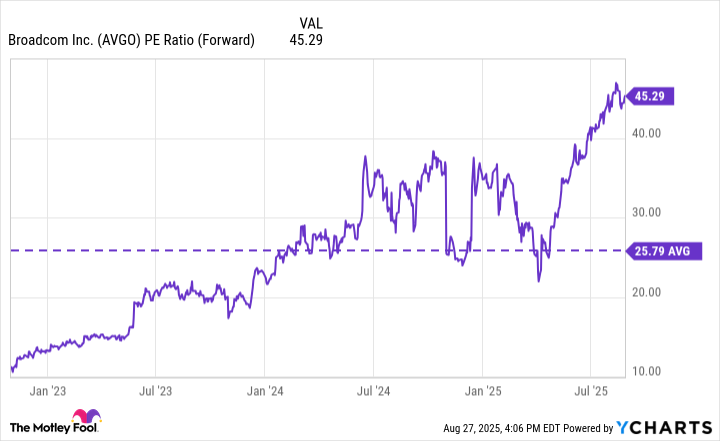

Now, here comes the tricky bit. Broadcom isn’t exactly cheap. Its forward P/E ratio sits at 45, which feels uncomfortably close to buying designer shoes during a cost-of-living crisis. Still, the market seems convinced that Broadcom will continue benefiting from the AI boom. And honestly? I agree.

Broadcom’s relationships with hyperscalers and its alliance with Apple make it less flashy but far more resilient than its peers. It’s like choosing a reliable Volvo over a temperamental Ferrari. Sure, the Ferrari might turn heads, but the Volvo won’t leave you stranded on the M25 during rush hour.

Units of patience required to invest in Broadcom instead of chasing hype: infinite. Potential reward for staying disciplined: also infinite. Emotional toll of resisting FOMO: moderate.

In conclusion, dear reader, Broadcom is the kind of stock you buy and tuck away like a fine wine-or perhaps a slightly too-expensive handbag. It may not spark joy immediately, but trust me, it will age beautifully. 🍷

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Gold Rate Forecast

- Why Nio Stock Skyrocketed Today

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR TRY PREDICTION

2025-08-31 01:13