Hark! A most curious spectacle unfolds before us! Boeing, that purveyor of airborne carriages (BA 0.04%), doth proclaim a triumph, a quarter’s earnings exceeding expectation by a modest sum – a mere $2 billion, if you please. A feat, to be sure, and a 57% improvement upon a prior lamentable showing. One might almost suspect a conjurer’s trick, were it not for the cold, hard figures. Yet, let us not be overly hasty in our applause, for memory, like a diligent accountant, reveals a prior quarter most woeful, a decline of 31% that casts a long shadow upon this present gaiety.

Indeed, to speak of improvement is, perhaps, a touch generous. Consider, if you will, that this recent prosperity is measured against a time when Boeing’s coffers were depleted by a sum exceeding twenty-four billion dollars. A state of affairs, I venture, that even the most optimistic shareholder would deem undesirable. We recall, with a shudder, the specter of ill-fated flights and designs found wanting – a misfortune that stirred anxieties amongst those who entrust their lives to these mechanical birds.

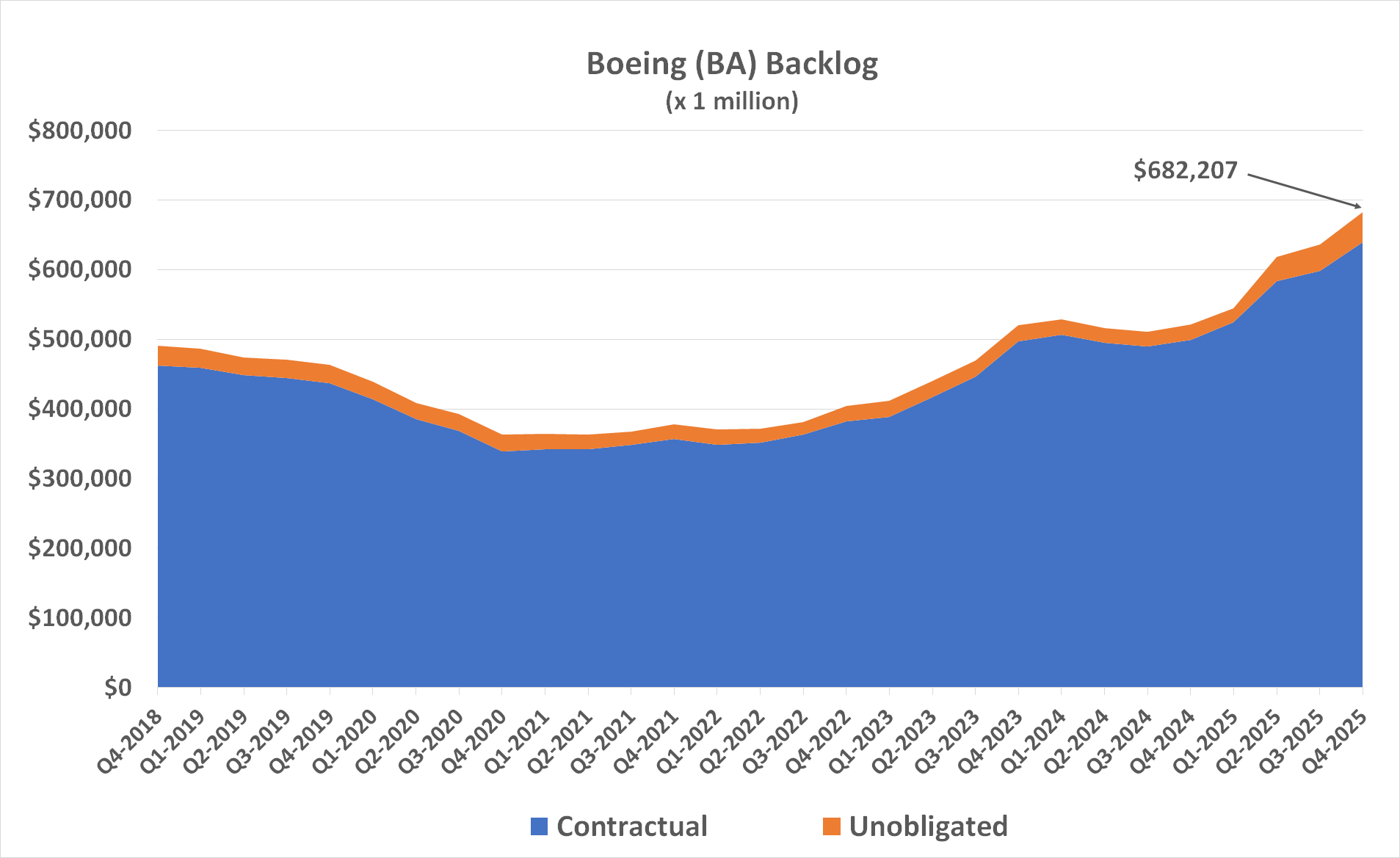

But hold! A far more diverting drama is afoot, a comedy of numbers that promises a prolonged and profitable farce. It is not the quarter’s revenue, but the company’s order backlog – a mountainous accumulation of promises to deliver – that truly captures the imagination. A staggering $682.2 billion, they claim, in orders yet to be fulfilled! A sum so vast, it rivals the fortunes of kings! And, most delightfully, this backlog appears not to stagnate, but to grow with each passing month, as if propelled by some unseen, avaricious force.

Of course, orders, like promises made in haste, can be broken. But let us indulge in a bit of fanciful thinking. Boeing itself forecasts a need for 43,600 new passenger jets between now and 2044. A prodigious number, to be sure, especially when one considers that there are presently but 30,300 in service, with a further 5,250 languishing in storage. And these existing vessels, alas, are not immortal; their average age is a mere fifteen years, a fleeting moment in the grand scheme of things, and their retirement looms ever closer.

This, naturally, is cause for rejoicing amongst Boeing’s shareholders. But let us not mistake a long-term trend for immediate salvation. The path to prosperity, like a turbulent flight, is rarely smooth. There will be setbacks, dips in the market, and perhaps even a temporary loss of altitude. Yet, this ever-growing backlog provides a comforting cushion, a signal that any such decline is merely a fleeting opportunity for the discerning investor.

Thus, we have a spectacle most amusing: a company buoyed by promises of future wealth, a backlog that grows ever larger, and shareholders who, like eager spectators, await the unfolding drama. It is a comedy, to be sure, but one with potentially substantial rewards for those who possess the wit to recognize a favorable turn of events. Let the farce continue!

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

- Wuchang Fallen Feathers Save File Location on PC

- 9 Video Games That Reshaped Our Moral Lens

2026-02-02 03:42