Market watchers, decked out in their best analytical tweed, have been peering suspiciously over their bifocals at BNB as it attempts to pirouette above that all-important $654 neckline. If the coin manages this feat—without tripping over its own shoelaces—it could well herald the sort of recovery only previously seen in hangover stories and the British pound.

Bulls Form a W — or is it an M? Chartists Ponder the Alphabet 📉🐂

The ever-observant trader Rai—who never naps, unlike some of us—has spotted what looks suspiciously like a double bottom pattern brewing on the BNB/USDT chart. Picture it: two dramatic plunges into the abyss, followed by an audacious leap above the $654 neckline. “W for win,” cries the bullish camp, while seasoned cynics wonder if it isn’t simply a slightly misshapen ‘M’ in disguise.

This W-shaped figure tends to murmur sweet nothings about trend reversals, especially when the volume’s turned up and the stop-losses are kept on a short leash. So far, the price action’s played along, with the bulls determined to hold their ground at the now-venerable $654.27 breakout zone.

Traders, not known for subtlety, have set their sights on $656.34 for a quick profit, stuffing their stop-losses just below $653.12, in case the crypto gods get mischievous. This setup is tighter than a bookie’s purse, making life interesting for anyone with a taste for high-stakes hopscotch.

After poking its head above the neckline, the price ducked back for a tentative retest—the trading equivalent of “Just checking if the door’s locked!” Should momentum gather, the stage is set for a charge toward that $667 target, provided, of course, everyone remembers their lines.

Sellers Throw Wet Blankets—Short-Term Volatility Steals the Show 😬

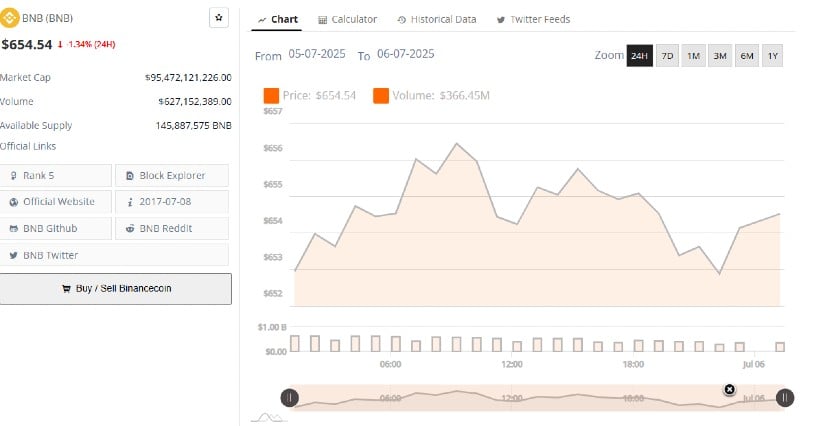

In the last 24 hours, BNB was about as adventurous as a vicar at a village fete, shuffling between $653 and $656 with the occasional slip, but ultimately clinging to respectability. The session finished at $654.54—a 1.34% dip, or as we call it in crypto: “Tuesday.”

The inability of BNB’s buyers to launch a proper siege on resistance conjured up a mini double top, just to keep things spicy. Short-lived rallies were promptly tied to a chair and interrogated by sellers lurking at $656–$657, who apparently had nothing better to do with their time.

The volume story? Much the same as any British pub after last call: robust early, then dwindling to a faint mumble. Total daily volume hit $627.15 million, but by session’s end, only $366.45 million had stuck around. All this suggests traders are waiting, perhaps brushing up on their Shakespeare, before making any grand pronouncements.

If the price can slap on a strong closing above $657—preferably with an audience—bulls might finally get the applause they crave. Until then, expect continued dithering around the $652–$654 support zone, and much hand-wringing in group chats.

Bollinger Bands Expand Their Waistline—Momentum Feels the Bop 🎈💪

Now then, BNB is clocking in at $655.77, with just enough pep to suggest it’s been at the energy drinks again. On the daily chart, price is sidling up to the upper Bollinger Band, which is, in the grand tradition of waistlines everywhere, quietly expanding.

The aforementioned upper band resides at $667.34—just eager to prove itself as a worthy resistance. Meanwhile, the 20-day simple moving average, doing its best impersonation of a stern governess, sits at $646.61, corralling buyers and wagging a finger at those who stray below $646–$648.

The MACD, not to be outdone, now shows its line jauntily crossing above the signal line, and the histogram has donned its best “green zone” attire. It’s not quite time for a champagne toast—MACD still lurks below zero—but it does hint that the bears are running out of clever tricks.

Should BNB manage to tiptoe past $667, the next celebration may roll all the way to $680—assuming, of course, the market doesn’t lose interest and wander off in search of something shinier. On the off-chance it stumbles, there’s always support at $646, ready to give it a consoling cup of tea and tell it things will be brighter tomorrow.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- Netflix Co-CEO Ted Sarandos Urges DC to Expand TV Projects Like ‘The Penguin’ After Warner Bros. Acquisition

2025-07-07 02:28