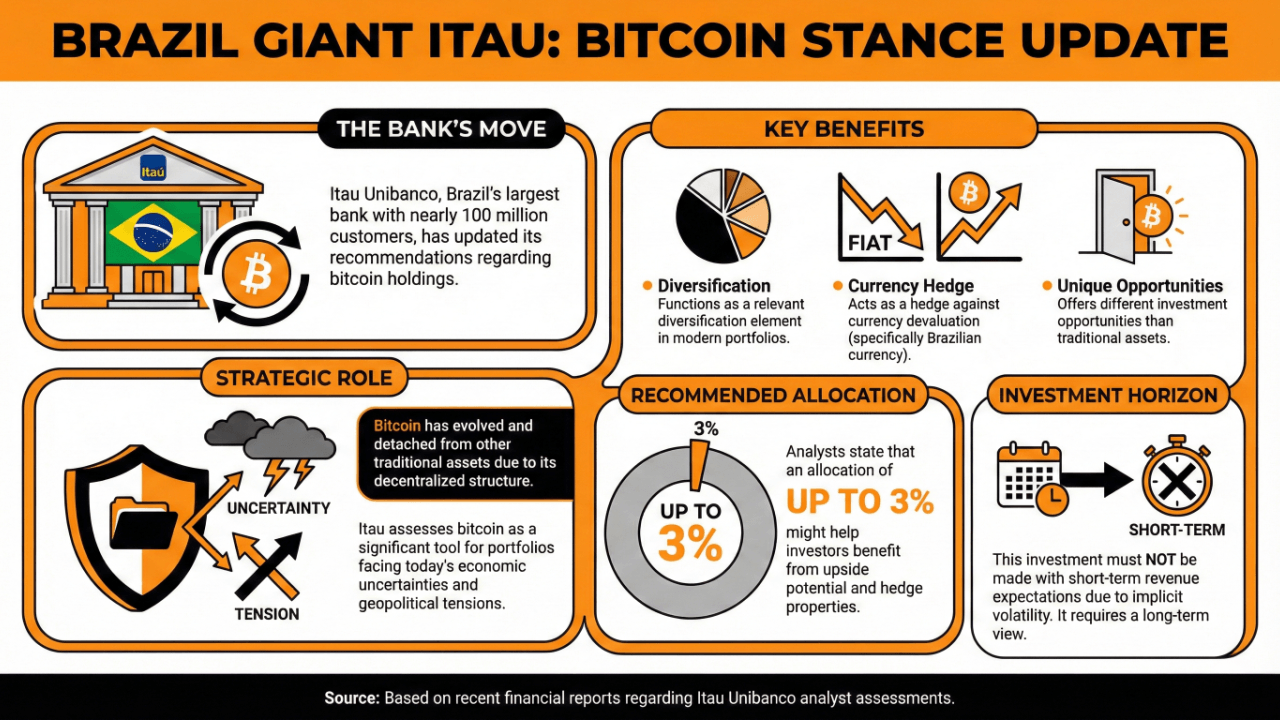

Now, listen here. Itau, that grand institution down in Brazil – the biggest bank they got, mind you – has come to a rather peculiar conclusion. They reckon you ought to put a smidge, a wee bit, up to 3% of your hard-earned fortunes into this here Bitcoin contraption. This, despite the fact it ain’t exactly been climbin’ the beanstalk this year. Seems a mite contradictory, don’t it? They say it’s for “diversification” and to keep your Brazilian Reais from takin’ a tumble. A hedge, they call it. A fancy word for coverin’ yer bets, if you ask me. 🙄

Itau Unibanco’s Report: A Little Tip o’ the Hat to Bitcoin

The Gist of It

Itau Unibanco – a bank so big, it serves nigh on 100 million folks – has changed its tune about this Bitcoin business.

Seems they done took a look-see and decided it might just be a useful thing for spreadin’ your risk. A fella’s got to protect his investments, after all. They declare in a report that Bitcoin ain’t connected to the usual ups and downs of the market, bein’ all “decentralized” and such. Offers different opportunities, they say. And 3% might just help you strike it rich when Bitcoin decides to have a good day… and protect ya from a bad one with a weak Reais.

Now, these Itau fellas, they warn ya not to go expectin’ riches overnight. Risk assets, they say, are fickle things. They’re prone to moods! Don’t go gamblin’ yer grocery money, they imply. Words of wisdom, I reckon. 😉

Why Should You Care?

Itau givin’ Bitcoin the nod is somethin’ to take notice of, even if the critter’s been movin’ slower than a sleepy sloth. It shows that the big boys are startin’ to sit up and pay attention.

But here’s the kicker, and a bit of irony for ya. If you’re a Brazilian investor holdin’ Reais, you’ve already lost some ground investin’ in Bitcoin this year, ’cause the dollar ain’t shined like it ought to. A most unfortunate circumstance! 😮

Still, Itau thinks sittin’ on the sidelines is the bigger risk now. They’re offerin’ folks a way to buy Bitcoin through these fancy Exchange-Traded Funds, or “ETFs” as they call ’em. Convenient, I suppose, for those who don’t know a blockchain from a bale of hay.

What’s the Look-Out?

With new rules comin’ in February, they say Bitcoin might just become a regular feature in Brazilian investments. Seems the bankin’ folk are takin’ a likin’ to it – or at least, recognizin’ the writing on the wall.

Frequently Asked Questions (because folks are always askin’)

-

What’s this here update from Itau Unibanco about Bitcoin?

Well, they’re sayin’ Bitcoin’s a good way to spread your wealth around and keep it safe from a fallin’ Reais. They recommend puttin’ up to 3% of yer money into it. -

Have they changed their mind about Bitcoin?

Seems they have. They now reckon Bitcoin’s a unique beast, not bound by the same rules as everything else -

What’s the catch?

Don’t go expectin’ to get rich quick! Bitcoin’s a risky proposition, prone to volatility. -

What does the future hold?

With new regulations comin’, they think Bitcoin might just become a real player in Brazilian investments.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Weight of Choice: Chipotle and Dutch Bros

2025-12-14 14:58