As a seasoned analyst with over two decades of trading experience under my belt, I find myself cautiously optimistic about BNB‘s current market position. The impressive 181.79% surge this year is undeniably noteworthy, but the recent weakening in momentum as indicated by the ADX and Ichimoku Cloud has me raising an eyebrow.

The price of BNB is nearly 10% from reaching its highest point ever, but it has already risen an impressive 181.79% in 2021. Despite this robust market performance, recent technical signs such as the ADX and Ichimoku Cloud indicate that the ongoing upward trend might be weakening.

As long as the positive trend stays solid and important resistance levels are close at hand, BNB needs a boost in its momentum to surpass its prior record-breaking peak price.

BNB Current Uptrend Could Not Last

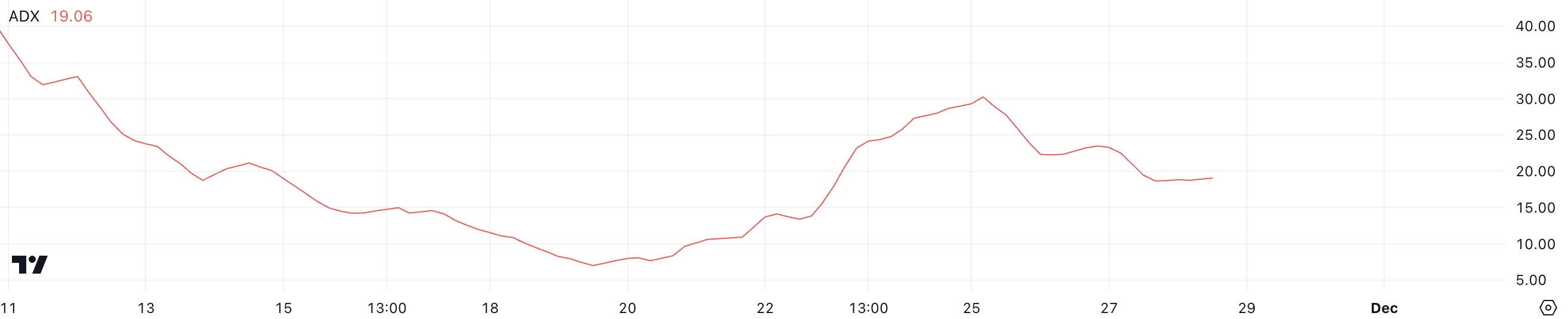

Right now, the BNB ADX stands at 19, which is lower than its previous value of over 30 two days back. This suggests a lessening or weakening trend. The ADX, or Average Directional Index, assesses the strength of a trend on a scale ranging from 0 to 100, without specifying the direction of the trend itself.

Values exceeding 25 point towards a robust trend, implying a strong directional movement. On the other hand, values below 20 hint at either a feeble or non-existent trend, suggesting little to no directional movement. The falling ADX indicates that although BNB’s price is still ascending, the momentum propelling it has noticeably weakened.

As an analyst, I find myself observing that the Average Directional Movement Index (ADX) stands at 19 on the Binance Coin (BNB). This suggests that the current uptrend may not be as robust as it was in recent times, potentially pointing towards a period of consolidation or a decrease in buying pressure.

To restore the upward trend’s power, it is essential for the ADX to climb over 25, indicating a resumption of strong momentum. Until this occurs, the price of BNB might continue moving horizontally or encounter more obstacles when trying to maintain its bullish course.

BNB Ichimoku Cloud Shows Mixed Signals

Currently, the Ichimoku Cloud chart for BNB indicates a blend of upward and downward trends. At present, the price hovers slightly above both the Kijun-Sen (represented by the orange line) and Tenkan-Sen (the blue line), suggesting a hint of optimism in the market.

Despite the price lingering close to the boundary of the Senkou Span A and B, it shows that the trend isn’t definitively robust yet. The upcoming green cloud hints at potential short-term support, but its somewhat flattened shape suggests a lack of significant momentum in either upward or downward direction.

To rekindle robust upward movement for BNB prices, it’s crucial that it surpasses the Kijun-Sen significantly and moves away from the cloud’s boundary. However, if it fails to do so and falls back beneath the cloud, this could indicate the start of a downward trend, suggesting a bearish market condition.

Alternatively, if it continues to hover above the clouds and observe the Tenkan-Sen surpassing the Kijun-Sen, this could strengthen the upward movement trend.

BNB Price Prediction: Will BNB Rise More Than 10% And Reach A New All-Time High?

At present, BNB’s Exponential Moving Averages show a bullish configuration as the short-term averages are above the long-term ones. This arrangement indicates that the upward trend is holding steady for now. If the price of BNB reclaims its momentum, it might shatter important resistance levels at $667 and $687.

If the price manages a strong surge from its current level, it might soar towards its former peak of $719.84 and possibly surpass that mark, establishing new highs. Meanwhile, the Exponential Moving Averages (EMAs) maintain a bullish outlook as long as the price remains above them.

On the other hand, indicators such as ADX and Ichimoku Cloud seem to indicate that the current upward trend might be weakening. Should a downward trend occur, the BNB price may challenge crucial support levels around $603 or possibly drop further to $593.

If the price falls slightly from its current supports, it might hint at a more significant correction, potentially weakening the existing bullish trend.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- PENGU PREDICTION. PENGU cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- ANDOR Recasts a Major STAR WARS Character for Season 2

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Where To Watch Kingdom Of The Planet Of The Apes Online? Streaming Details Explored

- Apocalypse Hotel Original Anime Confirmed for 2025 with Teaser and Visual

2024-11-29 02:03