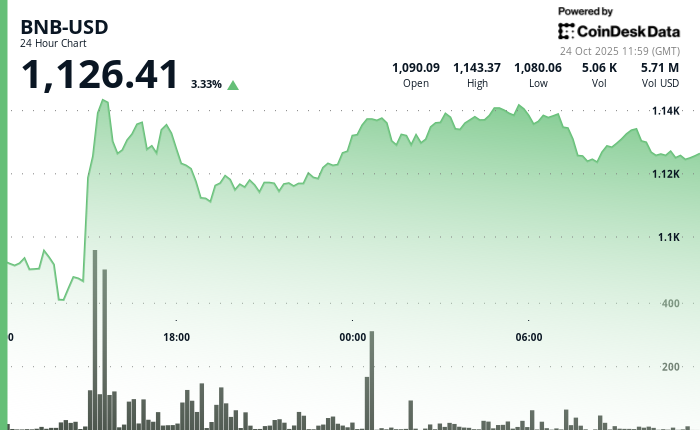

Ah, the never-ending drama of crypto, where the line between brilliance and absurdity is as thin as a blockchain transaction. Today, we have yet another spectacle to savor, with none other than U.S. President Donald Trump sending shockwaves through the digital markets. What did he do, you ask? Oh, just pardoning none other than Changpeng Zhao, the co-founder of Binance, who may now bask in the sweet aroma of freedom, and a 3.3% spike in Binance Coin (BNB) to a rather delightful $1,126. How utterly predictable.

What to know:

- BNB rose by 3.3% to $1,126-Thanks to a pardon, not a technological breakthrough. Who would’ve thought?

- Trading volume surged by nearly 35%-Because, as we all know, volume = true love in crypto.

- Industry experts (read: fortune tellers) predict that this pardon might just be the key to unlocking Binance’s U.S. market. We’ll see, won’t we?

Binance Coin (BNB) may have only climbed 3.3% in the last 24 hours to reach $1,126, but that was all it took to outshine the broader crypto markets. Why? Well, because President Trump decided that pardoning Changpeng Zhao, Binance’s former CEO, was the most fitting way to raise the coin’s value. Classic Trumpian logic: make a spectacle, and everything else follows.

Zhao, who allegedly violated the Bank Secrecy Act (whatever that means in the wild west of crypto), served a mere four months after pleading guilty. His sentence was a joke to many, but his pardon? A comedy masterpiece. Meanwhile, Zhao stepped down from the exchange he built, and the crypto world had a collective moment of confusion, mixed with just a pinch of envy. The pardon, we are told, was a significant turning point. David Namdar, CEO of CEA Industries, called it a ‘game-changer,’ but honestly, who wouldn’t? We all want our coins to rise by 3.3%, don’t we?

“The fundamentals for BNB have never looked better,” Namdar continued, sounding like the most optimistic person in the room. A global user base, real-world adoption, and consistent utility across DeFi and CeFi alike. What a revelation! Next, they’ll tell us that air is necessary for breathing. But, hey, we’re here for it.

BNB’s impressive rally was propelled by a surge in trading volume, which spiked 35% above its seven-day average. This spike saw the token rise from $1,085.96 to a modest $1,130.25. Clearly, the people have spoken. And what did they say? “Let’s accumulate more of this thing!” They did, however, encounter resistance-who doesn’t, right?-between $1,140 and $1,143. Apparently, BNB’s future is now a matter of whether it can break through $1,150 or fall back to $1,078. Such is the thrilling unpredictability of the crypto rollercoaster.

As of now, the coin is in a state of consolidation (read: it’s stuck). Short-term resistance at $1,128 has kept it grounded, while support at $1,124 has managed to hold firm, even after multiple attempts to knock it down. Will BNB break free, or will it face the inevitable pull of gravity? Stay tuned; the plot thickens.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- ETH PREDICTION. ETH cryptocurrency

- USD PHP PREDICTION

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-10-24 17:02