My dear reader, permit me to remark upon the current state of Binance Coin (BNB) as one might observe a lively assembly from behind a fashionable fan, all the while pretending not to notice the most eligible price suitor approaching the dance floor. The MACD, that most speculative of indicators, has quite indecorously taken a turn for the positive, while BNB itself hovers near resistance, longing for permission to lead. Observers—much like sharp-eyed chaperones—are riveted by every movement, lest a scandalous drop should shock the ton.

The market, for now, loiters most indolently in a drawing-room of consolidation, although one cannot help but notice a subtle rustle in the silks of momentum, hinting at a greater drama soon to unfold. Like a well-bred heiress, BNB maintains its composure near mid-range levels, supported by robust volume and the inexplicable optimism of its suitors. Oh, the suspense! ☕️

Range-Bound Price Action: A Country Ball with No Clear Winner

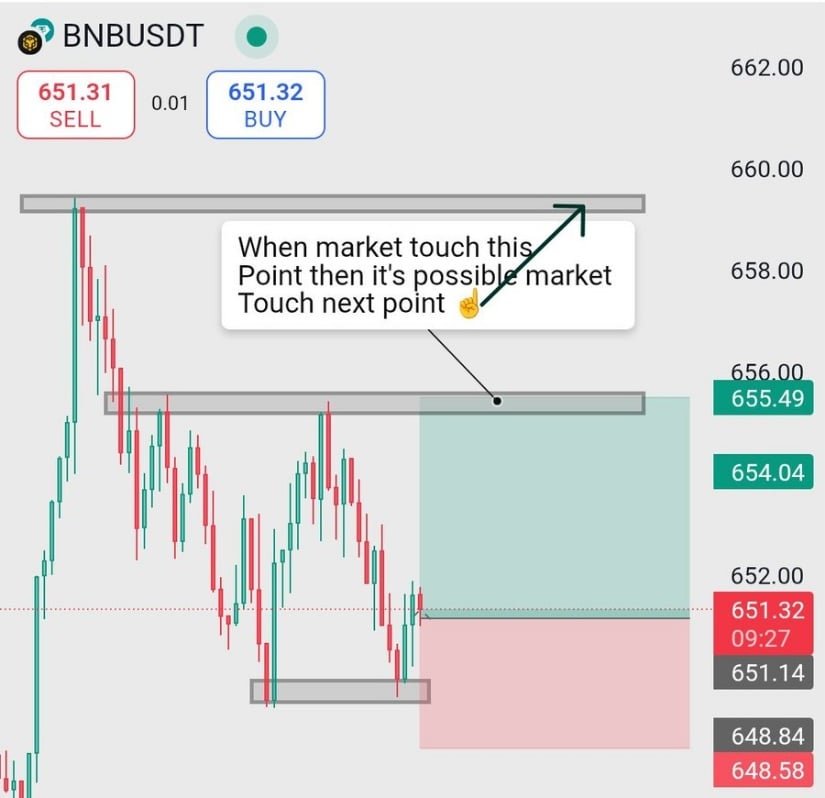

Turn your attention, if you please, to the hourly BNB/USDT chart, where our dear token flutters between support and resistance as if uncertain of whose hand to take for the next dance. Recently, it rebounded from the $648.84–$651 demand zone—the financial equivalent of refusing the vicar and waiting for Darcy. This area is much admired, having been defended more often than a maiden’s virtue at a Bath assembly, with buyers, one imagines, waving their fans most enthusiastically.

Minor resistance lurking at $655.49 awaits, like Lady Russell at the punch bowl—always there, never yielding ground. This obstinate level blends seamlessly with the wider resistance range approaching $660. Chart musings from “X” suggest that, should BNB manage a positively dashing move, a breakout is entirely possible (scandal!). Alas, no path to greatness is unopposed, and sellers lurk, ready to shame the price back to its chamber.

Trader Rai, who one presumes to be of keen intellect and questionable sleep routine, commented on “X” that $651.32 marks the line between triumph and melodrama. Should BNB falter here, a most unseemly correction may ensue—he even dares to whisper “bullish trap!” Should BNB, like any self-respecting Austen heroine, stand its ground, hope remains intact. If not, expect the supporting cast to swoon in unison. 😱

Daily and Weekly Indicators: The Plot Thickens, the Audience Yawns—or Do They?

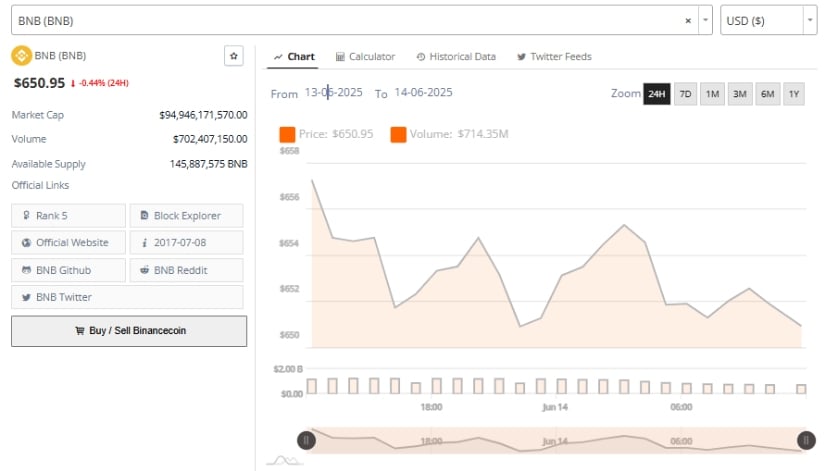

Surveying the 24-hour chart, one observes BNB’s price attempting an escape worthy of Lydia Bennet: it spiked recklessly to $655, tumbled to $652 (on the fainting couch, naturally), then revived above $650, where it now paces with great expectation.

Volume data (courtesy of Brave New Coin), reports a genteel $714 million in trading—certainly enough to throw a splendid party but not quite a riot. With a market cap of $94.95 billion, BNB secures its place among the most sought-after tokens at court.

Not to be outdone, analyst Andrew Griffiths (himself a suitor in the great Ball of Crypto) with a flourish on “X” declares BNB to be “maintaining a robust support zone,” as if the 100-day EMA were a stalwart butler ushering bulls to safety. Should buyers persist, the uptrend may yet survive the season.

The weekly chart, meanwhile, presents the price carousing near $650.48, just under the upper Bollinger Band at $691.94, as if eager for an elusive invitation to the grandest ballroom. Candlesticks dither, wicks flair, and—oh, the indecision!—while the mid-Bollinger Band at $621.47 steadfastly provides a genteel refuge. Should the Bollinger Bands begin to flutter more widely, even the most jaded trader might stir from slumber.

The MACD: A Suitor With Excellent Prospects

But let us not neglect the MACD on the weekly chart! That persistent fellow again finds himself positioned above the signal line, with a histogram so plump (4.28, if you please) that even Lady Catherine would take note. Since April 2025, this gentle upward slope has inspired bullish affection, if not outright proposals. Momentum, gentle yet clear, continues its ascent, as persistent as Mr. Collins at a parsonage tea.

Should this upward momentum hold and the price close above the upper Bollinger Band, BNB could set its cap for an ambitious $700–$750. But beware: a misstep around $651–$655 and BNB risks being escorted to the lower Bollinger Band at $550.99—an outcome more tragic than a cancelled ball.

👸 At present, the fortunes of Binance Coin hang in a delicate balance. Reports from Brave New Coin and TradingView supply ample gossip, and while the supporting cast of volume, MACD, and stoic support intrigue us, the eventual dénouement remains the province of the market’s ever-capricious mood. Will this tale end in a joyous waltz above $700, or a hasty retreat below $651? Cast your bets—and don’t forget your invitation to the next chart reading.

Read More

2025-06-15 00:23