Turns out BNB isn’t just a coin, it’s practically a fortress at $853, $660, and $564 – all thanks to those ever-dramatic derivatives!

So here’s the deal – BNB is in the middle of a market rollercoaster, and guess what? The most crucial support levels (read: the ones that could keep BNB from faceplanting) have been identified. Thanks, on-chain metrics! 🙄

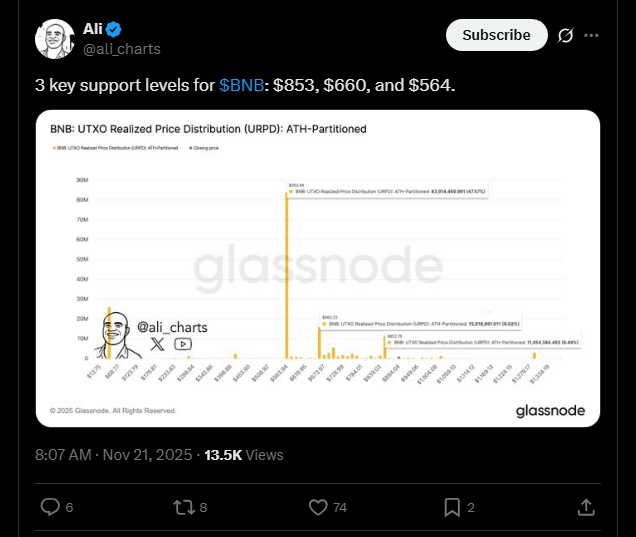

Three glorious numbers are currently holding BNB up like a superhero holding a heavy traffic sign: $853, $660, and $564. These aren’t just numbers, they’re “the zones” that everyone’s eyeballing. Apparently, if these levels break, we might all just cry.

According to Ali (@ali_charts) on X, these are the magic spots – or as I like to call them, BNB’s emotional support levels. You know, the ones you can’t live without.

Source – Ali (@ali_charts) on X

So, the top spot? $853. Yeah, that’s the VIP section of BNB’s support levels. It’s where the magic happens. But beneath that? Oh, we’ve got $660 – a comfy little mid-tier support. And finally, at the very bottom, we have $564, like the sad “are we really going to make it?” moment.

Derivatives Are Getting Messy – BNB Traders Are Nervous

The BNB derivatives market is hot – I mean, really hot. A 139% surge in options? Yeah, you heard that right. Futures? A little less exciting with a modest dip in open interest.

Basically, traders are hedging like it’s the latest fashion trend – constantly swapping their positions, making sure they don’t end up holding the bag when BNB decides to get dramatic. Futures volume? Oh, it’s soaring to a casual $5.32 billion. No big deal.

The net market position is… well, let’s just say “meh” (0.91). But Binance and OKX are like, “We’ve got this,” with their long positions. Meanwhile, the real traders are over there trying to play it cool, balanced, and mysterious, as always.

And let’s talk liquidations – because nothing says “we’re in for a wild ride” like over $8 million in long position losses in just 24 hours. Short liquidations? Not so much. It’s like the market is playing favorites.

Major players in this game? Binance, OKX, Bybit, and Bitfinex. They’re the ones making sure that intraday volume keeps flowing like it’s a never-ending coffee supply at a 24-hour cafe. ☕

The Staircase of Doom: BNB’s Support Zones Are Actually Beautiful

So, if you look closely, these support zones form a staircase pattern. It’s like the market is just walking down a beautiful, tragic staircase, one support level at a time. If BNB drops below these levels? Well, prepare for an emotional breakdown.

Here’s the thing – if BNB holds these support levels, it could totally bounce back, like the underdog of the crypto world. But if it can’t? It might be time for a dramatic market sell-off. Keep your popcorn ready. 🍿

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

2025-11-22 19:19