The heart of this new age, they say, beats with silicon. These tiny wafers, etched with pathways finer than a spider’s silk, are the engine of everything. Without them, the promises of artificial intelligence—a world of effortless calculation and boundless knowledge—would remain just dust motes dancing in the sun. And in this particular field, Broadcom has become a significant hand tending the crop.

Broadcom (AVGO +0.46%) has risen to supply the very bones of these data centers, the networking that binds it all. Demand, as one might expect from a fever dream of innovation, is substantial. Last year saw the stock climb a goodly 49%, a performance that left even its rival, Nvidia, trailing at 38%. A strong harvest, certainly, but one must always ask: can it be sustained?

On March 4th, Broadcom will lay bare its results for the fiscal first quarter, a reckoning of sorts. Wall Street, predictably, will be watching closely, seeking confirmation that this momentum continues. The question for us, those who put our capital at risk, is not merely if the numbers are good, but if the price reflects a true and lasting value.

The Thirst for Silicon: A Growing Demand

Nvidia’s processors are the favored tools for those building these intelligent machines, generally speaking. But the large players, the Alphabet’s of the world (Google, to those less inclined to corporate shorthand), are turning to Broadcom for alternatives. They seek a customization, a tailoring of the silicon to their specific needs, a field sown to their own design.

AVGO”>

The Rising Tide: A Look at the Numbers

The current estimates suggest a revenue of around $19.1 billion for the fiscal first quarter, a solid increase of 28% from the previous year. Much of this growth, predictably, is fueled by the demand for AI hardware. It’s a rising tide, lifting all boats, but some are sturdier than others.

Broadcom anticipates its AI semiconductor revenue to have doubled year over year, reaching $8.2 billion. An acceleration from previous quarters, a sign that the momentum is building. And the company’s net income for the full year 2025 reached $23.1 billion, a quadrupling from the previous year. A bountiful harvest, indeed.

A Question of Value: Is the Price Just?

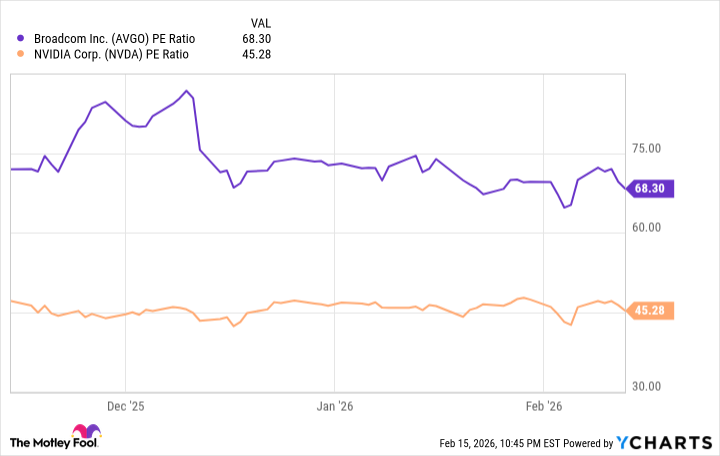

The question, as always, is not simply if the company is growing, but at what price? Based on last year’s earnings of $4.77 per share, the stock trades at a price-to-earnings ratio of 68. More than double that of the Nasdaq-100 technology index (32). A high price to pay for future promises.

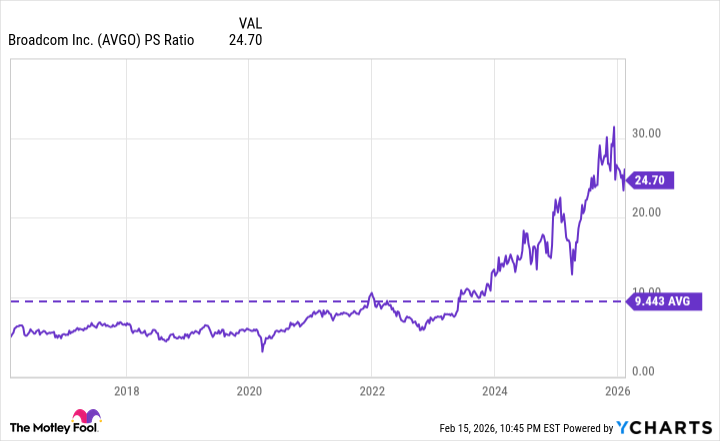

Compared to Nvidia, with a P/E ratio of 45, Broadcom appears particularly expensive. It’s trading at 24.7 times its annual revenue, nearly triple its 10-year average of 9.4. A rich valuation, even in a field brimming with optimism.

Wall Street anticipates a 50% increase in revenue for fiscal 2026, followed by another 40% in 2027. This forward projection lends some justification to the current valuation. But it also suggests that much of the future growth is already baked into the price.

For those seeking a quick return, a short-term profit, Broadcom may not be the wisest choice. This is a field for patient investors, those willing to hold for at least three years, perhaps longer. To reap the rewards, one must be willing to nurture the crop, to weather the storms, and to trust that the seeds sown today will blossom into a bountiful harvest tomorrow.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2026-02-18 23:52