The fortunes of energy companies, like the tides, ebb and flow, yet the grand narrative of human endeavor, driven by the need for warmth, light, and locomotion, persists. These past three years have witnessed a particular disquiet in the realm of oil and gas, a consequence of forces both predictable and unforeseen. The surge following the great stillness of 2020 proved, as so often happens, a temporary illusion. Crude oil and natural gas, once soaring in price, have descended, dragging with them the valuations of those who stake their livelihoods upon their extraction. The prognosticators at the U.S. Energy Information Administration foresee a further decline, a descent to a price of fifty-five dollars the barrel, a figure that speaks not of abundance, but of a waning dominion.

Yet, to pronounce the demise of this industry is to misunderstand the enduring nature of human need. The whispers of “peak oil,” a notion that consumption would inevitably wane, have proven premature, pushed back, like a stubborn winter, to the year 2050. The International Energy Agency, along with the venerable OPEC, and even the pragmatic minds at ExxonMobil, concur. Oil, it seems, will remain a necessity for decades to come, a truth that casts a long shadow upon the ambitions of those who champion a swift transition to renewable sources. BP, formerly British Petroleum, stands as a curious exemplar of this protracted struggle, a company attempting to navigate the treacherous currents of change while still clinging to the foundations of its past.

The management of BP, like all those who steer vast enterprises, are men caught between the demands of the present and the uncertainties of the future. They understand, with a clarity born of experience, that the age of fossil fuels is not ending tomorrow, yet they are also acutely aware of the moral and economic imperative to embrace alternatives. This has led them to ventures such as their partnership with JERA Nex, a commitment to offshore wind farms, ambitious in scope, with the potential to generate thirteen gigawatts of power – enough, they claim, to illuminate ten million homes, or, more pertinently in this age, to power the ever-growing demands of data centers, those silent cathedrals of the modern world. Lightsource BP, another endeavor, seeks to harness the sun’s energy and store it for institutional clients, a commendable effort, though one that has yet to yield substantial returns.

Indeed, the transition is proving more arduous than anticipated. The recent announcement of a four to five billion dollar impairment charge against their low-carbon business serves as a stark reminder of the challenges inherent in such undertakings. It is a lesson that many have learned, and will continue to learn: progress is rarely a straight line, and even the most well-intentioned endeavors are often beset by setbacks. Yet, BP persists, recognizing that proactive adaptation is preferable to reactive despair, even if it means accepting the occasional wound. The hope, of course, is that these investments in renewables will generate recurring revenue, mirroring the predictability of their oil and gas operations, and thus sustain the dividends that shareholders have come to expect.

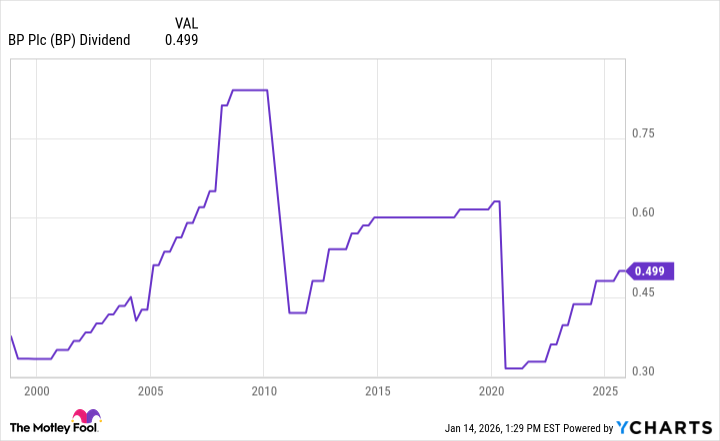

However, the matter of these dividends is not without its complexities. Unlike a steadily flowing river, BP’s payouts are subject to the capricious whims of the oil market. In 2010, and again in 2020, as crude prices plummeted, the per-share dividend was adjusted downwards, a reminder that even the most established companies are vulnerable to external forces. For those investors who demand unwavering predictability, BP may not be the ideal choice. It is a truth that all who engage in the marketplace must accept: certainty is an illusion, and risk is an inherent part of the equation.

Nevertheless, with a current yield of 5.6 percent and a long-term vision that extends beyond the immediate horizon, BP represents a not insignificant opportunity for those seeking income. It would not be a reckless gamble to include it as a third or fourth holding in a diversified portfolio, a testament to its enduring, if imperfect, strength. For in the grand tapestry of commerce, it is not always the most flawless threads that create the most enduring patterns, but those that, despite their imperfections, contribute to the overall richness and complexity of the design.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Gold Rate Forecast

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR TRY PREDICTION

2026-01-17 19:12