Boeing (BA) shares dropped 4% after the company posted its second-quarter earnings. Now, if you’re like me, you’re thinking, “Wait, isn’t that what happens when a company *doesn’t* do well?” But no, here’s the thing – the market’s been a little shaky lately, with the Dow Jones and the S&P 500 showing a bit of a limp. And don’t get too excited, Boeing stock has still climbed 28% this year, so I guess everything’s fine. Except when it isn’t.

So, let’s dive into this charade of ‘good news’ wrapped in a corporate *meh*.

1. Production Stabilization: Not Quite a Smooth Landing

Boeing delivered 150 commercial airplanes in Q2, which is great, except if you remember the 2018 numbers, you might notice a pattern – they’re just getting back to where they were. But sure, “stability” was the word of the day for CEO Kelly Ortberg. Great word, stability. Doesn’t that sound reassuring? He didn’t *actually* say it was stable. Just that it’s… “getting there.”

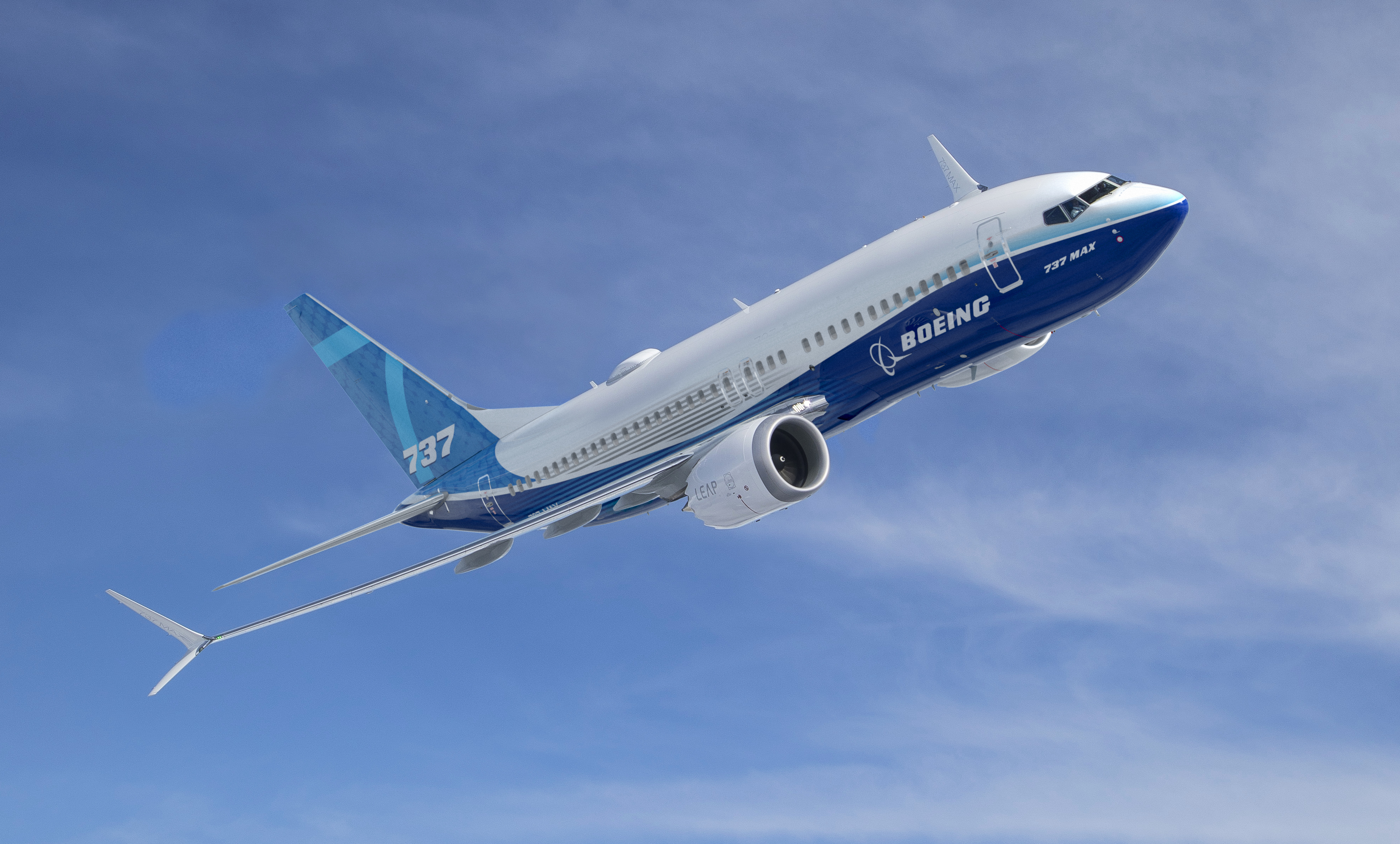

Here’s the showstopper: the 737 MAX. Boeing hit a target of producing 38 per month. Big deal, right? And if things go well, they might even ramp up to 42 per month. How thrilling. It’s like they’re slowly peeling back a bandage, trying not to rip it off too fast. We’re all just sitting here, waiting for them to *finally* get it right. Meanwhile, the 787 Dreamliner’s production bumped up from five to seven a month. Progress? You tell me.

As for revenue? Commercial airplane revenue went up by 81%. But let’s not ignore the fact that they were coming off a *pretty* low base. So, yeah, $10.9 billion sounds impressive, but it’s kind of like applauding a guy who finally walked up the stairs without tripping.

2. Boeing’s Bottom Line: Progress, But Slowly (and Not in the Way You Want)

So, Boeing’s doing better financially. Well, sort of. They reported a loss of $176 million. Yes, that’s less than last year’s $1.1 billion loss. Are we supposed to throw a parade for that? Like, “Oh, congratulations, you’re not losing as much money!” But don’t worry, the first half of 2025 looks a little better – a $285 million gain. Still not a win, but hey, at least the ship isn’t sinking as fast.

Free cash flow? Negative $200 million. Again, better than last year’s $4.3 billion, but I’m sure the company’s CFO is having a panic attack trying to explain why it’s still not positive. But here’s the twist: higher-than-usual 777 deliveries added some positive cash flow. You see how it works? One random good thing happens and suddenly things don’t look *quite* as terrible. It’s like when your neighbor’s tree falls down, and for a second, you feel better about your own dead plants.

Third-quarter cash flow could take a hit. There’s a $700 million payment coming from Boeing’s non-prosecution deal with the Department of Justice. So, things *could* get a little rocky. But CFO Brian West says, “As long as the global trade environment stays favorable,” expect positive cash flow in Q4. Well, isn’t that a lovely sentence to hang your hopes on?

3. Boeing’s Product Demand: The Only Thing That Seems to Work

Alright, here’s the kicker: Boeing has a $619 billion backlog. That’s right, billion. Orders for 5,900 airplanes, taking *seven years* to deliver. So, demand? Off the charts. Maybe it’s not all bad. Boeing is living the dream, while others might be waking up from it.

There was a juicy deal with Qatar Airways, who’s set to buy up to 210 widebody jets. The White House values that at $96 billion. I’m sure that made everyone feel better about whatever the hell else is going on at the company. Oh, and British Airways, they went for 32 Boeing 787-10s. Not bad. Maybe it’s time to pop open the champagne, but you’re still waiting for it to be delivered. What’s a few years of waiting for a $100 million jet anyway?

Here’s the thing, though – Boeing has been digging itself out of a hole for a few years. And sure, they’re the top player in the game, but let’s not kid ourselves. They’re like the guy who shows up to the party and says, “Hey, at least I’m here!” after everyone else has already had a good time. Is this the corporate equivalent of “I’m not *that* late, am I?”

But, who knows? Maybe they’ll keep flying high. Or maybe they’ll crash again. We’ll just have to wait and see. It’s always one or the other with them, isn’t it? 🎭

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Top gainers and losers

2025-08-05 08:48